|

|

|

|

|||||

|

|

In recent years, demand for advanced air transport options — especially electric vertical takeoff and landing (eVTOL) aircraft — has surged, driven by worsening urban congestion and rapid progress in transportation technology. This increased emphasis on urban air mobility is bolstering investor confidence in firms such as Vertical Aerospace Ltd. EVTL and Joby Aviation JOBY, both of which are developing eVTOL aircraft intended to reshape urban and regional air travel.

Vertical Aerospace continues to move forward with the VX4 aircraft, prioritizing certification efforts and broadening its reach into international markets. Joby, meanwhile, employs a vertically integrated strategy, focusing on both the development of its aircraft and the operation of air taxi services, supported by key strategic investors.

Given the strong potential of the global eVTOL market, it’s worth taking a closer look at which eVTOL stock has the advantage today and, more importantly, which one may represent the better investment at this time.

Underscoring the leadership’s confidence in long-term value creation, Vertical Aerospace insiders increased their stakes in it. To this end, the company disclosed that 16 members of its board and senior leadership team purchased additional ordinary shares in the open market during a two-week trading window last month. The buying follows earlier open-market purchases in May by chairman Dómhnal Slattery and two other directors.

Following the November purchases, Vertical Aerospace’s directors and senior leaders have increased their combined ordinary shareholdings by roughly 50%. Management said the transactions reflect insider confidence as the company nears critical milestones, including completion of the final phase of its transition flight-test program and the planned unveiling of the new aircraft on Dec. 10, 2025.

Last month, Vertical Aerospace secured a permit to fly from the U.K. Civil Aviation Authority and launched Phase 4 transition testing for its VX4 prototype. In October, the company was bolstered by the news that the U.K. Department for Transport would fund projects focused on zero-emission aircraft and vertical takeoff-and-landing technology. Among the initiatives selected is the OxCam AAM Corridor, a collaboration involving Skyports, Bristow Helicopters, NATS, Vertical Aerospace and Oxfordshire County Council.

The effort is designed to accelerate the shift from test flights to commercial advanced air mobility operations in the United Kingdom, with scheduled VX4 test flights serving as a central element of the program.

In November, Joby signed a memorandum of understanding with Red Sea Global (“RSG”) and The Helicopter Company (“THC”). The agreement includes plans for Joby to conduct pre-commercial evaluation flights of its electric air taxi in Saudi Arabia during the first half of 2026.

Under the partnership, Joby will collaborate with RSG — the developer of the Red Sea and AMAALA regenerative tourism destinations — and THC, a Public Investment Fund company and Saudi Arabia’s leading commercial helicopter operator, to set up a “sandbox” for pre-commercial testing. This environment will support the assessment of future air taxi operations in the region, with Joby conducting representative flights that incorporate charging operations, airspace integration and ground communications, similar to the demonstrations completed earlier in the UAE.

Moreover, Joby recently announced the signing of a letter of intent with Alatau Advance Air Group for the potential sale of its electric vertical takeoff and landing aircraft and related services valued at up to $250 million. The partnership aims to introduce cutting-edge air taxi services in Kazakhstan, marking a significant step in advancing sustainable aviation across Central Asia.

For Joby, this partnership provides a gateway to expand its international footprint and bring the zero-emission, quiet and efficient eVTOL technology to new markets. The deal complements Joby’s global expansion strategy as it continues to collaborate with governments and private entities worldwide to make air taxis a reality.

Joby is targeting the start of commercial services in the near term. As part of its air-taxi commercialization strategy, the company recently finalized the acquisition of Blade Air Mobility’s urban air mobility passenger business. Bringing Blade’s passenger unit into Joby’s fold represents an important milestone on the path to commercialization.

Joby’s growth prospects are bolstered by its strategic partnerships and advanced certification timeline. The company is well-served by its association with the Department of Defense and Japan’s auto giant Toyota TM. Toyota has invested $894 million in Joby and plans to invest another $250 million to reach a total of nearly $1 billion. The most recent $250 million investment by Toyota was made in two tranches. The capital injection aims to expedite Joby’s certification process and commercial production.

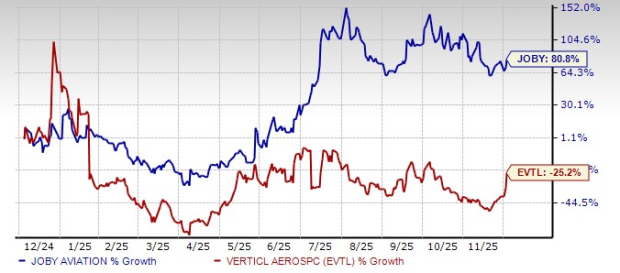

JOBY has scored better than EVTL in terms of price performance in a year’s time.

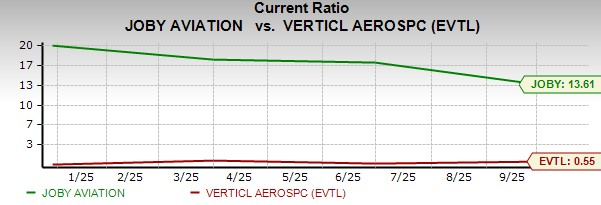

JOBY has a current ratio (a measure of liquidity) that is much higher than EVTL’s, making the former relatively stronger from a liquidity perspective. The ratio, being more than one, indicates that JOBY possesses sufficient capital to pay off its short-term debt obligations.

EVTL has surpassed the Zacks Consensus Estimate for earnings once, missing the mark on the other three occasions.

Vertical Aerospace Ltd. price-eps-surprise | Vertical Aerospace Ltd. Quote

JOBY has failed to surpass the Zacks Consensus Estimate for earnings even once, missing the mark on two occasions and delivering in-line earnings on the other two quarters.

Joby Aviation, Inc. price-eps-surprise | Joby Aviation, Inc. Quote

Joby looks like the stronger candidate in the nascent eVTOL arena. The company demonstrates more concrete commercial traction, has more robust partnerships, is making notable strides in infrastructure buildout and is supported by a significantly healthier liquidity position. Joby’s stronger share-price performance also underscores its relative advantage.

Vertical Aerospace is continuing to post steady technical advancements, while Joby’s higher level of commercial readiness leaves it better placed to benefit as the air mobility market expands.

Although the companies face similar industry risks — most notably uncertainty around future demand — based on our analysis, Joby presently holds an edge over Vertical Aerospace, despite both of them currently carring a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 7 hours | |

| 9 hours | |

| Feb-25 |

New Uber-Joby Aviation Partnership To Bring Ride Sharing To The Skies

JOBY

Investor's Business Daily

|

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite