|

|

|

|

|||||

|

|

Descartes Systems DSGX reported third-quarter fiscal 2026 non-GAAP earnings per share (EPS) of 50 cents, which beat the Zacks Consensus Estimate by 8.7%. The bottom line grew 19% year over year and 16% sequentially.

Descartes generated $187.7 million in revenues, marking an 11% year-over-year increase and a 4% sequential rise. This consistent growth signals healthy customer demand and the company’s expanding footprint across the global logistics landscape. Services revenues, which are recurring and make up the largest portion of its business, continued to be the key performance driver. Revenues from recent acquisitions, including 3GTMS and Finale, also contributed to this growth.

A major highlight this quarter was Descartes’ acquisition of Finale, Inc., a U.S.-based cloud inventory management provider catering to e-commerce businesses. The deal cost about $39.2 million in cash and up to $15 million in contingent payouts if Finale meets two-year revenue targets post acquisition. This acquisition fits with DSGX’s strategy of expanding its cloud-based solutions and content offerings while strengthening its GLN ecosystem.

Companies across the logistics ecosystem continue to rely on Descartes’ platform due to its ability to deliver timely, accurate and compliant data, an essential capability in an environment shaped by geopolitical pressures, fluctuating tariffs and evolving regulatory requirements.

The Descartes Systems Group Inc. price-consensus-eps-surprise-chart | The Descartes Systems Group Inc. Quote

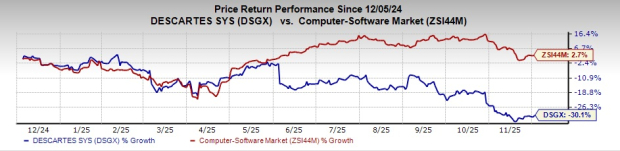

In response to a double-digit revenue growth, expanding margins and a profitability boost despite the ongoing volatility in global trade, sanctions and supply chain disruptions, DSGX’s shares went up 3.6% in pre-market trading today. In the past year, shares have declined 30.1% against the Zacks Computer - Software industry's growth of 2.7%.

Services revenues (contributed 93% of total revenues) in the reported quarter amounted to $173.7 million, up 16% year over year. DSGX saw steady third-quarter transaction volumes, but services revenue growth was driven mainly by strong global trade intelligence results, robust e-commerce customs filings and continued momentum in transportation management, including MacroPoint.

License revenues (1% of total revenues) were $1.9 million, which plunged 45.7% year over year.

Professional services and other revenues (6%) fell 22.4% year over year to $12.1 million, largely due to last year’s quarter, including about $3.7 million of low-margin hardware sales from the Ground Cloud business, which dragged results down.

Gross margin rose to 77% from 74% in the prior-year quarter, lifted by the absence of low-margin hardware sales. Excluding those, the margin still edged up due to revenue growth and operational leverage.

Operating expenses rose 11% year over year in the fiscal third quarter, driven mainly by recent acquisitions, partially offset by fiscal second quarter restructuring savings.

Driven by ongoing cost control and operating leverage from both organic and acquisitive growth, adjusted EBITDA increased 19% year over year to a record $85.5 million. Adjusted EBITDA margin came in at 45.6% compared with 42.7% in the previous-year quarter.

Income from operations was up 24% year over year to $56.6 million.

In the quarter under review, DSGX generated $73.4 million of cash from operating activities compared with $60.1 million in the prior-year quarter.

As of Oct. 31, 2025, the company had $278.8 million in cash, up from $240.6 million as of July 31, 2025.

As of Nov. 1, 2025, using current FX rates and factoring in the Finale acquisition, DSGX estimates fourth-quarter fiscal 2026 baseline revenue of about $161 million and baseline operating expenses of roughly $98.5 million.

This implies a baseline-adjusted EBITDA of roughly $62.5 million, or about 39% of baseline revenue as of Nov. 1, 2025.

Margins may fluctuate depending on revenue mix, FX rates and acquisition integration. For now, DSGX’s target range remains 40–45%, but it continues to monitor performance in upcoming quarters to assess potential upward adjustments.

DSGX currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Simulations Plus, Inc. SLP reported fourth-quarter fiscal 2025 adjusted earnings of 10 cents per share, matching the Zacks Consensus Estimate. The bottom line, however, compared unfavorably with the prior-year quarter’s 18 cents. Quarterly revenues declined 6% year over year to $17.5 million due to reduced software revenues. The top line matched the consensus mark. Shifting market dynamics, cautious biopharma spending and a strategic pivot toward cloud, AI and integrated workflows are likely to shape the company’s next stage of growth.

Cadence Design Systems CDNS reported third-quarter 2025 non-GAAP EPS of $1.93, which beat the Zacks Consensus Estimate by 7.8%. The bottom line increased 17.7% year over year, exceeding management’s guided range of $1.75-$1.81. Revenues of $1.339 billion beat the Zacks Consensus Estimate by 0.9% and increased 10.2% year over year. The figure also beat the management’s guided range of $1.305-$1.335 billion.

Blackbaud, Inc. BLKB reported third-quarter 2025 non-GAAP EPS of $1.10, which surpassed the Zacks Consensus Estimate by 2.8%. The bottom line increased around 11.1% year over year. Total revenues decreased 1.9% year over year to $281.1 million. This was due to the divestiture of EVERFI. The top line surpassed the Zacks Consensus Estimate by 0.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite