|

|

|

|

|||||

|

|

NOV Inc. NOV is one of the leading equipment and technology providers that serves a wide range of energy companies across 61 countries and is focused on delivering long-term, above-average returns. The company leverages its scale, proprietary technologies and manufacturing model — which is less asset-intensive than many peers — to support oil, gas and renewable energy development. With broad capabilities across drilling, completion and production, NOV continues to advance automation, predictive analytics and maintenance technologies that improve efficiency and lower environmental impact. Since the last six months, shares of the company have risen, leaving investors wondering whether the recent positive trend will continue or if NOV is due for a pullback.

Over the last few quarters, the company has also been struggling with contracting year-over-year earnings per share. So, before we dive into how investors should react, let's take a quick look at its current standing and outcomes.

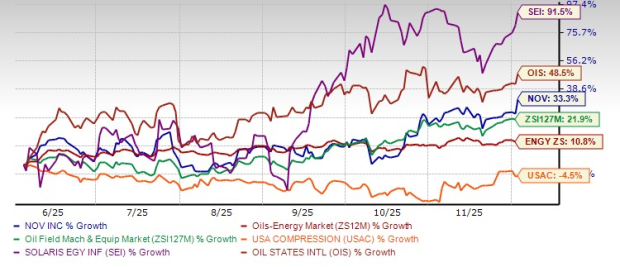

In the past six months, NOV’s shares climbed 33.3% compared with the Mechanical and Equipment Oil and Gas sub-industry and the broader oil and energy sector's rise of 21.9% and 10.8%, respectively. During the same time period, the stock outperformed its competitor, USA Compression Partners, LP USAC, which lost 4.5%. However, NOV lagged behind some of its peers like Solaris Energy Infrastructure, Inc. SEI and Oil States International, Inc. OIS, which surged 91.5% and 48.5%, respectively, in the same time frame.

Expanding Offshore and Deepwater Demand: NOV is strongly positioned to benefit from the global rebound in offshore development. The company’s subsea flexible pipe, FPSO systems and mooring solutions are seeing record orders and backlogs — the highest in five years. As deepwater projects ramp up in 2026-27, NOV’s technology leadership and cost-efficient solutions should enable it to capture significant market share and margin expansion across offshore and marine construction portfolios. Being in the mechanical and equipment sub-industry, its peer companies like USA Compression, Solaris Energy and Oil States International also benefit from the rebound in the offshore segment and expanding demand due to new deepwater projects.

Leadership in Technology and Innovation: NOV’s decades-long investment in R&D continues to yield game-changing products such as wired drill pipe, Agitator RAGE friction reduction tools and automated rig robotics. These innovations enhance safety, precision and drilling efficiency. NOV’s technological moat across high-barrier markets like deepwater, subsea and downhole tools underpins sustainable competitive advantage against peers like USA Compression, Solaris Energy and Oil States International and supports long-term growth visibility.

Consistent Margin Expansion in Energy Equipment Segment: NOV’s Energy Equipment segment delivered its thirteenth straight quarter of year-over-year Adjusted EBITDA margin growth, reaching 14.4%. The improvement stems from better pricing discipline, cost optimization and execution on a growing offshore backlog. These sustained gains validate management’s focus on efficiency, indicating that structural profitability improvements are likely to persist as demand strengthens in 2026.

Strategic Positioning for Energy Transition: NOV’s expertise in subsea, LNG and gas-processing systems aligns with the growing role of natural gas as a transition fuel. Expanding orders for FLNG and FSRU modules, including the new submerged swivel and yoke system in Argentina, showcase NOV’s pivot toward gas-related infrastructure. This transition-ready portfolio supports long-term relevance as the industry balances conventional and cleaner energy investments.

Near-Term Market Softness and Tariff Headwinds: Despite strong execution, NOV faces macro-driven softness in oilfield activity. Tariffs rose sequentially to nearly $20 million in the third quarter and are expected to reach $25 million in the fourth quarter of 2025. Combined with inflation and a sluggish North American rig count, these cost pressures could weigh on margins and dampen near-term earnings momentum, limiting upside before the offshore recovery in late 2026.

Sharp Earnings Decline and Margin Compression: Net income plunged 68% year-over-year to $42 million, and operating margins contracted to just 4.9%. Inflationary pressures, an unfavorable mix and restructuring costs eroded profitability. Despite stable revenues, profit deterioration signals limited pricing power in a softer market environment. Without sustained margin recovery, earnings growth may lag peers through the next few quarters.

Lower Near-Term Outlook for Q4 2025: Management expects fourth-quarter 2025 revenues to fall 5-7%, with Adjusted EBITDA projected at $230-$260 million, indicating that demand softness is likely to persist. The slowdown in both industrial and energy project activity continues to create uncertainty around near-term execution. For investors seeking immediate momentum, the absence of clear revenue growth drivers through the end of the year may limit confidence in NOV’s short-term performance.

Weakness in Energy Products and Services Segment: NOV’s Energy Products and Services segment’s revenues declined 3% and operating profit plunged to $38 million, pressured by lower drilling activity and delayed project awards. Profitability was further hit by tariffs and cost inflation, leading to an Adjusted EBITDA margin drop to 13.9%. The segment’s reliance on cyclical drilling markets creates vulnerability to E&P spending slowdowns and budget deferrals.

NOV stock stands out, backed by its recent outperformance against the broader industry and sector. While near-term challenges — such as tariff pressures, earnings declines and softer drilling activity — may limit immediate upside, the company’s long-term fundamentals remain solid. NOV’s strong positioning in offshore and deepwater markets, record backlog and sustained margin improvements in its Energy Equipment segment reinforce its ability to benefit from the next upcycle. Its leadership in drilling automation, subsea systems and gas-focused infrastructure also aligns with evolving global energy needs. As offshore activity accelerates in 2026-27, NOV’s operational leverage and technology edge against peers like USA Compression, Solaris Energy and Oil States International should pave the way for improved profitability. In this context, investors should consider staying invested in the Zacks Rank #3 (Hold) company now.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite