|

|

|

|

|||||

|

|

Shares of Capricor Therapeutics CAPR have skyrocketed 281.9% this week. The massive stock price surge was observed after the company reported positive top-line results from a late-stage study of deramiocel to treat cardiomyopathy associated with Duchenne muscular dystrophy (DMD). CAPR’s lead product candidate and only clinical pipeline asset, deramiocel, is an investigational, allogeneic cardiac-derived cell therapy.

The randomized phase III HOPE-3 study is evaluating deramiocel in 106 boys and young men with DMD. The patients, with an average age of 15 years, received either intravenous deramiocel at 150 million cells per infusion or placebo every three months for a year, all while remaining on stable corticosteroid therapy.

Per the data readout from the phase III HOPE-3 study, deramiocel delivered meaningful clinical benefits in a predominantly non-ambulatory DMD population. The study met its primary endpoint with statistical significance, showing a 54% slowing of disease progression in upper-limb function upon treatment with the investigational cell therapy for a year compared with placebo on the PUL v2.0 scale. This outcome suggests a notable preservation of daily functional abilities, an important indicator of independence for patients with advanced disease, substantially improving their quality of life.

The study also achieved its key secondary endpoint with statistical significance, demonstrating a 91% slowing in the deterioration of left-ventricular ejection fraction upon deramiocel therapy based on centrally reviewed cardiac MRI. Given that cardiomyopathy is a leading driver of mortality in DMD, the stabilization of cardiac function represents a meaningful advancement and addresses a major unmet need in this population.

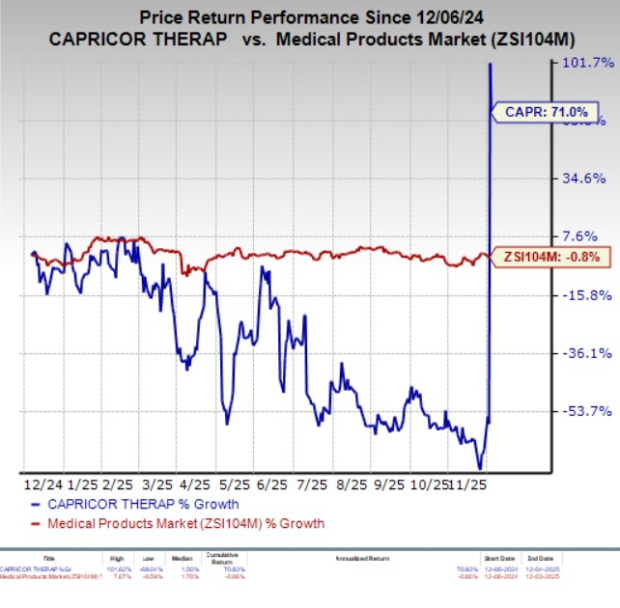

In the past year, shares of Capricor Therapeutics have surged 71% against the industry’s decline of 0.8%.

Taken together, the HOPE-3 results support deramiocel’s potential to slow both skeletal-muscle decline and cardiac deterioration, positioning it as a first-in-class therapy designed to treat Duchenne cardiomyopathy, which could improve long-term survival. Capricor Therapeutics further reported that the investigational therapy demonstrated a favorable safety and tolerability profile in the phase III HOPE-3 study, which was consistent with that observed in prior clinical studies.

We remind the investors that in July 2025, Capricor Therapeutics faced a massive regulatory setback after the FDA issued a complete response letter (CRL) to the biologics license application (BLA) seeking approval for deramiocel to treat cardiomyopathy associated with DMD. The application was supported by data from its phase II HOPE-2 study and an open-label extension (OLE) study compared with natural history data.

In the CRL, the FDA stated it could not approve CAPR’s BLA in its current form, citing a lack of sufficient clinical evidence to demonstrate effectiveness and requesting additional data. The agency also pointed to certain unresolved issues within the CMC section of the regulatory application.

However, Capricor Therapeutics believes that the latest phase III HOPE-3 results strengthen the long-term clinical profile of deramiocel, aligning with durability signals previously observed in the HOPE-2 study and its more than four-year OLE. Collectively, the data demonstrate consistent and reproducible benefits across multiple studies, reinforcing the therapy’s potential value in treating advanced DMD.

With this dataset in hand, Capricor Therapeutics plans to submit a formal response to the FDA’s earlier CRL, incorporating the new HOPE-3 results. This approach follows prior alignment with the agency, which had indicated that positive HOPE-3 findings could be sufficient to support a resubmission and advance the therapy toward potential approval for the DMD indication.

DMD is a severe genetic disorder that leads to progressive skeletal, respiratory and cardiac muscle loss. It impacts about 15,000 people (primarily boys) in the United States, and often progresses to cardiomyopathy and heart failure, with no cure and limited treatments.

Capricor Therapeutics, Inc. price-consensus-chart | Capricor Therapeutics, Inc. Quote

Capricor Therapeutics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector include CorMedix CRMD, Arcutis Biotherapeutics ARQT and ANI Pharmaceuticals ANIP, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

In the past 60 days, estimates for CorMedix’s 2025 earnings per share (EPS) have increased from $1.83 to $2.87. EPS estimates for 2026 have moved up from $2.48 to $2.88 during the same period. CRMD stock has gained 12% in the past year.

CorMedix’s earnings beat estimates in each of the trailing four quarters, with an average surprise of 27.04%.

In the past 60 days, estimates for Arcutis Biotherapeutics’ loss per share have narrowed from 44 cents to 24 cents for 2025. During the same time, EPS estimates for 2026 have increased from 9 cents to 41 cents. In the past year, shares of ARQT have rallied 151.3%.

Arcutis Biotherapeutics’ earnings beat estimates in each of the trailing four quarters, the average surprise being 64.80%.

In the past 60 days, estimates for ANI Pharmaceuticals’ EPS have increased from $7.28 to $7.54 for 2025. During the same time, EPS estimates for 2026 have improved from $7.78 to $8.15. In the past year, shares of ANIP have gained 45.2%.

ANI Pharmaceuticals’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 21.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite