|

|

|

|

|||||

|

|

Ralph Lauren Corporation RL and G-III Apparel Group, Ltd. GIII stand on opposite ends of the fashion spectrum, one a global luxury lifestyle powerhouse with under 2% share of a massive premium market, the other a diversified wholesale-driven operator racing to scale its owned brands while navigating license transitions. As the apparel industry pivots toward brand equity, pricing power and supply-chain agility, these two players offer a compelling contrast in strategic direction and competitive positioning.

RL benefits from a fully integrated consumer ecosystem, a strong balance sheet and an elevation plan that continues to strengthen its position in premium and luxury. Its model leans on DTC growth, disciplined storytelling and expansion into high-potential categories and regions.

GIII, in contrast, is rebuilding around owned brands like DKNY, Karl Lagerfeld and Donna Karan as it exits major PVH licenses and navigates tariff and demand pressures.

In a market where desirability trumps scale, RL’s elevation and GIII’s reinvention highlight two distinct paths to long-term growth. The question is whether disciplined elevation or agile reinvention wins the next chapter of apparel growth.

Ralph Lauren is demonstrating powerful brand and product momentum, driven by disciplined execution of its long-term Next Great Chapter: Drive strategy. Management highlights that RL continues to outperform expectations across regions, channels and categories, reinforcing the brand’s global relevance and consumer appeal. With less than a 2% share of a $400 billion premium and luxury market, the company’s diversified growth engines are elevating the lifestyle brand, expanding core and high-potential categories and deepening presence in top global city ecosystems, positioning RL for sustained market share gains.

Strong second-quarter fiscal 2026 performance, with double-digit revenue growth across all geographies and a higher quality of sales, showcases broad-based strength and successful product innovation across men’s, women’s, children’s, outerwear, handbags and core icons like polos and cable-knit sweaters. RL’s mix continues to shift toward higher-margin categories, while women’s apparel and handbags outpaced total company growth. Core categories, representing more than 70% of revenues, delivered mid-teens growth, signaling the durability of timeless assortments. RL’s shift toward elevated distribution and stronger DTC contribution continues to support structural margin expansion.

The company is also strengthening its digital economics. Double-digit digital growth, improved omnichannel capabilities and the rollout of the Ask Ralph AI assistant enhance conversion and customer lifetime value, adding efficiency to the ecosystem.

For fiscal 2026, RL expects constant-currency revenue growth of 5-7% and operating margin expansion of 60-80 bps. However, reciprocal tariffs, cost inflation and macro uncertainty pose downside risks, particularly in the back half of the year. As a discretionary category, apparel remains highly sensitive to consumer spending patterns, making RL’s near-term outlook dependent on broader economic stability despite its improving fundamentals.

G-III Apparel offers an attractive investment opportunity through its strong portfolio of owned and licensed brands, strategic shift toward higher-margin products, and robust market positioning in North America. In second-quarter fiscal 2026, the company generated net sales of $613 million, exceeding guidance despite a year-over-year decline caused primarily by the exit from Calvin Klein and Tommy Hilfiger licenses.

With its owned brands — DKNY, Donna Karan, Karl Lagerfeld and Vilebrequin — now driving the majority of revenues, GIII is steadily reducing its reliance on lower-margin licensed products and rebuilding its mix toward more profitable, controllable assets.

GIII’s business strategy centers on scaling its owned brands, optimizing distribution channels and enhancing operational efficiency. The company continues investing in operational efficiency and digital capabilities, including warehouse consolidation, upgraded supply-chain systems, AI-enabled processes and 3D design tools that improve speed-to-market and cost structure. Double-digit growth in its owned e-commerce platforms, supported by targeted digital marketing and influencer activations, is strengthening brand visibility and engagement across consumer segments.

However, the near-term outlook is constrained by tariffs, retail caution and transition-related volume pressure. Fiscal 2026 revenues are expected to be $3.02 billion, down from $3.18 billion in fiscal 2025 and below prior guidance. Adjusted EPS of $2.55-$2.75 implies a roughly 40% earnings decline, highlighting a challenging transition year before the benefits of owned-brand scaling and operational improvements fully materialize.

The Zacks Consensus Estimate for Ralph Lauren’s fiscal 2026 sales and EPS implies year-over-year growth of 9.5% and 24.9%, respectively. The EPS estimates for fiscal 2026 and 2027 moved up 2.7% and 2.8%, respectively, in the last 30 days.

The Zacks Consensus Estimate for G-III Apparel's fiscal 2026 sales and EPS suggests a year-over-year decline of 4.9% and 38.7%, respectively. EPS estimates for fiscal 2026 and 2027 have remained stable in the past 30 days.

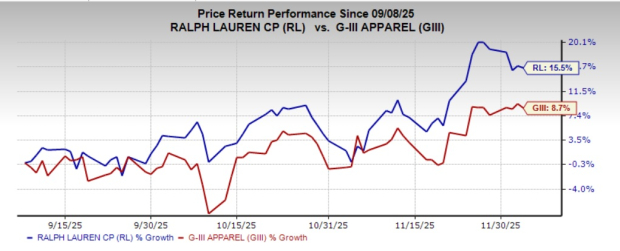

In the past three months, RL shares had the edge in terms of performance, having a total return of 15.5%, whereas G-III stock gained 8.7%.

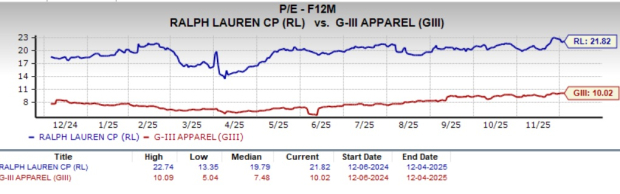

From a valuation standpoint, RL currently trades at a higher forward price-to-earnings (P/E) multiple of 21.82X compared with GIII Apparel’s 10.02X. GIII stock looks cheap from a valuation perspective. Expanding the owned-brand portfolio and reducing reliance on licensed labels, sustainability, Digital Transformation and Omnichannel Strategy highlight GIII’s growth prospects.

Ralph Lauren does seem pricey. However, its valuations reflect its focus on investments in digital transformation, omnichannel expansion and product diversification, positioning it for long-term growth. If the company sustains its execution, the premium could be warranted.

While both Ralph Lauren and G-III Apparel present distinct long-term strategies, the fundamental indicators tilt decisively in favor of RL. Ralph Lauren emerges as the clearer long-term winner, supported by steady brand momentum, disciplined execution and a strengthening shift toward higher-margin categories. Rising analyst confidence, reflected in recent positive estimate revisions, reinforces the durability of its growth narrative. The market’s stronger response to RL’s shares further highlights investor preference for its pricing power, global reach and consistent performance.

G-III remains a compelling value-driven transition story, but ongoing license exits, tariff exposure and retail caution cloud near-term visibility. With stronger fundamentals and clearer strategic traction, RL offers the more compelling investment case.

RL currently carries a Zacks Rank #2 (Buy), whereas GIII has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite