|

|

|

|

|||||

|

|

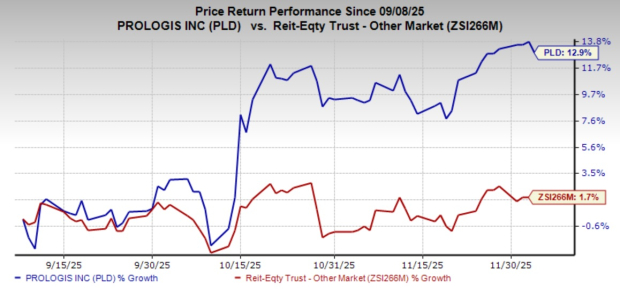

Prologis PLD shares have climbed 12.9% over the past three months, outperforming the industry's growth of 1.7%. This marks a sharp reversal from the more uneven performance seen earlier in the year.

Investors have responded positively to signs of stabilizing industrial fundamentals, improving leasing momentum and upbeat commentary from the company’s third-quarter results. Strong execution and a healthier demand tone across logistics real estate have helped the stock regain traction.

Analysts seem optimistic about this Zacks Rank #3 (Hold) company. The Zacks Consensus Estimate for its 2025 FFO per share has moved marginally northward over the past months to $5.80. It also calls for a 4.3% increase year over year.

A major reason behind the stock’s recent strength is the company’s solid third-quarter performance. Prologis posted record leasing activity of nearly 62 million square feet, reflecting a clear pickup in customer decision-making and stronger new leasing velocity. Occupancy improved to 95.3%, and rent change remained extremely healthy at 49% on a net effective basis, signaling the durability of its long lease mark-to-market embedded in the portfolio. Moreover, according to the company, the lease mark-to-market ended September at 19%, positioning Prologis for strong rent growth as leases roll over the next several years.

Another meaningful driver is the strengthening demand environment. Management noted that customer sentiment has turned decisively more positive. Early signs of a broad-based pickup are becoming visible across geographies. Net absorption in U.S. industrial real estate reached an estimated 47 million square feet for the quarter, and market vacancy has stabilized at around 7.5%, where Prologis believes it is topping out. This inflection aligns with management’s view that rents and occupancy have reached their cyclical bottom.

The company’s fast-growing data center platform is adding a new layer of investor enthusiasm. With 5.2 gigawatts of power either secured or in advanced stages, Prologis now represents one of the largest owners of utility-fed power suitable for data centers. Every megawatt the company can deliver over the next three years is already in discussions with customers, underscoring the depth of demand. Management is also exploring new capitalization strategies that could accelerate value creation in this segment.

As of Sept. 30, 2025, this industrial REIT had a total available liquidity of $7.5 billion. PLD maintains an in-place cost of debt of just 3.2% with more than eight years of average remaining maturity. This financial flexibility allows the company to invest through the cycle while capturing returns from build-to-suit developments and strategic expansions.

Given these tailwinds, the stock’s upward trajectory has fundamental support. The backdrop of stabilizing supply, improving demand and a multiyear path of rent uplift suggests that Prologis is entering a more constructive earnings phase. Whether the stock can continue rising at the same pace depends on macro conditions, but the underlying fundamentals paint a favorable medium-term picture.

Despite the positive momentum, several risks could temper future performance. Market rents have recently slowed after years of rapid growth, and while Prologis expects a recovery, the timing remains uncertain. A slower macroeconomic backdrop could also weigh on customer expansions, particularly for cyclical industries such as housing-related goods and autos, which the company noted remain softer.

At the company level, Prologis continues to benefit from its unmatched global logistics footprint, disciplined balance sheet management and strategic positioning in both traditional industrial real estate and newer growth areas such as data centers and distributed energy.

The broader industrial sector is also showing improving sentiment, supported by easing supply pressures and clearer signs that leasing demand is returning to a more normalized pace. This combination of internal execution and sector-level stabilization has created a more constructive backdrop for Prologis shares.

Some better-ranked stocks from the broader REIT sector are VICI Properties VICI and W.P. Carey WPC. VICI Properties and W.P. Carey each carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for VICI Properties’ 2025 FFO per share is pegged at $2.37, suggesting a 4.9% year-over-year increase.

The Zacks Consensus Estimate for W.P. Carey’s 2025 FFO per share is pegged at $4.92, calling for a year-over-year rise of 4.7%.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite