|

|

|

|

|||||

|

|

After a prolonged rally throughout 2025, quantum computing stocks are starting to give back their gains.

Big tech could serve as a backdoor way to gain exposure to the quantum computing opportunity.

Shares of Nvidia have been sliding since the company reported earnings in mid-November.

For three years, investors have poured record sums into artificial intelligence (AI) stocks -- particularly those involved with enterprise software, data centers, or designing and manufacturing semiconductors.

Throughout 2025, however, a new theme in the AI landscape has emerged: quantum computing. The quantum AI landscape is split into two categories. On one side there are pure plays like IonQ, Rigetti Computing, and D-Wave Quantum. On the other side, cloud hyperscalers Amazon, Alphabet, and Microsoft are each exploring custom quantum chip designs.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Let's take a look at how the quantum computing trade has performed over the last year. From there, I'll detail why Nvidia (NASDAQ: NVDA) is my top pick in a packed field of quantum AI contenders right now.

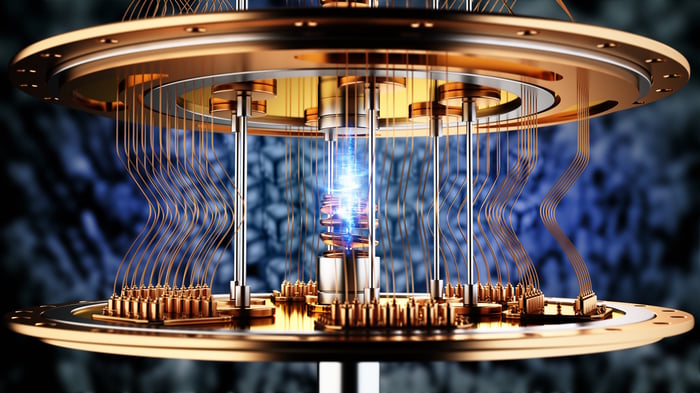

Image source: Getty Images.

The allure of quantum computing lies in the idea that enthusiasts are buying into the idea that this technology will revolutionize sophisticated applications across various fields, including drug discovery, financial risk modeling, manufacturing, logistics, energy management, and more.

While intriguing, quantum computing remains primarily a theoretical and exploratory endeavor -- hinging on simulations as opposed to measurable commercial adoption.

Nevertheless, quantum pure-play stocks have become all the rage among AI investors. Over the last year, shares of Rigetti Computing have soared by as much as 1,770% while D-Wave Quantum stock gained over 1,500% at its peak.

While this level of momentum might suggest that investing in quantum computing stocks is a no-brainer, smart investors are digging deeper.

All of the quantum pure plays are trading materially lower than their all-time highs, with the most pronounced selling activity occurring over the last month. Adding insult to injury, history suggests these stocks could plummet even further -- potentially losing 80% of their value.

The reason for the sell-off can be summed up in a few talking points:

Investors are beginning to wake up to the idea that quantum pure-play AI stocks are more favored by aggressive day traders than prudent institutional investors. Against this backdrop, the soaring valuations and current sell-off seen across IonQ, Rigetti, and D-Wave more than echo a potential dot-com-style bubble-bursting event.

Since Nvidia reported financial results for its fiscal third quarter on Nov. 19, shares have dropped by as much as 5%. While this may not seem meaningful, even a nominal decline can erase hundreds of billions in market capitalization for a company that was valued at $5 trillion just a few weeks ago.

One of the biggest concerns surrounding Nvidia is whether the acceleration of AI infrastructure investment from the hyperscalers is sustainable. Skeptics contest that big tech is spending too heavily on capital expenditures (capex). Should these companies tighten their infrastructure budgets, Nvidia could face a meaningful deceleration in revenue growth and profit margins.

In addition, Alphabet's success with its custom chip architecture -- called Tensor Processing Units (TPUs) -- is beginning to eat away at the narrative that Nvidia is king of the chip realm.

While the concerns explored above are valid, I think they are overblown.

On the chip side of the equation, Alphabet's TPUs are geared for custom workloads such as deep learning. By contrast, Nvidia's GPUs are more purpose-built or multifaceted pieces of hardware that are used across a number of different generative AI platforms and use cases.

Regarding AI infrastructure, forecasts from McKinsey & Company are calling for nearly $5 trillion to be spent on upgrading data centers, servers, and networking equipment through 2030. These tailwinds bode well for Nvidia, and in some ways are already becoming evident. The company has more than $300 billion in backlog for its current Blackwell GPUs, upcoming Rubin architecture, and accompanying data center products.

Moreover, Nvidia just linked up with Anthropic in a multibillion-dollar deal in which the AI developer will be leveraging Rubin chips for its next-generation models.

In addition to AI infrastructure, Nvidia is expanding its addressable market into software through a new partnership with Palantir Technologies as well as the telecommunications industry via a strategic investment in Nokia.

Lastly, Nvidia recently unveiled some new products in its quantum computing roadmap, including NVQLink interconnect services, which will complement the company's existing CUDA-Q software system.

Right now, Nvidia trades at a forward price-to-earnings (P/E) multiple of just 23.5. Simply put, Nvidia stock hasn't been this cheap since April (when shares crashed after the "Liberation Day" tariff announcement).

In my eyes, Nvidia stock is becoming too cheap to ignore. The company's revenue and profits remain robust, demand and future business visibility is through the roof, and its addressable market is expanding -- making Nvidia a compelling long-term opportunity.

Against this backdrop, I think now is a great time to buy the dip in Nvidia.

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of December 1, 2025

Adam Spatacco has positions in Alphabet, Amazon, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, IonQ, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 2 hours | |

| 3 hours | |

| 3 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite