|

|

|

|

|||||

|

|

Dycom Industries, Inc. DY has climbed 39.6% in the past three months, significantly outperforming the Zacks Building Products - Heavy Construction industry, the broader Construction sector and the S&P 500 Index.

This specialty contracting firm operating in the telecom industry is gaining from robust demand for fiber and digital infrastructure, backed by increased data center projects. Moreover, the optimism surrounding the Broadband Equity, Access and Deployment (BEAD) program, alongside the company’s accretive acquisitions, is an additional catalyst for its growth prospects amid an unfavorable macro scenario.

Notably, during the past three months, Dycom also outperformed a few of the notable market players, including Quanta Services, Inc. PWR, MasTec, Inc. MTZ and Primoris Services Corporation PRIM. These market players offer substantial competition to DY across utility, energy and telecommunications infrastructure projects. During the said time frame, Quanta, MasTec and Primoris Services have gained 23.3%, 25.4% and 11.1%, respectively.

Let us decode the factors that are driving Dycom’s momentum.

Dycom is well-positioned to realize benefits from the strong fiber and digital infrastructure in the near and long term. The telecommunications infrastructure environment is expanding as hyperscalers and large technology companies invest in long-haul and middle-mile fiber networks to support rising data usage and new compute requirements. This robust market trend is not only benefiting Dycom but also the other market players, including Quanta, MasTec and Primoris Services.

Notably, DY believes that the market is in the early stages of a generational deployment of digital infrastructure, with the construction of new outside plant data center networks to ramp up in the 2026 calendar year. These prospects favor the company’s long-term growth (continued expansion into 2027 and beyond), given its expertise in handling highly complex and large-scale builds. During the first nine months of fiscal 2026, Dycom’s contract revenues grew 13% year over year to $4.09 billion, driven by robust demand for telecommunications and digital infrastructure, fueled by accelerating fiber builds and a massive ramp-up in data center needs. Besides, as of October 2025, DY’s total backlog grew 4.7% year over year to $8.22 billion, with the next 12-month backlog rising 11.4%.

Dycom stands to benefit significantly from the BEAD program as the initiative moves from the planning stage to the deployment stage. During the third quarter of fiscal 2026, the company highlighted that the National Telecommunications and Information Administration has approved the final deployment plans of the program across 15 states and three U.S. territories, with Louisiana already receiving full access to its funding. The program represents a large multiyear catalyst, with $29.5 billion in expected state and territory spending and roughly $26 billion directed specifically toward fiber or HFC infrastructure, an area directly aligned with Dycom’s core capabilities. About two-thirds of all BEAD-funded locations will be served using these technologies, expanding DY’s addressable market over the next four-plus years.

The company’s early positioning appears strong, as it has already secured more than $500 million in verbal BEAD-related awards, none of which are yet included in backlog, suggesting substantial upside as states convert awards to contracts. This trend is paving the way for new contracts, project starts and meaningful revenue contribution beginning in Dycom’s second quarter of fiscal 2027. With deep relationships across carriers and long-standing engagement with states on deployment planning, the company is well situated to capture a meaningful share of BEAD-driven rural broadband construction.

One of Dycom’s long-term growth strategies includes advancing through targeted acquisitions that strengthen its position across key infrastructure markets. On Nov. 18, 2025, the company agreed to acquire Power Solutions, LLC, one of the largest providers of mission-critical electrical infrastructure solutions for data centers and other vital industries in the greater Washington, D.C., Maryland and Virginia area. This deal adds scale, strengthens Dycom’s relationships with hyperscalers and allows the combined company to offer end-to-end services from outside-plant fiber networks to inside-the-fence electrical systems. With more than $1 billion in backlog and strong margins, Power Solutions is immediately accretive and significantly enhances its long-term growth platform.

DY also completed the acquisition of Black & Veatch’s public-carrier wireless infrastructure business earlier in fiscal 2025. This addition expanded Dycom’s wireless construction capabilities and increased its presence in several high-demand regions. The business is expected to contribute meaningfully to revenues through fiscal 2026 and strengthen the company’s position in wireless network modernization.

Due to robust digital infrastructure growth and long-term demand drivers, Dycom laid out an upbeat fourth-quarter and fiscal 2026 outlook. For the fiscal fourth quarter, it expects contract revenues between $1.26 billion and $1.34 billion, up from $1.085 billion reported in the year-ago quarter. Adjusted EBITDA is expected to be between $140 million and $155 million, reflecting growth from $116.4 million reported a year ago. Also, adjusted earnings per share (EPS) for the fiscal fourth quarter are expected in the range of $1.62-$1.97, up from $1.17 reported in the prior-year quarter.

For fiscal 2026, Dycom now expects total contract revenues in the range of $5.350-$5.425 billion (prior expectation was $5.290-$5.425 billion), representing a 13.8-15.4% year-over-year increase.

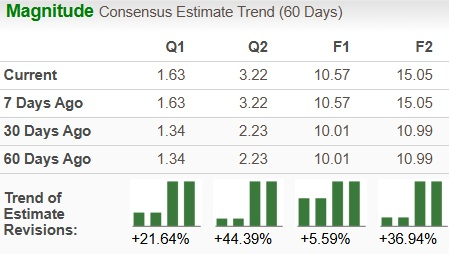

DY’s earnings estimates for fiscal 2026 and fiscal 2027 have trended upward over the past 60 days. The revised estimated figures for fiscal 2026 and fiscal 2027 imply year-over-year growth of 25.2% and 42.3%, respectively.

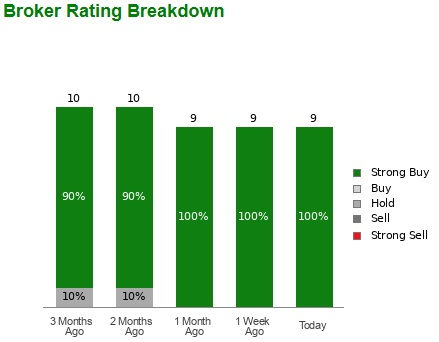

The robust market fundamentals and DY’s strategic in-house capabilities are likely to have induced bullish sentiments among analysts.

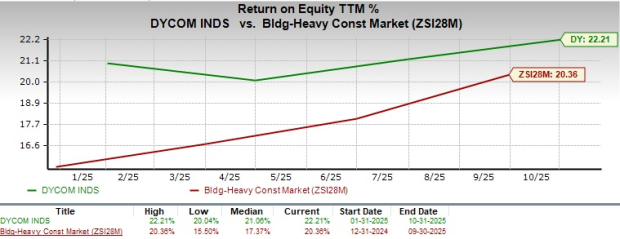

DY's trailing 12-month return on equity (ROE) of 22.2% exceeds the industry’s average, underscoring its efficiency in generating shareholder returns.

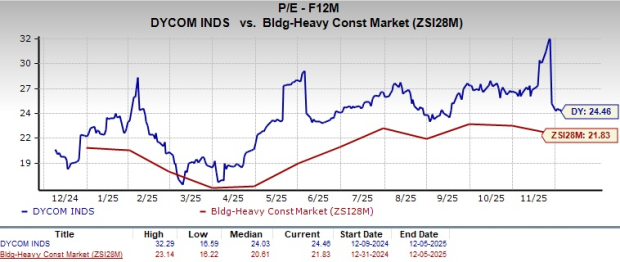

Dycom stock is currently trading at a premium relative to its industry peers, with a forward 12-month price-to-earnings (P/E) ratio of 24.46, as shown in the chart below.

As discussed above, Dycom’s growth is supported by strong fiber-deployment momentum and accelerating demand for digital and data-center infrastructure. The stock’s growth outlook is reinforced by double-digit revenue gains, a rising backlog and expanding opportunities tied to hyperscaler network builds, which are expected to ramp up further into 2026 and beyond.

Challenges remain, including Dycom’s premium valuation and exposure to broader macro uncertainty, but its rising ROE, upward-moving earnings estimates, strong contract visibility and scale advantages offset these risks. With robust fundamentals, expanding end-market demand and execution that continues to outpace competition, DY stock presents a compelling investment case now.

Analysts’ optimism regarding DY stock is reflected in all nine recommendations, pointing to a "Strong Buy”, representing 100% of all recommendations.

Summing up, in the present digital infrastructure cycle, this current Zacks Rank #1 (Strong Buy) stock stands as an appealing buy for investors now. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

PWR

Investor's Business Daily

|

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite