|

|

|

|

|||||

|

|

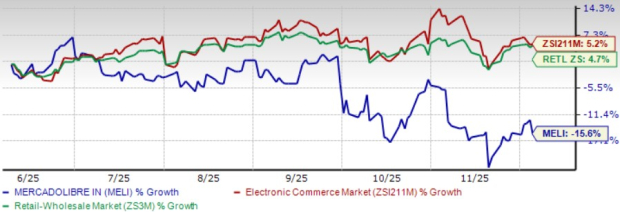

MercadoLibre MELI shares have declined 15.6% over the past six months, underperforming the Zacks Retail-Wholesale sector and the Zacks Internet-Commerce industry’s growth of 4.3% and 5.2%, respectively.

The decline in MELI's performance reflects investor concerns over margin compression from aggressive strategic investments, elevated competitive intensity and macroeconomic volatility across Latin American markets. The stock's pullback signals growing caution toward the company's near-term profitability trajectory and questions about whether current spending levels represent a sustainable path to market leadership or an increasingly expensive arms race with diminishing returns.

MELI's operational strategy is prioritising market share expansion over near-term profitability, resulting in meaningful volume acceleration while pressuring margins across both the commerce and fintech segments. Lowering Brazil’s free-shipping threshold unlocked record items-sold growth in the third quarter of 2025, yet operating margin slipped to 9.8% down 70 basis points year over year, as logistics and fulfilment costs grew faster than revenue. The Zacks Consensus Estimate for fourth-quarter 2025 revenues is pegged at $8.45 billion, up 39.5% year over year, implying that top-line momentum will continue even as margins may stay constrained.

Fintech spending adds further pressure, with early-stage credit card issuance across Brazil, Mexico and Argentina weighing on returns. In the third quarter, Net Income Margin fell to 5.7%, down from 7.5% last year, while Net Interest Margin After Losses held at 21%, reflecting higher funding costs and the impact of expanding younger credit cohorts. Together, these metrics indicate that MELI is in a margin-dilutive phase of its credit expansion, where portfolio growth outpaces monetisation. The Zacks Consensus Estimate for fourth-quarter total payment volume is pegged at $81.67 billion, up 38.6% year over year, pointing to continued activity but also a larger credit base to absorb. These dynamics indicate that MELI’s investment cycle remains in the cost-intensive phase, limiting the pace at which profitability can stabilise.

The Latin American e-commerce and fintech markets have become increasingly crowded as global and regional platforms reinforce their presence. Amazon AMZN continues expanding its fulfillment network and product breadth across Brazil and Mexico, using its global scale and Prime ecosystem to intensify price and delivery competition. This dynamic forces MELI to sustain heavier spending on free shipping, logistics and conversion-driving incentives to defend its lead. Sea Limited SE, through Shopee, remains aggressive in value-driven categories, backed by the financial capacity to extend promotional cycles and deepen seller subsidies. eBay EBAY also retains influence in cross-border commerce, offering merchants an established global marketplace that competes with MELI’s seller ecosystem.

MELI trades at a forward 34.91x price-to-earnings multiple, well above the Zacks Industry average of 24.37x and the broader sector multiple of 24.95x. This valuation appears elevated compared to Amazon’s 24.37x, Sea Limited’s 30.8x and eBay’s 17.4x. The premium embeds significant expectations for sustained revenue growth and eventual margin recovery, leaving limited room for execution missteps or competitive intensification that could undermine profitability assumptions.

MELI's heavy investment spending is pressuring margins, yet the strategy is successfully expanding the user base and ecosystem engagement. The company's initiatives to reduce friction points, including lower free shipping thresholds, expanded delivery coverage and enhanced payment flexibility, are attracting users despite elevated costs. During the third quarter of 2025, unique active buyers grew 26% year over year to 76.8 million. Monthly active fintech users increased 29% to 72.2 million, while assets under management surged 89% to $15.1 billion.

The critical question is whether this expanding user base can be effectively monetized once the investment cycle moderates. Cross-selling opportunities between commerce and fintech services create potential revenue streams, as marketplace buyers transition into payments users and credit recipients. The credit card business in Brazil, where older cohorts have reached profitability, suggests that the business model can generate returns once portfolios mature. The Zacks Consensus Estimate for 2025 earnings per share is pegged at $40.27, unchanged over the past 30 days and up 6.85% year over year, indicating expectations for modest earnings growth despite margin pressures. If MELI can successfully convert current user growth into higher purchase frequency, improved take rates and deeper financial services adoption, the investments may prove justified. However, the timeline for achieving sustainable monetization remains uncertain, and execution risks persist in translating user metrics into long-term earnings growth.

MercadoLibre, Inc. price-consensus-chart | MercadoLibre, Inc. Quote

MELI's investment case presents offsetting considerations as margin pressures weigh against user growth momentum. The expanding user base provides long-term potential, yet near-term profitability compression and premium valuation relative to Amazon, Sea Limited and eBay create uncertainty. Given robust volume metrics offset by elevated spending, the timeline for margin recovery remains unclear.

MELI currently carries a Zacks Rank #3 (Hold), suggesting current shareholders can maintain positions while monitoring profitability trends. Prudent investors may prefer waiting for a more attractive entry point before initiating new positions.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 45 sec | |

| 9 min | |

| 12 min |

Anthropic Shows Olive Branch At Enterprise Event. Software Stocks Gain.

AMZN

Investor's Business Daily

|

| 16 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite