|

|

|

|

|||||

|

|

Johnson & Johnson JNJ faces several challenges, like potential losses from expiring drug patents, ongoing legal battles related to its talc powder and broader macroeconomic uncertainties. Here, we discuss the various headwinds that J&J faces and see if the drug and medical devices giant is well-equipped to navigate them.

J&J lost U.S. patent exclusivity for its multibillion-dollar product Stelara in 2025. Stelara was a key top-line driver for J&J, accounting for around 18% of J&J’s Innovative Medicine unit’s sales in 2024, before it lost patent exclusivity in 2025.

Several biosimilar versions of Stelara have been launched in the United States in 2025. According to patent settlements and license agreements, Amgen AMGN,Teva Pharmaceutical Industries TEVA/Alvotech, Samsung Bioepis/Sandoz and some other companies have launched Stelara biosimilars this year.

The launch of generics by Amgen, Teva and other companies is significantly eroding Stelara’s sales and hurting J&J’s sales and profits in 2025. Stelara sales declined around 40% in the first nine months of 2025. In the first nine months of 2025, the negative impact of the Stelara sales decline, due to biosimilar competition, was approximately 10.1% on the Innovative Medicine segment operational sales.

Stelara biosimilar competition is expected to accelerate as the number of biosimilar entrants increases. Stelara sales are expected to come down from almost $11 billion in 2023 to around $3.0 billion in 2027, per our estimates.

In addition, sales in 2025 are being hurt by the impact of the Medicare Part D redesign under the Inflation Reduction Act (IRA). Among other measures, the IRA requires the U.S. Department of Health and Human Services (HHS) to effectively set prices for certain single-source drugs and biologics reimbursed under Medicare Part B and Part D.

In August 2023, the HHS selected J&J’s drugs, Xarelto, Stelara and Imbruvica as one of the first 10 medicines subject to government-set prices. J&J expects a negative impact of approximately $2 billion in sales due to the Medicare Part D redesign in 2025. The Part D redesign is mainly hurting sales of drugs like Stelara, Erleada, Imbruvica and pulmonary hypertension drugs.

J&J faces more than 73,000 lawsuits for its talc-based products, primarily baby powders. The lawsuits allege that its talc products contain asbestos, which caused many women to develop ovarian cancer. J&J insists that its talc-based products are safe and do not cause cancer. The company permanently discontinued the sales of the talc-based Johnson’s Baby Powder.

In April, a bankruptcy court in Texas rejected J&J’s proposed bankruptcy plan to settle its talc lawsuits after a two-week trial in Houston. J&J has gone back to the traditional tort system to fight the lawsuits individually, with its bankruptcy strategy to settle the lawsuits failing for the third time.

In the MedTech segment, though overall sales improved in the past two quarters, J&J continues to face headwinds in China. Sales in China are being hurt by the impact of the volume-based procurement (VBP) program, which is a government-driven cost containment effort in China. J&J expects continued impacts from VBP issues in China as the program continues to expand across provinces and products.

Despite headwinds like softness in the MedTech unit, the legal battle surrounding its talc lawsuits, the Stelara patent cliff and the impact of Part D redesign, J&J looks quite confident that it will be able to navigate these challenges.

J&J has recorded a strong operational performance so far in 2025, backed by double-digit growth in revenues from key brands and contributions from new launches.

J&J expects operational sales growth in both the Innovative Medicine and MedTech segments to be higher in 2026.

In 2026, J&J expects accelerated growth in the Innovative Medicine segment despite the loss of exclusivity of Stelara. The growth is expected to be driven by its key products, such as Darzalex, Tremfya, Spravato and Erleada as well as new drugs like Carvykti, Tecvayli and Talvey and recently launched products, including Tremfya in inflammatory bowel disease (IBD), Rybrevant plus Lazcluze in non-small cell lung cancer and Inlexzo in bladder cancer.

In the MedTech segment, J&J expects better growth than 2025 levels, driven by increased adoption of newly launched products across all MedTech platforms and increased focus on higher-growth markets. J&J expects to launch new products like Shockwave C2 Aero catheter and Tecnis intraocular lens in the United States, as well as make a regulatory submission for the OTTAVA robotic surgical system in 2026. These new products may also contribute to growth in 2026. Moreover, the potential separation of its Orthopaedics franchise into a standalone orthopedics-focused company, called DePuy Synthes, should improve its MedTech unit’s growth and margins, as the Orthopaedics franchise has been a slow-growth business for J&J.

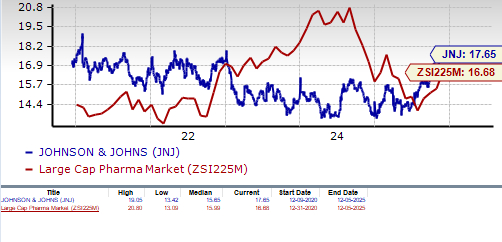

J&J’s shares have outperformed the industry year to date. The stock has risen 39.7% in the year-to-date period compared witha 14.1% increase for the industry.

From a valuation standpoint, J&J is slightly expensive. Going by the price/earnings ratio, the company’s shares currently trade at 17.65 forward earnings, higher than 16.68 for the industry. The stock is also trading above its five-year mean of 15.65.

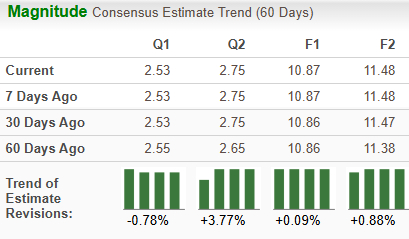

The Zacks Consensus Estimate for 2025 earnings has risen from $10.86 per share to $10.87, while that for 2026 has increased from $11.38 to $11.48 over the past 60 days.

J&J has a Zacks Rank #3 (Hold) currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Stock Market Today: Dow Up After New Trump Tariffs; Novo Plunges On Drug Trial Results (Live Coverage)

JNJ

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Stock Market Today: Dow Falls On New Trump Tariffs; Novo Plunges On Drug Trial Results (Live Coverage)

JNJ

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite