|

|

|

|

|||||

|

|

lululemon athletica inc. LULU is likely to witness top-line growth when it reports third-quarter fiscal 2025 results on Dec. 11, after market close. The Zacks Consensus Estimate for fiscal third-quarter sales is pegged at $2.49 billion, indicating a 3.8% increase from the year-ago quarter's reported figure.

The consensus estimate for the company's fiscal third-quarter earnings is pegged at $2.22 per share, suggesting a 22.3% decline from the year-ago quarter’s actual. Earnings estimates have been unchanged in the past 30 days.

The Vancouver-based company has been reporting steady earnings outcomes, as evident from its bottom-line surprise trends in the past several quarters. lululemon has a trailing four-quarter earnings surprise of 5.3%, on average. Given its positive record, the question is, can LULU maintain the momentum?

Our proven model does not conclusively predict an earnings beat for LULU this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

lululemon has an Earnings ESP of -0.37% and a Zacks Rank #3. You can see the complete list of today's Zacks #1 Rank stocks here.

lululemon’s third-quarter fiscal 2025 results are expected to reflect persistent softness in North America, mainly the U.S. lululemon has faced persistent headwinds in its Americas business due to a challenging macroeconomic environment marked by elevated inflation and higher interest rates. These factors have weighed on discretionary spending, particularly impacting the women’s category, a core segment for the brand. This slowdown has been especially pronounced in the United States, where consumer caution continues to pressure luxury and premium retailers.

On its last reported quarter’s earnings call, management indicated that a meaningful recovery in its Americas business is not expected until 2026, underscoring persistent near-term weakness in the U.S. business. Our model predicts revenues for the Americas business to decline 0.1% year over year for third-quarter fiscal 2025.

Additionally, headwinds from ongoing uncertainty stemming from increased tariffs on imports from China and Mexico are likely to have led to higher costs. This, along with heavy markdowns and fixed-cost deleverage, is expected to have pressured the gross margin in the to-be-reported quarter. On the last reported quarter’s earnings call, management cited the impacts of new tariffs and the removal of the de minimis provision as structural headwinds that will intensify in the second half of 2025, hurting the gross margin in the fiscal third quarter.

For the third quarter of fiscal 2025, the company expects a 410-bps year-over-year decline in the gross margin due to a 230-bps impact of higher tariff rates and the removal of the de minimis exemption, along with fixed cost deleverage and continued investment in its multi-year distribution center project. The company expects an 80-bps year-over-year increase in markdowns, driven by higher seasonal clearance. This weakness underscores near-term profitability challenges. Our model estimates a year-over-year gross margin contraction of 410 bps to 54.4% in the fiscal third quarter.

lululemon athletica inc. price-eps-surprise | lululemon athletica inc. Quote

lululemon also faces SG&A expense deleverage due to planned investments in strategies and initiatives to fuel long-term growth. These investments include digital marketing and seasonal store openings to drive guest acquisition, build brand awareness and expand testing for longer-term growth opportunities.

On its last reported quarter’s earnings call, management warned about an increase in deleverage in the quarters ahead, led by softer top-line projections, currency headwinds and ongoing investments in its Power of Three x2 plan, despite several enterprise-wide cost savings initiatives in place. Throughout fiscal 2025, the company will continue to allocate resources to support market growth, advance international expansion and strengthen technology capabilities.

For the third quarter of fiscal 2025, SG&A, as a percentage of sales, is expected to deleverage 150 bps year over year, driven by higher foundational investments, including related depreciation and strategic initiatives to enhance brand awareness and support growth. The operating margin for the fiscal third quarter is expected to decline 560 bps year over year, including a 230-bps impact of tariffs and de minimis. We expect the SG&A expense rate to increase 150 bps to 39.5%, with the operating margin declining 560 bps to 14.9%.

However, LULU is poised to benefit from the strong business momentum in its international markets, including Mainland China and the Rest of the World, as the brand connects well with customers globally. The company has been on a growth trajectory with its Power of Three x2 growth plan, focusing on product innovation, guest experience and market expansion. Initiatives like community-based events and brand campaigns have been crucial for increasing brand awareness, attracting customers and strengthening brand loyalty. These efforts are expected to have aided the company's fiscal second-quarter performance.

On the last reported quarter’s earnings call, management expressed confidence in the ongoing strength of its international business, particularly in Mainland China. Our model predicts international revenues to increase 15.2% year over year for third-quarter fiscal 2025, with 23.7% growth expected for Mainland China.

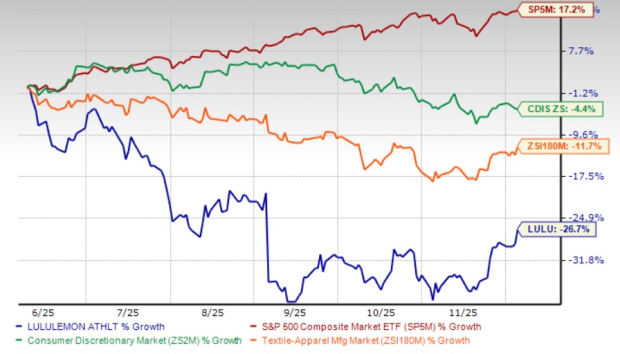

lululemon’s shares have exhibited a downtrend in the past six months, losing 26.7% compared with the industry’s decline of 11.7%. Meanwhile, the company has also underperformed the Zacks Consumer Discretionary sector’s decline of 4.4% and the S&P 500’s growth of 17.2%.

The LULU stock has underperformed V.F. Corporation VFC, Ralph Lauren Corporation RL and Guess? Inc.’s GES rally of 46.3%, 36.3% and 41.1%, respectively, in the past six months.

At its current price of $190.01, the LULU stock trades 19.3% above its 52-week low of $159.25. Moreover, lululemon’s current stock price stands 55.1% below its 52-week high of $423.32.

From the valuation standpoint, the company trades at a forward 12-month P/E multiple of 14.58X, below the industry average of 16.22X.

The stock trades at a discount to the broader industry, suggesting the market is pricing in a more cautious outlook for near-term growth. This relative underpricing indicates that investors are waiting for clearer signs of margin stabilization, international momentum translating into sustained earnings strength, and the company’s innovation pipeline regaining traction.

lululemon is facing a challenging retail backdrop, with inflation, rising interest rates and softer discretionary spending weighing on consumer behavior. Luxury and premium categories, particularly in the Americas, are under pressure, while tariffs remain an additional headwind. These factors have created a difficult environment for growth, but the company continues to execute on its long-term vision.

Momentum is being driven by its Power of Three ×2 strategy, which targets doubling of revenues by 2026 through three pillars — international expansion, growth in the men’s business and enhanced digital engagement. This multi-pronged approach is helping lululemon balance near-term challenges with structural growth opportunities.

International markets stand out as a key driver, with China playing a central role in lululemon’s plan to significantly scale global revenues. Alongside digital investments that deepen customer engagement and a growing men’s apparel segment, lululemon is positioning itself for resilience and long-term value creation.

No matter how the stock responds to the upcoming third-quarter fiscal 2025 results, lululemon’s global strength, particularly across key international markets, underscores the durability of its brand and long-run growth drivers. As lululemon continues to invest in product innovation, market expansion and deeper digital engagement, the path ahead looks geared toward rebuilding momentum.

However, near-term challenges in the Americas, including softer discretionary demand and the drag from higher costs, are likely to weigh on profitability and keep investor expectations measured. Ongoing macro challenges continue to blur near-term visibility and the current valuation suggests caution for near-term growth. For existing shareholders, the long-term strategy provides a basis for staying the course, while prospective investors may find it reasonable to wait for additional confirmation from the upcoming results before increasing exposure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 |

Companies Are Replacing CEOs in Record Numbersand Theyre Getting Younger

LULU

The Wall Street Journal

|

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite