|

|

|

|

|||||

|

|

About the Industry

Internet Services companies are primarily those that rely on huge software and hardware infrastructure, referred to as their "properties," to deliver various services to consumers. People can avail the services by accessing these properties with their personal connected devices from almost anywhere in the world.

Companies generally operate two models: an ad-based model and an ad-free model where the service is charged. Alphabet, Baidu and Akamai are some of the larger players while Crexendo, Upwork, Dropbox, Etsy, Shopify, Uber, Lyft and Trivago are some of the emerging players. Very large players (mainly Alphabet) tend to skew averages. Because of the diversity of services offered, it is difficult to identify industrywide factors that could affect all players.

Factors Determining Industry Performance

Zacks Industry Rank Remains Positive

The Zacks Internet - Services industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #99, which places it among the top 41% of 243 Zacks-classified industries.

The group’s Zacks Industry Rank, which is basically the average rank of all the member stocks, indicates that there are several opportunities in the space.

Looking at the aggregate earnings estimate revisions over the past year, improvements in both the 2025 and 2026 estimates have been more or less consistent, remaining relatively stronger in the last three months. As a result, the aggregate estimates for 2025 and 2026 are up a respective 18.1% and 5.5% over the past year.

Historically, the top 50% of Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. So the industry having moved into the top 50% indicates that it may be turning a corner.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Valuation: Rich

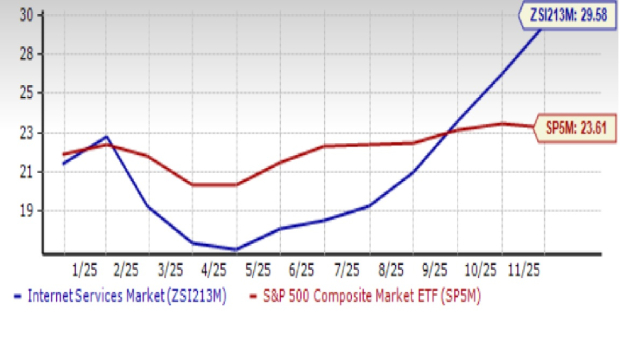

Over the past year, the industry has been more volatile than both the broader Technology sector and the S&P 500. After dipping in April, however, it has been rising more or less consistently and its current returns are superior to both the broader sector and the S&P 500.

The industry’s net gain of 75.5% over the past year is more than the broader sector’s 26.9% and the S&P 500’s 16.4%.

One-Year Price Performance

Industry's Current Valuation: Unattractive

On the basis of forward 12-month price-to-earnings (P/E) ratio, we see that the industry is currently trading at a 29.58X multiple, which is a 45.2% premium to its median value of 20.37X over the past year. This is also a 25.3% premium to the S&P 500’s 23.61X and a slight premium to the sector’s 29.07X.

Over the past year, the industry has traded in the range of 17.17X to 29.58X, a much broader range than the S&P’s 20.62X to 23.82X. The sector has traded in the 23.12X to 30.04X range.

Forward 12 Month Price-to-Earnings (P/E) Ratio

2 Solid Bets

We are spoilt for choice because a number of players in the Internet Services industry are looking good at this point. This despite the fact that the industry is highly diverse, and so there’s the possibility that some players would be doing exceedingly well while others not so much. We currently have a Zacks #1 (Strong Buy) rating on both Yatra and Tencent discussed below.

Yatra Online, Inc. (YTRA): Headquartered in Gurugram India, Yatra operates an online travel booking platform (web and mobile app) in India, selling domestic and international air ticketing, hotel bookings, homestays, holiday packages, bus ticketing, rail ticketing, cab bookings and ancillary services for leisure and business travelers. It also offers tours, sightseeing, event services, travel vouchers and coupons.

The corporate segment remains robust for Yatra, as the company is growing at nearly double the 8-9% growth of the corporate travel industry. Other than its robust offerings, management has said that the rapid adoption of digital processes by Indian companies has them looking out for a digital platform like Yatra, which is translating to solid growth rates.

Additionally, the Meetings, Incentives, Conferences, and Exhibitions (“MICE”) business is doing exceptionally well. Yatra is already a dominant player in the segment and management is open to strategic M&A to further consolidate this lead. The company added 34 new clients in the last quarter with an annual billing potential of $29.5 million. Clearly, the Sep 2024 acquisition of Globe Travels, which brought supplier synergies, technology innovation and cross-selling opportunities, is paying off.

While the Indian aviation industry has been sluggish this year, the Hotels and curated packages segment has been robust for Yatra. This is attributable not just to market strength but also to Yatra’s initiatives. Improving supply, better service standards and a growing preference for experiential stays are boosting demand from both MICE and leisure customers. Under-penetration of digital systems in corporate isa boon.

Yatra’s new interface for hotels that provides a transparent per-room per-night pricing model is likely to be supporting conversions. Additionally, the best-price guarantee of matching of besting the lowest rates in the market is also helping. Its internal generative AI powered travel assistant now enables seamless flight and hotel bookings and payments.

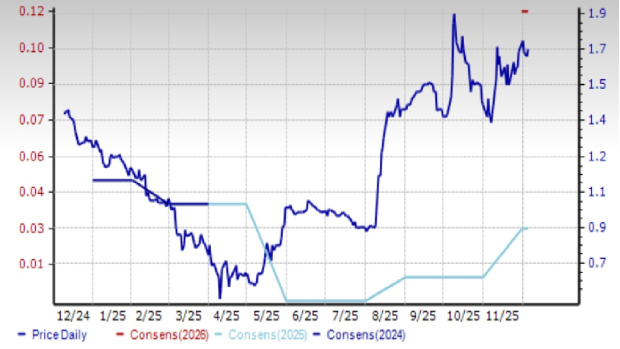

The company beat earnings estimates by a penny on revenue that beat by 46.4%. The estimate for 2026 (ending March) is up 2 cents (200%) in the last 30 days. The 2027 estimate is currently 12 cents (up from a penny estimated in 2026). The lone analyst providing estimates currently expects 2026 revenue and earnings growth of 23.8% and 250%, respectively. For 2027, he’s expecting 6.9% revenue growth and 300% earnings growth (off a small base).

The shares of this Zacks Rank #1 (Strong Buy) stock are up 16.8% over the past year.

Price and Consensus: YTRA

Tencent Holdings Ltd. (TCEHY): Shenzhen, China-based Tencent Holdings is an Internet service portal providing value-added Internet, mobile and telecom services and online advertising. Tencent's leading Internet platforms in China are QQ Instant Messenger, QQ.com, QQ Games, Qzone, 3g.QQ.com, SoSo, PaiPai and Tenpay. It has brought together China's largest Internet community to meet the various needs of Internet users including communication, information, entertainment, e-commerce and so forth.

The company posted another quarter of strong revenue growth as gaming remained very strong across both domestic and international markets; its AI initiatives generated rich dividends in game engagement, ad targeting and efficiency enhancements across gaming, video and coding; and healthy trends in fintech and business services. It also made significant headway in further developing its Hunyuan LLM.

Management detailed the performance of its key services on the call: “for communication and social networks, combined MAU of Weixin and WeChat grew year-on-year and quarter-on-quarter to 1.4 billion. For digital content, Tencent Music Entertainment Group is paying Space and Apple, solidifying its leadership position in music streaming. For games, Delta Force is now the top three game in China by gross receipts, while Valorant successfully expands from PC to mobile.”

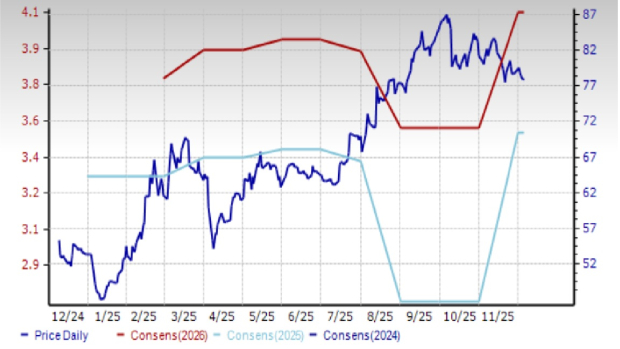

Tencent topped estimates in the last quarter. Its revenue beat by around 1.3% while earnings beat by 22.8%. The 2025 estimate has increased 53 cents (15.6%) in the last 30 days while the 2026 estimate increased 54 cents (13.6%). At these levels, they represent a 15.2% increase in revenue and a 20.2% increase in earnings for 2025 and a 11.4% revenue increase and 14.4% earnings increase in the following year.

The shares of this Zacks Rank #1 (Strong Buy) stock are up 48.2% over the past year.

Price and Consensus: TCEHY

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-05 | |

| Dec-09 | |

| Dec-08 | |

| Nov-26 | |

| Nov-19 | |

| Nov-12 | |

| Nov-12 | |

| Nov-07 | |

| Aug-26 | |

| Aug-12 | |

| Aug-08 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite