|

|

|

|

|||||

|

|

IonQ's share price gains have lagged those of other quantum stocks.

The industry opportunity still remains quite speculative at this point.

Investors will also want to keep an eye on the company's rising costs.

With shares up by a relatively modest 63% over the past 12 months, IonQ (NYSE: IONQ) hasn't received as much hype as other pure-play quantum computing stocks like Rigetti Computing and D-Wave Quantum, which have both soared by over 800% over the same time period.

That said, the investor optimism is mainly related to industrywide tailwinds that can't be attributed to one specific company. Let's dig deeper into the pros and cons of IonQ to see how it compares to the alternatives and decide if it has millionaire-maker potential.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Much like generative artificial intelligence (AI) today, and the internet before it, quantum computing is one of those once-in-a-generation technologies that promises to totally change the way people live and do business. The goal is to create devices capable of quickly solving problems that would currently be unfeasible for the most powerful supercomputers. And if things work out, it could allow scientists to quickly discover new materials, logistics routes, or pharmaceutical drugs.

While quantum computing is something that has felt just around the corner for decades, investors started taking it seriously in late 2024 when industry leader Alphabet announced its cutting-edge Willow chip capable of solving its own errors. Both Alphabet and International Business Machines believe they can bring commercially viable quantum computing devices to market within five years. And much like a rising tide lifts all boats, the accelerated timeline has sent capital flowing into other industry players like IonQ.

This month, the industry got another boost when Nobel Prize-winning physicist John Martinis claimed that China is just "nanoseconds" behind the West in developing viable quantum computers. This is seen as a bullish factor for American quantum stocks because it opens a stronger opportunity for government support and possible subsidies.

Like most publicly traded quantum computing stocks, IonQ is tackling the picks-and-shovels side of the industry, aiming to provide the hardware and software its enterprise clients will need to create value with the technology. The company is unique because of its trapped-ion architecture, which management believes is the most promising platform for quantum computer development because of its stability and accuracy.

Most of us aren't physicists, so it will be tough to compare the merits of IonQ's technological approach with other players like Rigetti Computing. That said, IonQ's third-quarter earnings report can give us some clues about how the market is responding to its products and services.

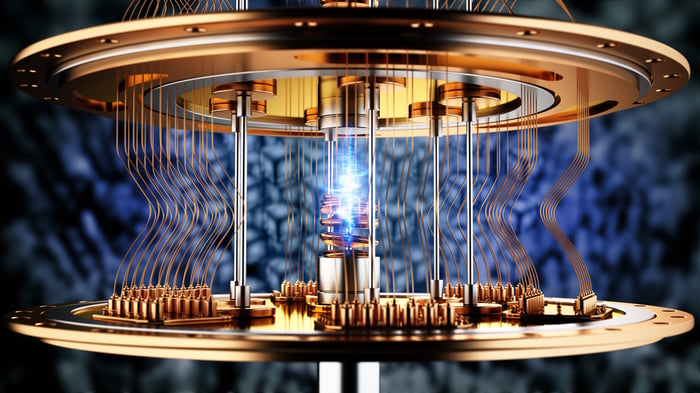

Image source: Getty Images.

Revenue jumped by an eye-popping 222% year over year to $39.9 million as clients in a variety of industries continue experimenting with its cloud-based "quantum-as-a-service" offering, which allows them to access the technology without having to buy or build their own devices. The company is performing dramatically better than its close rival, Rigetti Computing, which saw its third-quarter sales drop 18% to $1.9 million despite offering similar cloud-based quantum computing services.

However, IonQ's situation isn't all good. While the company's revenue is growing at an impressive clip, its losses are increasing almost just as fast. Third-quarter operating losses ballooned from $53.1 million to $168.8 million, driven by a nearly 500% explosion in general and administrative costs, which refers to things like managerial and office salaries. Investors would probably prefer to see more of that money going toward research and development as IonQ aims to pioneer its novel technology.

With a market cap of just $17.2 billion, IonQ clearly has millionaire-maker potential if its unique trapped-ion quantum computing technology turns out to outperform other competing architectures. The company's rapid top-line growth is also very encouraging.

That said, it is still very early to be betting on quantum computing stocks. And IonQ's rising general and administrative spending raises questions about its financial discipline. Investors should probably wait for more information before considering a position in the company.

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of December 8, 2025

Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends IonQ. The Motley Fool has a disclosure policy.

| 12 hours | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite