|

|

|

|

|||||

|

|

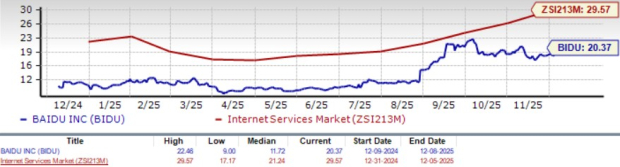

Baidu BIDU presents an intriguing investment case for those evaluating China's technology sector at current valuation levels. Trading at a forward price-to-earnings ratio of 20.37x, the stock sits at a substantial discount to the Zacks Internet-Services industry's 29.57x and the Zacks Computer and Technology sector's 29.03x.

This valuation gap raises important questions about whether the market is simply accounting for near-term pressures or overlooking fundamentals that may become more visible over time. For investors, the key consideration is whether BIDU’s discount reflects short-term adjustments or a fair valuation for its current transition phase. Let’s delve deeper to understand where the stock stands currently.

BIDU’s Apollo Go continues to scale at a pace that now signals early commercial viability rather than experimental rollout. The platform provided 3.1 million fully driverless rides in the third quarter of 2025, up 212% year over year and accelerating from 148% in the prior quarter, pushing cumulative rides beyond 17 million by November 2025. Its expansion into Switzerland with PostBus, fully driverless permits in Abu Dhabi and broader testing zones across Hong Kong reflect growing regulatory confidence in its technology. With operations in 22 cities and 100% fully driverless service across major Chinese mainland markets, Apollo Go is building density that few peers match. Despite rising competition from Tesla TSLA, Alibaba BABA backed AutoX and others, BIDU retains an execution lead grounded in 240 million autonomous kilometres and improving unit economics, strengthened further by the cost-efficient RT6 vehicle platform.

BIDU’s AI infrastructure strategy is becoming a key catalyst for its long-term positioning as enterprises shift toward AI-native workflows. At the core of this ecosystem is ERNIE 5.0, the company's latest omni-modal foundation model designed to handle multimodal reasoning, real-time interaction and domain-specific instruction following. These capabilities support applications ranging from digital employees and AI-native marketing tools to autonomous driving perception systems, allowing enterprises to run higher-quality inference with fewer resources. The Qianfan platform has evolved into an agent-centric MaaS environment that supports full life-cycle development of enterprise AI agents across manufacturing, logistics, energy and automotive use cases. AI Cloud Infrastructure generated RMB 4.2 billion in revenues in the third quarter of 2025, up 33% year over year. Meanwhile, competition from Alibaba Cloud and Tencent Holdings TCEHY remains active, but BIDU's ability to connect ERNIE 5.0 directly into its infrastructure, frameworks and applications creates a cohesive architecture that supports long-term enterprise adoption.

BIDU's online marketing business continues facing structural headwinds that are offsetting momentum in emerging growth areas. Online marketing revenues declined 18% year over year in the third quarter of 2025 to RMB 15.3 billion, reflecting ongoing weakness in China's advertising market and intensifying competition from integrated e-commerce and social media platforms. This core business segment, which historically generated the majority of company revenues and profits, is experiencing pressure from macroeconomic uncertainty, changing advertiser preferences and the gradual shift of marketing budgets toward short-form video and live-streaming formats where BIDU has less market share. While the company is developing AI-native marketing services, including agents and digital humans that showed 262% year-over-year growth, these innovations remain a relatively small portion of total advertising revenues and have not yet scaled sufficiently to offset legacy business declines.

BIDU shares have appreciated 45.8% over the past year, underperforming the Zacks industry's 67.7% growth and trailing gains posted by Alibaba and Tencent, which rose 76% and 46.6%, respectively. Notably, BIDU has significantly outperformed Tesla’s shares, which rose only 9.6% over the same timeframe, suggesting that despite challenges in its core advertising business, the market is pricing in greater long-term potential from BIDU's AI and autonomous driving initiatives.

The Zacks Consensus Estimate for fourth-quarter earnings per share is pegged at $1.50, down 5 cents over the past 30 days and suggesting a 42.97% year-over-year decline. The consensus mark for 2025 earnings is pegged at $7.16 per share, up 13 cents over the past 30 days, indicating a 32% annual decline. These trends signal that while Apollo Go and AI Cloud show operational momentum, the timeline for offsetting advertising headwinds and heavy AI reinvestment costs remains uncertain.

Baidu, Inc. price-consensus-chart | Baidu, Inc. Quote

Baidu's investments in AI infrastructure, cloud services and autonomous driving position it at the centre of China's technology transformation. However, persistent advertising weakness and uncertain AI monetization timelines constrain near-term profitability. While BIDU outperformed Tesla over the past year, it lagged Alibaba and Tencent, reflecting cautious investor sentiment. With mixed earnings estimate revisions and the stock trading at a valuation discount to industry peers, existing shareholders should hold current positions, while new investors may benefit from waiting for a clearer entry point. BIDU currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 9 hours | |

| 11 hours | |

| 14 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Elon Musk: Tesla FSD Coming To Europe, Alongside Cybercab, Optimus Production

TSLA

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite