|

|

|

|

|||||

|

|

Seagate Technology Holdings plc STX has entered fiscal 2026 with exceptional momentum, supported heavily by booming AI-driven storage requirements. The company reported robust year-over-year revenue growth, record non-GAAP gross margins and strong operating profitability for first-quarter fiscal 2026. As AI adoption accelerates globally, Seagate’s optimistic fiscal 2026 outlook is grounded in the belief that large-capacity hard drives will remain critical for supporting the massive influx of unstructured data that AI workloads generate.

AI is reshaping the storage landscape in profound ways. Inferencing models consume and produce extraordinary volumes of data, which must be stored, monitored and fed back into training cycles. Video-based AI applications are a dominant contributor here, creating an enormous surge in data generation. Seagate noted that one minute of AI-generated video can be almost 20,000 times larger than a 1,000-word text file. As text-to-video tools gain traction, this surge in data creation is already boosting storage needs and strengthening long-term demand for high-capacity drives.

This demand surge aligns well with Seagate’s Heat-Assisted Magnetic Recording (HAMR)-based Mozaic platform roadmap. Seagate expects HAMR to help exploit megatrends like AI and machine learning, which will drive secular demand for cost-effective mass capacity storage solutions. Seagate shipped more than 1 million Mozaic drives during the September quarter. Since its HAMR-based Mozaic drives are the industry’s only products offering 3 terabytes per disk, cloud customers are lining up for them.

Seagate has five global CSPs qualified on its Mozaic 3+ terabyte-per-disk products, offering up to 36TB per drive, and remains on track to qualify the remaining three CSPs by the first half of 2026. The Mozaic products are performing strongly in production, with Seagate on track to reach 50% exabyte crossover on nearline HAMR drives in the second half of 2026. The company has also begun qualifying with a second major CSP on the Mozaic 4+ terabyte-per-disk platform, offering up to 44TB per drive, with volume ramp expected in early 2026.

Management expects demand to remain solid, led by global cloud data centers. It projects higher revenue and margin expansion as customers adopt its next-generation storage solutions. For the fiscal second quarter, it expects revenues of $2.7 billion (+/- $100 million). At the midpoint, this indicates a 16% year-over-year improvement. Non-GAAP earnings are expected to be $2.75 per share (+/- 20 cents).

However, Seagate faces challenges, such as exchange rate volatility, high debt burden and lingering macro and supply chain uncertainties. Moreover, stiff competition from Western Digital Corporation WDC and Pure Storage, Inc. PSTG persists.

Western Digital is benefiting from a booming AI and cloud computing demand environment. Increasing sales in the cloud end market are driven by solid demand for higher-capacity nearline products. It shipped 204 exabytes, up 23%, backed by strength in ePMR products up to 26TB CMR and 32TB UltraSMR. It aims to ensure scalability in HAMR qualification ahead of volume production in early 2027. Agentic AI is driving future data growth, while its platform business is growing with increased on-prem and cloud storage demand and continued investment to scale further. It expects fiscal second-quarter revenues of $2.9 billion (+/- $100 million), up 20%, driven by strong data center demand and HDD uptake.

Pure Storage continues to reshape the future of enterprise storage with innovations tailored for modern data workloads—particularly AI, containerization and high-performance computing (HPC). The company is gaining from healthy sales, solid enterprise and subscription momentum. Its Evergreen//One ensures SLA-backed performance, capacity and security with always-modern, disruption-free technology, while the rising uptake of Enterprise Data Cloud, hyperscaler gains and resilient execution support growth. Management shifted to range-based guidance, expecting fiscal 2026 revenues of $3.6-$3.63 billion, up 14% at the midpoint, 300 basis points above its prior 11% growth outlook. The non-GAAP operating income is expected to be $185-$195 million, with around 14% year-over-year growth at the midpoint.

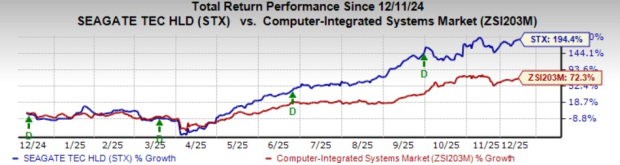

In the past year, shares have surged 194.4% compared with the Zacks Computer Integrated Systems industry’s growth of 72.3%.

In terms of forward price/earnings, STX’s shares are trading at 23.24X, lower than the industry’s 23.47X.

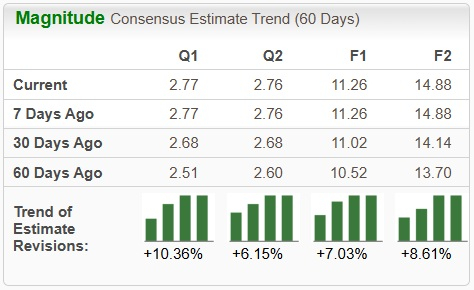

The Zacks Consensus Estimate for STX’s earnings for fiscal 2026 has been revised up 7.03% to $11.26 over the past 60 days.

Currently, Seagate sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite