|

|

|

|

|||||

|

|

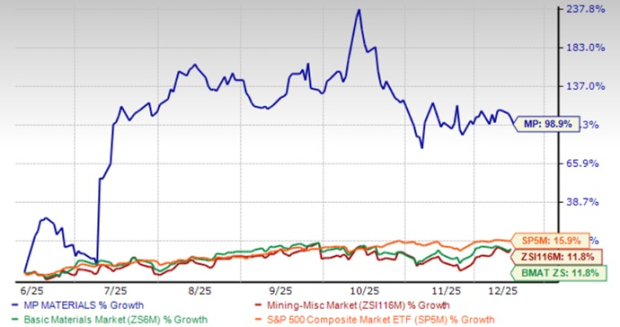

MP Materials MP shares have soared 98.9% in the past six months, far outpacing the industry’s 11.8% growth, the Zacks Basic Materials sector’s 11.8% rise and the S&P 500’s gain of 15.9%.

The stock’s rally has been driven by major developments during this period. This includes the agreement with the United States Department of War (DoW), formerly known as the Department of Defense, to accelerate a domestic rare earth magnet supply chain, a long-term deal to supply Apple AAPL with recycled rare earth magnets, as well as back-to-back solid production numbers in the second and third quarters of 2025.

While MP Materials has outshone another player in the rare earths space, Lynas Rare Earths Limited LYSDY, which gained 49.5% in the past six months, it has lagged Energy Fuels UUUU, which has gained 175.6% in the same time frame.

While this rally may tempt investors, it is important to assess the underlying drivers and their sustainability, as well as the company’s growth prospects and potential risks, before making any investment decision.

In July, MP Materials announced a landmark long-term agreement to supply Apple with rare earth magnets manufactured in the United States, entirely from recycled materials. Apple and MP Materials have collaborated over the past five years to develop advanced recycling technology that enables recycled rare earth magnets to be processed into material that meets Apple’s rigorous standards. Also, in July, MP Materials entered into a partnership with the DoW that will fast-track the development of a domestic rare earth magnet supply chain.

In November, MP Materials also announced it has partnered with the DoW to establish a strategic joint venture with the Saudi Arabian Mining Company (Maaden) to develop a rare earth refinery in the Kingdom. This will leverage Saudi Arabia’s competitive energy base, solid infrastructure and the untapped rare earth resources.

MP Materials is demonstrating strong growth in rare earth production, with back-to-back solid quarterly performances so far this year. Production of neodymium and praseodymium (NdPr) reached 721 metric tons in the third quarter, a 51% surge from the year-ago quarter. This outscored MP Materials’ previous record NdPr production of 597 metric tons in the second quarter.

The company’s NdPr production amounts to 1,881 MT for the first nine months of 2025, 114% higher than the prior year. MP has already surpassed its 2024 NdPr production of 1,294 MT. The company has been ramping up its NdPr production since it started production in the fourth quarter of 2023.

Rare Earth Oxide (REO) production was down 4% year over year to 13,254 metric tons (MT) in the third quarter. Despite this, it was the second-highest quarter on record in the company’s history. MP Materials had reported REO production of 13,145 metric tons in the second quarter of 2025.

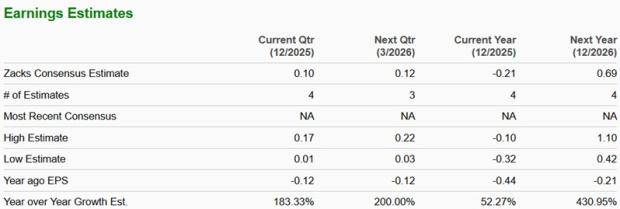

The Zacks Consensus Estimate for MP Materials’ revenues is projected to grow 13.66% year over year in 2025, and further 79% in 2026.

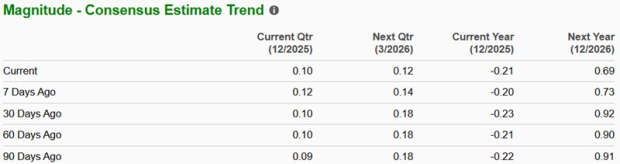

The consensus estimate for 2025 earnings is currently pegged at a loss of 21 cents per share. The estimate for 2026 stands at earnings of 69 cents per share, implying a potential turnaround.

The Zacks Consensus Estimate for MP’s fiscal 2025 and 2026 earnings has moved south over the past 90 days.

MP is trading at a forward 12-month price/sales multiple of 25.41X, a significant premium to the industry’s 1.44X. It has a Value Score of F.

Energy Fuels is trading higher at 40.39X while Lynas is comparatively a cheaper option, trading at 11.11X.

MP Materials operates the Mountain Pass Rare Earth Mine and Processing Facility, the only rare earth mining and processing site of scale in North America. These materials are essential for a wide range of existing and emerging clean-tech technologies, including electric vehicles, wind turbines, robotics, drones and defense systems. With China dominating the global supply, the United States is increasingly prioritizing the development of domestic rare earth capabilities.

The multibillion-dollar investment package and long-term commitments from DoW provide MP Materials the opportunity to capitalize on this. MP will construct the second domestic magnet manufacturing facility (the 10X Facility), which will take total U.S. rare earth magnet manufacturing capacity to 10,000 metric tons and cater to both the defense and commercial sectors. Also, the $500 million agreement with Apple marks a transformative step for MP, launching its recycling platform and scaling up its magnet production business.

MP Materials’ unmatched positioning in the U.S. supply chain, efforts to ramp up operations and premium partnerships with Apple and the DoW indicate a robust growth runway. Investors holding MP shares should continue to do so to benefit from the solid long-term fundamentals.

However, new investors can wait for a better entry point, considering the premium valuation and the downward estimate revision activity in earnings. MP stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour |

Iran Says Khamenei Killed As U.S.-Israeli Attacks Continue; Dow Jones Futures Loom

AAPL

Investor's Business Daily

|

| 4 hours |

Trump Says Khamenei Killed In U.S.-Israeli Attacks. How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 5 hours | |

| 7 hours | |

| 7 hours |

Trump Says Khamenei Likely Killed In U.S.-Israeli Attacks On Iran. How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 8 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 13 hours | |

| 14 hours | |

| 16 hours | |

| 22 hours | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite