|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The Federal Reserve announced its third interest rate cut of 25 basis points yesterday amid persistent inflation and a softening job market. This lowered the Fed funds rates to the 3.5%-3.75% range.

“In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks,” Fed officials said in their policy statement. The rate-sensitive sectors, including Financial Services, were among the top performers in the S&P 500 Index yesterday.

Banks, the major constituents of the Financial Services sector, witnessed a notable rise yesterday. The KBW Nasdaq Regional Banking Index and the S&P Banks Select Industry Index both inched up 3.3%. Shares of Wall Street biggies like Bank of America BAC and Citigroup C rose more than 1%, while KeyCorp KEY, Citizens Financial CFG, and Wells Fargo WFC rallied more than 2%.

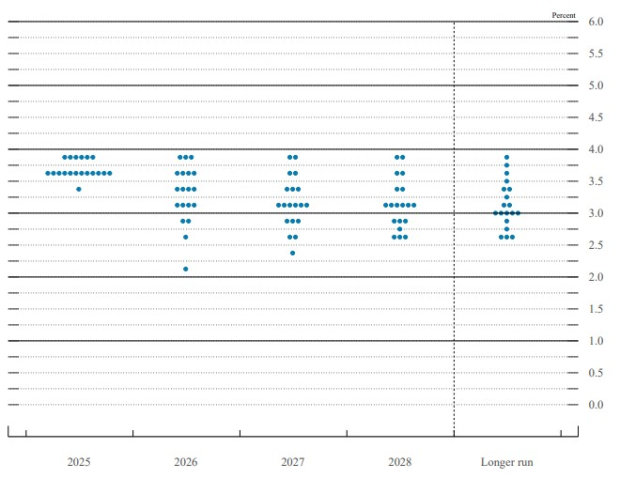

The Fed officials, through the dot plot (which maps out policymakers' expectations for where interest rates could be headed in the future), signaled one cut in 2026. This would bring rates close to 3.4% by 2026-end. For 2027, the Fed projected the terminal rate hitting 3.1%, indicating one further rate cut. The rate is expected to remain unchanged in 2028.

Fed’s Dot Plot

Additionally, the central bank came out with the latest Summary of Economic Projects (SEP). Per the latest SEP data, the U.S. economy is anticipated to grow at the rate of 1.7% this year and 2.3% in 2026.

The unemployment rate is seen ticking down to 4.4% next year from 4.5% this year, unchanged from the last update in September. The unemployment rate currently stands at 4.4%.

The central bank also reduced the inflation target to 2.9% for 2025 from 3% predicted in September. For 2026, inflation will likely be 2.4%, down from the prior forecast of 2.6%. This indicates that the outlook for economic growth is higher next year, with inflation expected to drop and the unemployment rate inching down.

Lower rates will support net interest income (NII) expansion, a critical earnings driver for banks. While lower benchmark rates can compress yields on loans and securities, the easing of funding pressures helps preserve margins.

Also, a rate cut makes refinancing more affordable, reducing the risks of defaults. This, in turn, can help banks improve credit quality and limit the need for higher loan-loss provisions. Further, lower rates are expected to encourage consumers and businesses to borrow. Such increased lending activity can result in larger profitability for banks as they earn more interest on these loans.

Citigroup: NII has been supporting the company’s top-line growth over the years. The metric witnessed a three-year CAGR of 8.4% (ended 2024), with momentum continuing in the first nine months of 2025. NII will continue expanding on the back of stabilizing funding costs and loan growth. Management projects 2025 NII to rise 5.5% year over year.

Citigroup continues to emphasize growth in core businesses through streamlining consumer banking operations globally. The company has successfully exited from consumer banking businesses in nine countries. These initiatives will free up capital and help the company pursue investments in wealth management and investment banking (IB) operations, which will stoke fee income growth.

Citigroup expects total revenues to exceed $84 billion in 2025, with revenues projected to see a 4-5% CAGR through 2026.

The Zacks Consensus Estimate for 2025 and 2026 earnings implies year-over-year growth of 27.7% and 31.1%, respectively. It currently carries a Zacks Rank of 3 (Hold).

Bank of America: The company’s NII witnessed a CAGR of 9.3% over the last three years (ended 2024), with the uptrend continuing in the first nine months of 2025. The company is seeing an upside in NII this year, driven by decent loan demand, fixed asset repricing, lower interest rates and robust deposit balances. Management expects NII (FTE) to be $15.6-$15.7 billion in fourth-quarter 2025, up 8% year over year. In 2026, growth in NII is expected to be in the range of 5-7%.

Moreover, BAC has embarked on an ambitious expansion plan to open financial centers in new and existing markets. By 2027, it plans to expand its financial center network and open more than 150 centers. It also remains committed to providing modern and state-of-the-art financial centers through its ongoing renovation and modernization project. Thus, the initiative will likely support the Bank to cross-sell other product suites like credit cards, auto and mortgage loans.

The Zacks Consensus Estimate for BAC’s 2025 and 2026 earnings implies a year-over-year rise of 15.9% and 14.4%, respectively. It carries a Zacks Rank #2 (Buy) at present. It carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

KeyCorp: Though the Federal Reserve has reduced interest rates by 75 basis points (bps) this year and 100 bps in 2024, the rates are still relatively higher than the 2020 and 2021 levels of near-zero rates. This will continue to support KeyCorp’s net interest margin (NIM) growth. In 2024, NIM (on a tax-equivalent basis) was 2.16%, relatively stable from the 2023 level of 2.17%. In the first nine months of 2025, the metric expanded mainly attributable to balance sheet repositioning, fixed-rate assets, swap repricing and stabilizing funding costs. NIM is expected to rise, driven by an improving deposit mix, decent loan growth, balance sheet repositioning, stabilizing deposit costs and the reinvestment of low-yielding fixed-rate securities.

Management remains cautiously optimistic about potential loan growth in 2025. The top line is expected to keep improving, supported by decent loan demand and pipelines, along with the company’s efforts to strengthen fee income. In 2025, the company expects adjusted total revenues (tax equivalent or TE) to be up 15% from the prior year, reflecting record growth on the back of robust fee income and NII.

The Zacks Consensus Estimate for KEY’s 2025 and 2026 earnings implies year-over-year rallies of 15.8% and 6.9%, respectively. It currently has a Zacks Rank #2.

Wells Fargo: The bank is positioning itself to benefit from a softer rate environment, which will likely drive increased lending activity, stabilize the NIM and help further market share gains across fee-generating businesses.

Wells Fargo has signaled that interest rate cuts will help stabilize funding costs, making deposit growth a central pillar of its balance sheet strategy. Lower rates typically spur loan demand, and freed from its asset cap, the bank aims to aggressively grow both consumer and corporate loan assets. Management expects 2025 NII to be roughly stable year over year, as lower rates support a rebound in loan origination and reduce deposit pricing pressures.

Further, WFC is moving to expand across multiple business lines now that the Fed has lifted the asset cap that limited its growth since 2018. With this, the bank gains room to scale fee-based businesses like payment services, asset management, and mortgage origination, enhancing its revenue mix and supporting future top-line growth.

The Zacks Consensus Estimate for WFC’s 2025 and 2026 earnings implies year-over-year rallies of 2.2% and 5.4%, respectively. It presently carries a Zacks Rank #2.

Citizens Financial: Organic growth is the company’s key strength, as reflected by its rising revenue trend. The company’s total revenues witnessed a CAGR of 3% over the last four years (2020-2024), driven by strength in NII and fee income.

In 2025, Citizens Financial expects NII to grow 3-5% and non-interest income to rise 8-10% year over year. Decent loan growth and the Fed’s rate cuts, along with increasing fee income, will keep supporting top-line growth.

CFG’s long-term strategy involves growth in wealth management offerings, improved capabilities in the high-net-worth segment and expansion into key markets. The company is also investing in its payments platform and solidifying commercial middle market coverage with investments in key expansion markets that complement private banking business success.

Management expects a return on average tangible common shareholders’ equity of 16-18% and a NIM to be 3.25-3.50% range by 2027.

The Zacks Consensus Estimate for CFG’s 2025 and 2026 earnings implies year-over-year increases of 5.6% and 7.7%, respectively. It currently carries a Zacks Rank of 3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite