|

|

|

|

|||||

|

|

I have said it before and I’ll say it again: Tesla stock moves in manic cycles of booms and busts. Right now, it is firmly back in boom mode.

After a difficult couple of years, marked by shrinking market share and slowing sales growth, the tide has started to turn. Sales at Tesla (TSLA) are accelerating again, and several of its most ambitious “moonshot” initiatives, the kinds of projects that truly differentiate the company, are finally approaching commercialization.

Fully autonomous driving continues to advance, the robotaxi network is preparing to roll out at scale and Tesla’s energy generation and storage business, a smaller business vertical, is booming. Even humanoid robots are no longer a distant concept but an emerging part of the company’s roadmap.

While the focus this year has been on some emerging AI winners such as Alphabet (GOOGL) and Broadcom (AVGO), a new year will define new trends. AI will certainly play a role in those trends, but the shift should include Tesla in 2026.

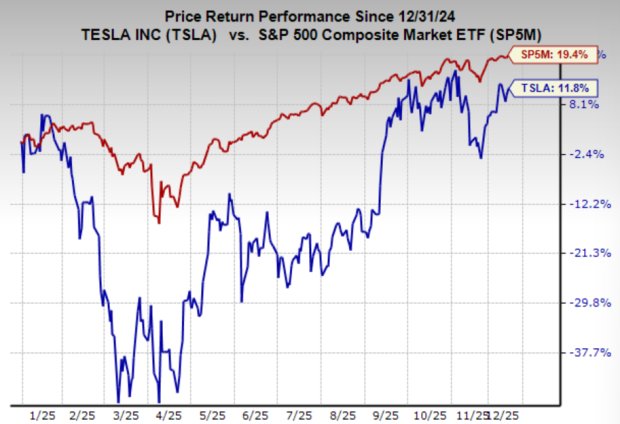

It’s clear from TSLA’s performance this year that the ride has been volatile, with the stock lagging the broader market year-to-date. But the tone has shifted meaningfully since the April lows, and momentum has strengthened even further in recent months. In this report, I will walk through the technical setup that points to a potential major breakout, and I’ll detail the business catalysts that could make Tesla one of the standout winners in 2026.

Tesla’s momentum shift has been building in the latter half of this year, and the chart makes this clear. The stock began accelerating in late summer after breaking out of a tight multi-month consolidation, launching into a sharp rally that carried shares back toward prior highs. Since then, Tesla has been working through another orderly consolidation phase, digesting those gains.

What stands out is how well TSLA held up during the recent market volatility. Over the past month, many high-beta names saw meaningful corrections, yet Tesla largely stayed within this range. This kind of relative strength near the top of a multi-month range is often a constructive sign, suggesting that institutional buyers are supporting the stock even as broader conditions fluctuate.

Tesla now sits just below a level of resistance. Above that resistance lies a clean path back to record highs. A decisive push through the $460 level would mark a textbook breakout from this consolidation and likely serve as the trigger for the next major leg higher. Given the improving fundamentals, narrative and strengthening momentum behind the stock, such a breakout could carry significant follow-through.

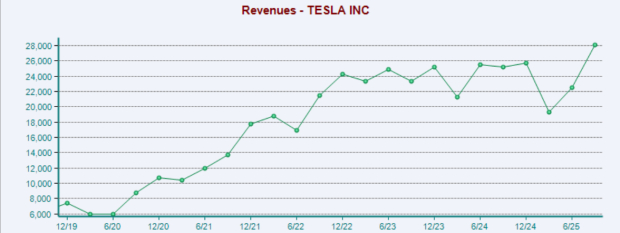

After nearly three years of stagnant growth, Tesla has finally begun to reaccelerate. The company posted new record-high sales in its most recent quarter, and even showed meaningful improvement in China, a market where it has faced intense competitive pressure and had struggled to maintain momentum. While near-term sales forecasts for the upcoming quarter and full year remain mixed, expectations improve substantially beyond that. Analysts project growth of 19% in the following quarter and 11.7% for next year.

One of the strongest contributors to this recovery is Tesla’s Energy Generation and Storage segment. This business has quietly become Tesla’s highest margin division, and its growth profile is far more explosive than the automotive segment. Energy storage deployments have compounded at an extraordinary 180% over the past three years.

The narrative around Tesla has been bleak at times over the past few years, but the company’s underlying strengths are beginning to reassert themselves. And as history has repeatedly shown, it is unwise to count Elon Musk out.

Even if EV sales never reaccelerate to the extraordinary levels seen between 2020 and 2022, Tesla now has enough emerging catalysts to drive the stock meaningfully higher. The company’s future is no longer tied solely to vehicle deliveries.

Self-driving technology is the most immediate and consequential of these catalysts. Full Self-Driving is showing rapid improvement, with FSD appearing closer than ever to unsupervised capability. The most recent iterations of the FSD software, most notably the v14.1.x in October showed an exceptionally impressive improvement from the prior models.

This has major implications not only for the owners of Tesla’s, but for Tesla’s robotaxi business. Elon Musk has been increasingly vocal about its readiness, even going so far as to proclaim this week that driverless robotaxis are “three weeks away,” perhaps the most specific timeline he has offered to date. If robotaxis launch at scale, the revenue model shifts from one-time vehicle sales to a high-margin, recurring, software-driven service—potentially unlocking one of the largest new markets Tesla has ever pursued.

Humanoid robots add another powerful long-term catalyst. The timeline remains uncertain, but Musk and Tesla are clearly positioning themselves as key players in this emerging field. Given the company’s advantage in AI training data, hardware integration, and manufacturing scale, it would be unwise to dismiss the potential of this program. As I noted earlier, you can never count Musk out.

As investors look toward 2026, the market narrative may broaden beyond the dominant AI leaders of this year. Companies like Alphabet and Broadcom have captured most of the attention in the second half of this year, and deservedly so, given their emerging roles in AI infrastructure and software. But leadership rarely stays static, and as we move into a new phase of the cycle, the opportunity set is likely to expand. Tesla is increasingly poised to be part of that shift.

While Alphabet and Broadcom will remain foundational players in the AI ecosystem, Tesla’s integration of AI into real-world applications, robotaxis, autonomy, robotics, energy systems, opens the door to a narrative shift. is applying AI in ways that directly monetize physical assets, transportation networks, and energy infrastructure.

For investors looking for opportunities in the coming year, Tesla stands out as a continued innovator and key played in the major technological trends. If even a fraction of what Musk promises comes to fruition, Tesla will continue to have a winning stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 min | |

| 19 min | |

| 21 min |

Uber, Latest Victim of Disruption Panic, Still Has Role in Robotaxis

GOOGL TSLA

The Wall Street Journal

|

| 38 min | |

| 1 hour | |

| 1 hour | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours |

Modi pitches India as global artificial intelligence hub at AI summit

GOOGL

Associated Press Finance

|

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite