|

|

|

|

|||||

|

|

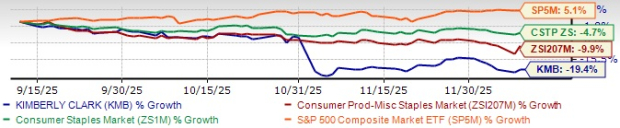

Kimberly-Clark Corporation KMB has experienced a steep decline over the past three months, with its shares tumbling 19.4%, underperforming the Zacks Consumer Products–Staples industry's dip of 9.9%. The company also trailed the Consumer Staples sector’s decline of 4.7% and the S&P 500's rally of 5.1% during the same period.

KMB’s Past 3 Months’ Performance

Kimberly-Clark’s share performance is being challenged by softer global demand, inflation and currency volatility. Elevated marketing and promotional investments are adding near-term margin pressure, while recent business exits further weigh on the results. Despite these hurdles, the company continues to support its brands and innovation pipeline to stabilize its performance.

Kimberly-Clark has also underperformed its peers, including Procter & Gamble PG, Albertsons Companies ACI and The Clorox Company CLX.

Shares of Procter & Gamble, Albertsons and Clorox have declined 11.3%, 8.6% and 17%, respectively, over the same period.

KMB vs. Peer Performances

Closing at $103.14 yesterday, the KMB stock stands 31.4% below its 52-week high of $150.45 reached on March 10, 2025. Kimberly-Clark is trading below its 50 and 200-day simple moving averages of $110.31 and $125.33, respectively, signaling bearish sentiment in maintaining the recent performance levels.

KMB Trades Below 50 & 200-Day Moving Averages

The recent slide in the stock has contributed to Kimberly-Clark’s discounted status. This leading global consumer goods company is currently trading at a compelling discount relative to its industry. The KMB stock trades at a forward 12-month price-to-earnings (P/E) ratio of 14.60, lower than the industry’s average of 17.58.

KMB P/E Ratio (Forward 12 Months)

Procter & Gamble and Clorox trade at higher forward P/E ratios of 19.44 and 16.31, respectively, than Kimberly-Clark, while Albertsons trades at a lower forward P/E ratio of 7.68.

Kimberly-Clark’s stock has struggled as the company navigates an increasingly challenging global operating environment. Softer demand in several international markets, heightened deal intensity, and cautious consumer behavior in emerging economies have introduced volatility to category performance, forcing the company to maintain elevated levels of brand support and commercial investment, which weigh on margin recovery.

Profitability pressures have further dampened investor sentiment. In the third quarter of 2025, the adjusted gross margin slipped 170 basis points year over year as cost inflation and tariff-related expenses outweighed productivity gains.

Currency headwinds have added another layer of strain. Net sales are expected to face a roughly 100-basis-point hit from currency translation and a 290-basis-point decline due to the PPE divestiture and the exit of its private label diaper business in the United States. Adjusted operating profit growth is projected to be constrained by a 380-basis-point reduction from the same divestiture and exit, along with an additional 70-basis-point negative effect of currency translation.

Adjusted earnings per share are expected to be similarly pressured, including a 320-basis-point impact from the divestiture and exit, a 100-basis-point effect from higher net interest expenses and an elevated effective tax rate, and a 150-basis-point negative influence from currency translation, including its impacts on income from equity interests.

Kimberly-Clark’s promotional posture has also intensified. To defend share amid increased competition, the company continues to invest heavily in marketing, innovation and trial-driving promotions across its good-better-best ladder. While these efforts support long-term brand health, they constrain near-term margin expansion and heighten profitability pressure.

KMB is making steady progress in navigating a complex global environment by leveraging its innovation-led growth strategy and strong brand equity. The company continues to deliver volume-plus-mix expansion, driven by new product platforms across the good-better-best spectrum. Innovations, such as improved diaper technologies and strengthened value-tier propositions, are helping Kimberly-Clark maintain market share despite intense competition.

Productivity remains a central pillar of the company’s turnaround strategy. Through its 2024 Transformation Initiative, Kimberly-Clark is achieving industry-leading efficiency gains that help offset inflation, tariff pressures and rising cost-to-serve. These savings enable the company to reinvest in brand building, sustain innovation cycles and enhance price value architectures — all while maintaining financial discipline.

Commercial execution is being strengthened across regions. Kimberly-Clark is elevating marketing, targeted promotions and omnichannel activation to drive trial of innovations while protecting long-term brand equity. Strong growth in digital channels and club formats reflects improved channel alignment, with management emphasizing optimized assortment design, pack architecture and premiumization to support sustained mix improvement.

Kimberly-Clark’s acquisition of Kenvue will create a $32-billion global health and wellness leader, combining 10 iconic brands with KMB’s commercial expertise and Kenvue’s innovation platform. The deal is expected to deliver $2.1 billion in synergies, accelerate category leadership across regions and drive meaningful EPS growth by the second year. This move strengthens KMB’s long-term growth, expands its consumer health footprint and enhances its ability to serve consumers throughout their lives.

Operational resilience is another key focus. The company is mitigating currency and tariff volatility through strategic sourcing and supply-chain optimization, while adjusting overhead structures in line with portfolio changes. With long-term targets of at least 40% gross margin and an 18-20% operating margin, Kimberly-Clark is positioning itself for stronger profit delivery as these initiatives compound through 2026 and beyond.

While Kimberly-Clark is navigating meaningful headwinds, from softer global demand and currency volatility to elevated promotional spending and tariff pressures, there are also early signs of stabilization, driven by innovation-led growth, stronger productivity gains and improved commercial execution. The upcoming Kenvue acquisition further strengthens its long-term strategic position, though integration and financing risks remain. For current and prospective investors, a cautious stance is appropriate.

Kimberly-Clark’s recovery efforts are underway but not yet fully secured. Those with a higher risk appetite may view the stock’s discounted valuation as an opportunity for selective exposure, while more conservative investors should wait for clearer improvement in margin trends, international demand and synergy visibility before committing.

At present, KMB carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 6 hours | |

| 7 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Stock Market Today: Dow Sinks As EU Makes Trump Tariff Move; IBM Dives On This AI Threat (Live Coverage)

PG

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite