|

|

|

|

|||||

|

|

Pure-play stocks IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. have soared by as much as 545% over the trailing year.

Investors have been enamored with the sizable addressable opportunity that quantum computers bring to the table.

Historical precedent paints a worrisome picture for quantum computing stocks in the new year.

If you think artificial intelligence (AI) is the only hot trend on Wall Street, you haven't been paying close enough attention to the quantum computing revolution.

Over the trailing year, shares of quantum computing pure-play stocks IonQ (NYSE: IONQ), Rigetti Computing (NASDAQ: RGTI), D-Wave Quantum (NYSE: QBTS), and Quantum Computing Inc. (NASDAQ: QUBT) have rallied by 43%, 545%, 458%, and 67%, respectively. For context, the growth-focused Nasdaq Composite has risen by closer to 19%.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

With online publication The Quantum Insider pegging the addressable opportunity for quantum computing at $1 trillion by 2035, and analysts at Boston Consulting Group estimating it can create up to $850 billion in global economic value by 2040, it's not surprising to see investors gravitating toward these pure-play stocks. But based on what history has repeatedly told investors, the script is likely to flip in 2026.

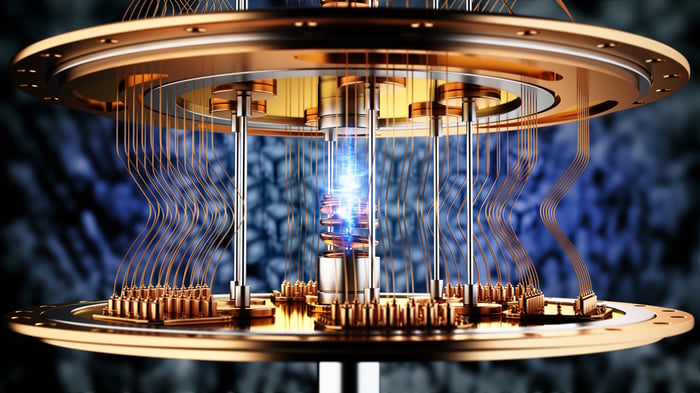

Image source: Getty Images.

In its simplest form, quantum computing involves specialized computers that use the principles of quantum mechanics to solve complex problems that classical computers can't handle.

Quantum computers can:

Perhaps just as exciting as what quantum computers may be able to do on a practical basis is the early stage partnerships some of these pure-play stocks have landed. For instance, Rigetti Computing has a three-year deal, in collaboration with QphoX, to advance superconducting quantum-networking technologies for the Air Force Research Laboratory.

Rigetti and IonQ are also allowing subscribers of Amazon's quantum cloud service (Braket) and Microsoft's quantum cloud service (Azure Quantum) access to their quantum computers to run simulations and test their hardware.

The other significant catalyst for quantum computing stocks is the prospect of major investments in the years to come. In October, money-center titan JPMorgan Chase unveiled its $1.5 trillion, 10-year Security and Resiliency Initiative, which will feature direct equity and venture capital investments of up to $10 billion in companies critical to national economic security and resiliency. Quantum computing was among the 27 sub-areas initially identified by JPMorgan Chase for investment.

Image source: Getty Images.

While it would appear that this quantum computing quartet is destined for success, historical precedent offers a different story.

Although history can't guarantee what will happen next with any specific stock or Wall Street's major indexes, certain events have strongly correlated with directional moves for equities over multiple decades. One of these correlations, which has a perfect track record of forecasting future movements in specific classes of equities, pertains to next-big-thing technologies and innovations.

What history has made abundantly clear is that every game-changing technology over the last 30 years has endured an eventual (keyword!) bubble-bursting event. Beginning with the internet, and followed by hyped trends such as genome decoding, nanotechnology, 3D printing, blockchain technology, and the metaverse, all next-big-thing trends were overhyped and failed to deliver.

The common theme among these correlated events is that investors overestimate the adoption rate, early stage utility, and path to optimization for the game-changing technology in question. In other words, investors become wide-eyed by large addressable opportunities and overlook that every game-changing technology needs time to mature and evolve.

Even though sales for IonQ, Rigetti, D-Wave, and Quantum Computing Inc. are expected to jump considerably in 2026, this technology is still in its extremely early commercialization phase. The few Wall Street analysts covering these companies who've weighed in don't believe quantum computers will be helpful for practical problem-solving, relative to classical computers, till the tail-end of this decade.

Furthermore, there's almost no evidence that businesses are generating a positive return on their quantum computing investments. These are telltale signs of a bubble that we've repeatedly witnessed over the last three decades.

The valuation aspect of next-big-thing trends is another historical concern.

In the 15 months leading up to the bursting of the dot-com bubble in March 2000, investors witnessed some of Wall Street's cutting-edge, internet-driven stocks peak at price-to-sales (P/S) ratios north of 30. Historically, P/S ratios above 30 have proved unsustainable over an extended period.

Given that IonQ, Rigetti, D-Wave, and Quantum Computing Inc. are still in their early ramp-up phase, their respective trailing 12-month P/S ratios are well above 30. Even if we look at sales projections for 2028, all four companies would still have P/S ratios north of 30. Historical precedent points to a significant pullback in these stocks, based on 30 years of valuation data for hyped trends.

It's also unclear whether these four companies will be able to maintain their first-mover advantage. With some members of the "Magnificent Seven" developing quantum processing units and possessing more cash on their balance sheets than they know what to do with, the days of IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. leading the charge may be numbered.

While 2025 has been a banner year for quantum computing pure-play stocks, a date with history in 2026 can completely flip the script.

Before you buy stock in Rigetti Computing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rigetti Computing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $499,978!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,126,609!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of December 8, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Amazon, IonQ, JPMorgan Chase, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 2 hours | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite