|

|

|

|

|||||

|

|

GE Vernova GEV stock soared to an all-time high earlier this week after it wowed Wall Street again with updated artificial intelligence-boosted guidance and beyond, including doubling its dividend and boosting buybacks.

Long-term investors should consider buying GEV stock right now at its records since playing the stock market timing game is exceedingly difficult. GE Vernova’s big breakout should also have investors looking to buy other best-in-class AI energy stocks before they soar to new highs.

The two top AI energy stocks we dive into are Constellation Energy and NextEra Energy.

GEV has skyrocketed ~400% since its April 2024 IPO, crushing Nvidia’s 100% and nearly all the S&P 500 in the process as Wall Street clamors to buy the companies powering the AI age.

The natural gas turbine giant and small modular nuclear reactor standout finally broke out of a trading range it’s been stuck in since early August after its latest bullish investor update.

The GE spinoff’s massive growth runway is fueled by AI’s unquenchable thirst for power. It said its “electrification backlog will double in the next 3 years” as AI hyperscalers and the U.S. government race to support the AI boom that’s projected to increase U.S. electricity demand by 75% to 100% by 2050.

AI is driving the electricity boom because generative AI like Chat GPT use 10x the energy of an average Google search, with large data centers consuming as much electricity as a midsize city.

The biggest companies in the world are all-in on AI, with AI hyperscalers Amazon, Microsoft, Alphabet, and Meta set to spend ~$400 billion on capital expenditures in 2025 alone—up over 300% against 2018 levels.

Globally, companies are set to spend $7 trillion in capex for data center infrastructure by 2030. This backdrop is why the U.S. government is aiming to quadruple nuclear energy capacity and help spark an all-of-the-above energy boom.

Without more power and a robust grid, electricity prices will soar more than they already have, and AI innovation will falter.

The need to expand the U.S. power base and the grid is the most critical challenge that AI hyperscalers, the government, and Wall Street are racing to solve.

No one can be certain which AI hyperscalers will eventually dominate or which artificial intelligence upstarts will start churning out massive profits.

Wall Street is growing increasingly confident that the AI boom will be powered by next-generation energy companies across various industries.

Constellation Energy CEG has established itself as one of the undisputed heavyweight champions of the AI energy era. CEG is the pioneering force behind the growing relationship between AI companies and nuclear power via its groundbreaking 20-year power deals with Microsoft and Meta.

The AI hyperscalers and the U.S. Department of Energy are helping CEG restart nuclear reactors that were shuttered for economic reasons and pursue its SMR growth plans.

CEG, already the largest U.S. nuclear power plant operator, is about to get dramatically bigger and broader with its $27 billion acquisition of natural gas and geothermal powerhouse Calpine. The deal, which cleared the final DOJ regulatory hurdle on December 5, will also help Constellation expand into tech-heavy Texas and California.

Constellation raised its dividend by 10% in 2025 and 25% in 2024 as part of a plan to consistently boost its payout. The nuclear energy powerhouse is expected to grow its adjusted EPS by ~8% in 2025 and ~22% in 2026. CEG’s near-term trajectory is part of “visible, double-digit long-term base EPS growth backed by the Nuclear Production Tax Credit.”

CEG shares have soared 615% since their debut in early 2022, matching AI powerhouse Nvidia NVDA and blowing away the rest of the Mag 7 tech stocks. The stock briefly broke out to new highs in October before sliding down and finding support near its previous 2025 peaks.

The nuclear energy giant trades around 8% below its highs after Constellation jumped above its 50-day on Thursday. Now might be the time to buy CEG before it possibly breaks out to new all-time highs heading into 2026.

NextEra Energy NEE is one of the largest electric power and energy infrastructure companies in the U.S., with a growing portfolio across solar, battery storage, nuclear energy, and beyond. NEE crushed the S&P 500 over the past 25 years (810% vs. 460%), and outpaced the benchmark in the last 15 years.

The renewable energy and Florida-based utility powerhouse outperformed during these long-term horizons, even though it is up just 10% in the past five years while the S&P 500 soared 95%.

Yet, it could finally be ready to break out in 2026 after the Fed lowered interest rates again, making its dividend yield more attractive. It trades around 15% below its highs, which it was rejected near several times since 2021, including recently. Thankfully, it found support at its long-term 21-week moving average.

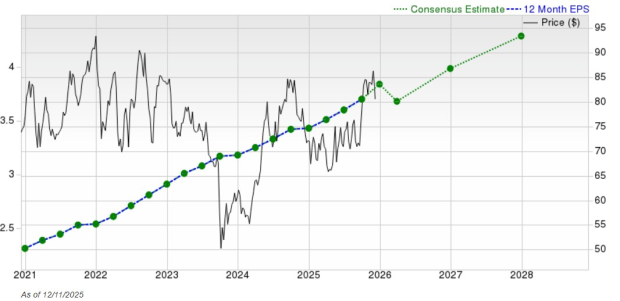

Image Source: Zacks Investment Research

More importantly, its AI energy credentials are growing. NEE said earlier this month that it expects to add 15 gigawatts of new power generation for data centers by 2035 (and upwards of 30 GWs) via deals with Google, Meta META, Exxon Mobil, and beyond.

NEE’s NextEra Energy Resources division is one of the biggest electric power and energy infrastructure companies in the world, and its Florida Power & Light segment is one of the largest electric utilities in the U.S.

All in, NEE is one of the largest producers of wind and solar energy, a battery storage leader, and a nuclear energy company. Plus, FPL “continues to operate and invest in the nation's largest gas-fired fleet.”

The energy giant is projected to grow its revenue by 13% this year and 14% next year, helping boost its adjusted earnings by 7% and 8%, respectively, following a 10% average expansion in the past five years. NextEra’s near-term EPS outlook is part of a longer-term growth trend.

NEE’s dividend yield sits at 2.8% and it is one of roughly 70 S&P 500 Dividend Aristocrats (meaning it’s paid and raised dividends for at least 25 straight years).

It’s time for investors to consider buying NextEra as a potential best-in-class AI energy stock that boasts strong earnings and revenue growth, dividends, and breakout potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 min | |

| 12 min | |

| 13 min | |

| 16 min | |

| 42 min | |

| 42 min | |

| 50 min |

Nvidia Earnings Are Coming. This Option Trade Sets Up A Way To Profit.

NVDA

Investor's Business Daily

|

| 53 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Stock Market Today: Dow, S&P 500 Rebounding From Sell-Off; AMD Rallies; Solar Name Fried (Live Coverage)

META

Investor's Business Daily

|

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite