|

|

|

|

|||||

|

|

Novo Nordisk NVO has stumbled through 2025, with its shares down 41.5% year to date despite finally resolving U.S. supply constraints for its semaglutide-based GLP-1 blockbusters — Ozempic for type II diabetes (T2D) and Wegovy for obesity. The recovery in product availability has not translated into market confidence, leaving investors questioning what is driving the continued slide.

Much of the downside was observed after the company cut its 2025 sales and operating profit growth outlook in July, on the back of weaker-than-expected momentum of Ozempic and Wegovy due to intensifying GLP-1 competition from Eli Lilly LLY, foreign exchange headwinds, and widespread compounded semaglutide use in the United States. International demand has also been uneven, adding to pressure on NVO’s GLP-1 franchise. The same pressures hit third-quarter results as well, forcing the company to trim its full-year guidance for a second time.

To turn things around, Novo Nordisk underwent a major structural shift, appointing a new CEO and making significant changes to its board of directors. CEO Mike Doustdar announced a major restructuring program in September 2025 to streamline operations and reinvest in its core diabetes and obesity businesses. The plan includes reducing its global workforce by about 9,000 employees, targeting annualized savings of around DKK 8 billion by 2026.

Novo Nordisk has also come under heavy U.S. pricing pressure, prompting it to roll out early, strategic self-pay pricing changes for Wegovy and Ozempic to revive demand, broaden access, and counter intensifying competitive headwinds. By broadening availability, Novo Nordisk hopes to regain share from Eli Lilly while reinforcing affordability across both diabetes and obesity segments. However, investors remain skeptical as steep price cuts threaten margin compression and existing market challenges create uncertainty around NVO’s long-term GLP-1 economics, competitive position and medium-term growth outlook.

Adding to these pressures, several smaller biotech players are advancing rapidly in the obesity arena, attracted by the sizeable and still underpenetrated market opportunity. Earlier this week, Structure Therapeutics GPCR reported meaningful weight-loss data from the ACCESS clinical program of its investigational candidate, aleniglipron, for treating obesity. Structure Therapeutics is gearing up to initiate late-stage studies of aleniglipron for obesity around mid-2026, pending alignment with the FDA. Shares of NVO were down following the news, signaling investor concerns amid the intensifying competitive landscape.

These developments underscore Novo Nordisk’s mounting execution risks and competitive pressures in 2025. Despite decisive management actions, slowing semaglutide momentum, intensifying GLP-1 rivalry, and rising threats from emerging biotechs have deepened investor skepticism. While NVO’s long-term potential remains anchored to the vast, underpenetrated obesity market, its near-term headwinds make the stock a challenging bet at current levels. Let’s dig deeper and understand the company’s strengths and weaknesses to understand how to play the stock.

Novo Nordisk’s success in recent years has been driven by the sales of Ozempic and Rybelsus (oral) for T2D, and Wegovy for obesity. Despite recent market turmoil, the company is still a dominant player in the diabetes and obesity care market, with one of the industry's broadest portfolios.

Ozempic and Wegovy are the major revenue drivers, generating DKK 152.5 billion in the first nine months of 2025. As of July 1, CVS Caremark, a major pharmacy benefit manager, has designated Wegovy as its preferred GLP-1 therapy for weight loss.

Novo Nordisk is expanding semaglutide's reach through new indications. Wegovy is now approved for reducing major cardiovascular events, easing HFpEF symptoms, and relieving osteoarthritis-related knee pain in obesity.

The FDA is also reviewing Novo Nordisk’s application for a 25 mg oral semaglutide for obesity, with a decision expected soon. Oral pills could boost adherence over injections. Potential approval would give Novo Nordisk a notable advantage as the sole manufacturer of a marketed oral obesity pill, positioning it to capture significant market share. Rybelsus’ label in the United States and the EU has been expanded to include cardiovascular benefits in diabetes patients. A 7.2 mg Wegovy dose, showing up to 25% weight loss in the STEP UP study, is under review in the United States and the EU. Label expansion is also being sought for Ozempic in treating peripheral artery disease in the United States and the EU.

Eli Lilly is Novo Nordisk’s fierce competitor in the diabetes/obesity space. Despite being on the market for less than three years, LLY’s tirzepatide-based drugs, Mounjaro (T2D) and Zepbound (obesity), have become its key top-line drivers, eating away market share from NVO. Following strong third-quarter results, Eli Lilly raised its 2025 full-year revenue and EPS guidance. In the first nine months of 2025, the drugs generated combined sales of $24.8 billion, accounting for 54% of Eli Lilly’s total revenues.

Beyond its GLP-1 portfolio, Novo Nordisk is broadening its presence in rare diseases. The company has submitted a regulatory filing seeking approval for Mim8 in hemophilia A in the United States. NVO has also secured both EU and U.S. approvals for Alhemo to treat hemophilia A and B, with or without inhibitors.

The FDA has also granted accelerated approval to Wegovy as the first GLP-1 therapy to treat noncirrhotic metabolic dysfunction-associated steatohepatitis with moderate-to-advanced liver fibrosis. This marked a significant milestone in liver care by offering patients a treatment that can both halt disease activity and reverse liver damage.

Novo Nordisk is also developing several next-generation obesity candidates in its pipeline, especially targeting the lucrative U.S. market. The most advanced candidate in Novo Nordisk’s pipeline is CagriSema injection, a fixed-dose combination of cagrilintide and Wegovy. The company plans to file for its regulatory application in 2026. NVO is also gearing up to launch a dedicated late-stage program evaluating cagrilintide as a monotherapy for obesity.

Novo Nordisk is currently gearing up to advance another next-generation candidate, amycretin, for weight management into late-stage development. The phase III program on amycretin is planned to be initiated during the first quarter of 2026. The company is also developing oral monlunabant in a mid-stage obesity study. It recently signed a $2.2 billion deal with Septerna for developing and commercializing oral small-molecule medicines for treating obesity, diabetes, and other cardiometabolic diseases.

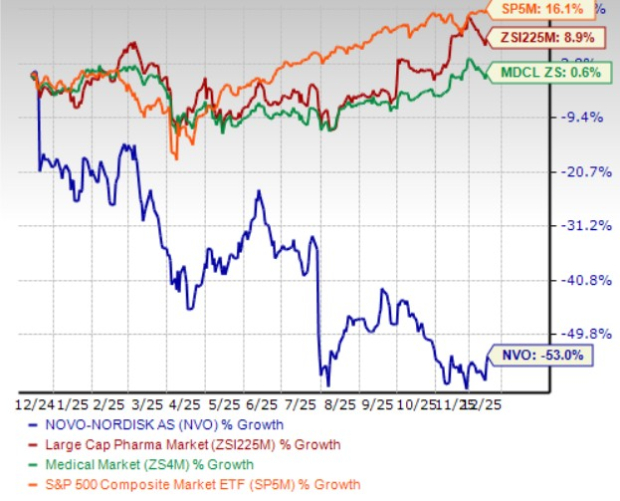

In the past year, Novo Nordisk shares have plunged 53% against the industry’s 8.9% growth. The company has also underperformed the sector and the S&P 500 during the same time frame, as seen in the chart below.

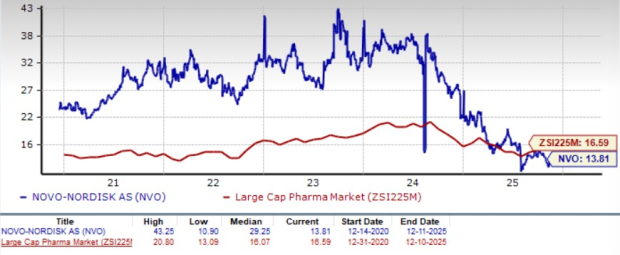

Novo Nordisk is trading at a discount to the industry, as seen in the chart below. Going by the price/earnings ratio, the company’s shares currently trade at 13.81 forward earnings, which is lower than 16.59 for the industry. The stock is trading much below its five-year mean of 29.25.

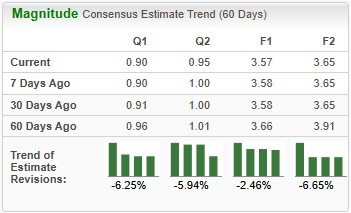

Earnings estimates for 2025 have deteriorated from $3.66 to $3.57 per share over the past 60 days. During the same time frame, Novo Nordisk’s 2026 earnings estimates have declined from $3.91 to $3.65.

Novo Nordisk, currently carrying a Zacks Rank #5 (Strong Sell), has had a challenging year as U.S. GLP-1 demand softens, competition from Eli Lilly and compounded alternatives increases, and its market share slips. The U.S. pricing reset poses added margin pressure, while back-to-back guidance cuts weigh on near-term visibility. Although the 9,000-job restructuring could enhance efficiency over time, it also raises execution risk and signals the need for deeper cost discipline. Meanwhile, the agreement with the U.S. Administration, though likely to boost patient access to authentic semaglutide, intensifies uncertainty around long-term GLP-1 profitability at a time when compounded semaglutide alternatives and uneven international uptake remain unresolved challenges.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competition in the obesity treatment market is intensifying as the space attracts new contenders beyond leaders Eli Lilly and Novo Nordisk. Smaller biotech firms, like Structure Therapeutics and Viking Therapeutics VKTX, are advancing GLP-1–based therapies to challenge the incumbents. Viking Therapeutics is developing its dual GIPR/GLP-1 RA, VK2735, both as oral and subcutaneous formulations for the treatment of obesity.

From an investment standpoint, NVO currently lacks meaningful near-term catalysts to support a sustained recovery heading into 2026. While the pipeline is advancing and semaglutide retains strong clinical appeal, current challenges are likely to outweigh these strengths in the near term. The pricing reset, paired with slowing prescription trends and Lilly’s rapid market share gains, materially weakens NVO’s medium-term growth trajectory. Analysts also continue to trim earnings estimates, leaving valuations at risk of further downside. Until Novo Nordisk demonstrates renewed demand momentum, stabilizes market share, and shows that restructuring can meaningfully improve margins, investors would be better served by reducing exposure or selling the stock outright.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 30 min |

Novo Nordisk and Vivtex collaborate for oral medicines development

NVO

Pharmaceutical Business Review

|

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Novo Nordisk Licenses Vivtex Tech for Up to $2.1 Billion to Deepen Obesity Push

NVO

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite