|

|

|

|

|||||

|

|

Interactive Brokers Group, Inc.’s IBKR greatest strength in the brokerage space stems from its deep, multi-asset global market access, which remains unmatched by most retail and even many institutional focused competitors. The firm enables clients to trade across more than 160 markets, dozens of currencies and a wide range of asset classes, including equities, options, futures, foreign exchange (FX), bonds and funds, from a single unified platform.

This global breadth not only differentiates IBKR from brokers that are predominantly U.S.-centric, but also positions it as the preferred choice for sophisticated investors, hedge funds, proprietary traders and internationally active retail clients.

Since IBKR continues to actively scale its global footprint, expanding exchange connectivity, adding regional markets, and broadening currency and product capabilities, the ongoing expansion helps the firm tap into rising international wealth creation and cross-border investing trends, particularly in emerging markets where demand for global investment access is accelerating.

Moreover, the company’s disciplined cost structure, automated systems and global regulatory expertise allow it to operate efficiently at scale, preserving strong margins even as it grows across jurisdictions.

In order to enhance its global presence, Interactive Brokers has continuously been undertaking several initiatives. Recently, the company announced that eligible clients outside of Brazil can now trade Brazilian equities through B3, the Brazil Stock Exchange, giving investors more ways to access emerging market opportunities across Latin America. Also, IBKR has announced the introduction of United Arab Emirates equities through two leading exchanges. Clients of IBKR worldwide can now access the Abu Dhabi Securities Exchange and the Dubai Financial Market.

A few months ago, the company launched zero-commission U.S. stock trading in Singapore and NISA accounts to help Japanese investors build wealth tax-free. After launching Forecast Contracts (those whose value is based on whether a specific event will occur at or before a particular time) for eligible clients in the United States and Hong Kong, IBKR has expanded it into Europe.

Apart from these, IBKR has expanded its offerings with Plan d’Epargne en Actions accounts for French clients and the IBKR GlobalTrader app for global stock trading. Its clients are also allowed to trade stocks on one of the largest stock exchanges in Southeast Asia, Bursa Malaysia.

In 2023, IBKR announced the consolidation of its brokerage operations in the European Union, which aligns with its commitment to operational efficiency through automation. Also, after becoming the first SFC-licensed securities broker to be approved to allow retail clients to trade cryptocurrencies in Hong Kong, the company launched crypto trading in the U.K.

Product Diversification Efforts: Interactive Brokers has continuously been making efforts to expand the product suite and reach of its services. In October 2025, the company launched the Karta Visa card for its clients to make purchases globally with a card linked to their IBKR account. In August, it introduced Connections, a feature designed to help investors discover trading opportunities and evaluate investments by highlighting related ideas across global markets.

Also, it has pioneered nearly 24-hour overnight trading on U.S. stocks and ETFs, launched commission-free IBKR Lite and introduced the Impact Dashboard for sustainable investing.

Other notable launches include the IBKR Desktop platform and low-cost cryptocurrency trading through Paxos Trust Company. These initiatives are expected to strengthen Interactive Brokers’ market share amid stiff competition and help diversify operations.

Technological Excellence: Unlike many of its peers, IBKR has a very low level of compensation expenses relative to net revenues (10.4% in the first nine months of 2025). This helps the company generate solid growth. Further, Interactive Brokers has been emphasizing developing proprietary software to automate broker-dealer functions, leading to a steady rise in revenues. Over the last five years (2019-2024), total net revenues witnessed a compound annual growth rate (CAGR) of 21.8%, with the upward momentum continuing in the first nine months of 2025.

IBKR also has a robust Daily Average Revenue Trades (DARTs) number, which, along with a favorable trading backdrop, is expected to keep driving the top line. The company’s technological superiority, combined with easier regulations to improve product velocity, will likely help its net revenues through higher client acquisitions.

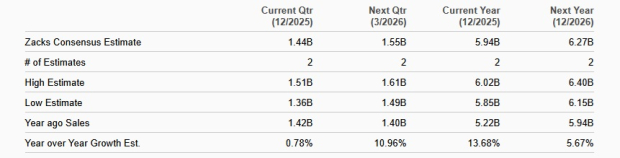

The Zacks Consensus Estimate for IBKR’s 2025 and 2026 revenues is $5.94 billion and $6.27 billion, which indicates year-over-year growth of 13.7% and 5.7%, respectively.

Efficient Capital Distributions: While Interactive Brokers was consistent with its dividend payment for a long time, it hiked its quarterly dividend 150% to 25 cents per share in April 2024. In April 2025, it once again announced a dividend hike of 28% and a four-for-one forward split of its common stock to make shares more accessible to investors.

IBKR uses insignificant debt to finance its operations. Thus, given a solid liquidity position, the company is expected to be able to sustain its dividend payments in the future, enhancing shareholder value.

Like IBKR, its close competitor Robinhood Markets, Inc. HOOD has also been accelerating growth through rapid product innovation. Its key launches include Cortex, an AI assistant for custom indicators, market analysis and real-time insights, and Legend, which adds advanced tools such as futures trading, short selling, simulated options returns and near-24/5 index options access.

Moreover, Robinhood Social introduces verified trading profiles, strategy sharing, expert portfolio tracking and soon copy trading, with users able to open up to 10 accounts for different strategies. Internationally, Robinhood is offering tokenized U.S. stocks and ETFs across 31 EU/EEA countries with 24/5 commission-free trading and aims to tokenize private companies.

IBKR’s another peer TradeWeb Markets Inc. TW has been rolling out products to bolster its market share.

TradeWeb launched electronic portfolio trading for European government bonds, spanning U.K. Gilts, EUR and single currency notes. Tradeweb was also the first platform to launch portfolio trading for corporate bonds in 2019.

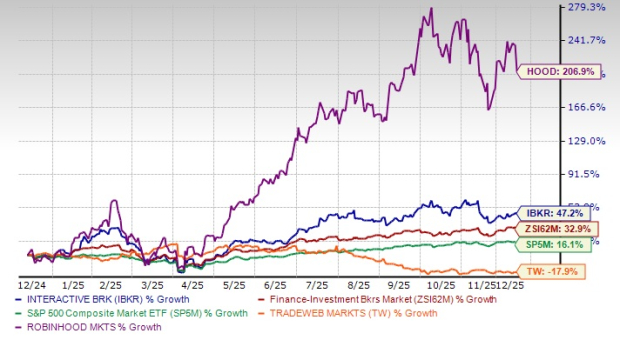

In the past year, IBKR shares have gained 47.2%, outperforming the industry and the S&P 500 Index’s 32.9% and 16.1% rallies, respectively. While the company’s performance compares unfavorably with that of HOOD, its performance has been better than that of TradeWeb.

TradeWeb shares have lost 17.9% and the Robinhood stock has skyrocketed 206.9% in the past 12 months.

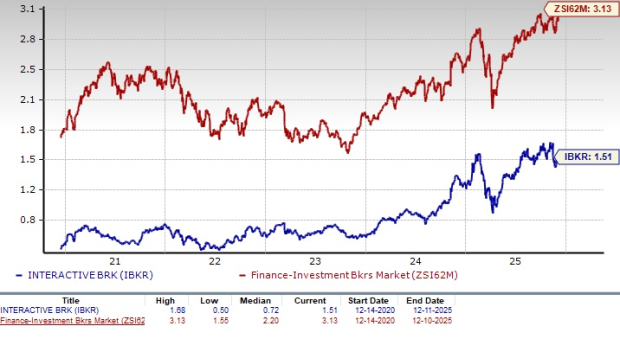

Looking at its valuation, the IBKR stock appears inexpensive relative to the industry. The company is currently trading at a trailing 12-month price-to-tangible book (P/TB) ratio of 1.51, below the industry’s 3.13 over the last five years.

IBKR is well-positioned for growth in the current volatile operating environment. Rapidly evolving trends are expected to benefit the company’s revenues and expand its market share. Its strong technological capabilities and diversified product offerings enhance its global reach, supporting long-term growth.

Moreover, by combining global access with advanced tools, competitive pricing and institutional-grade capabilities, Interactive Brokers reinforces its position as one of the most comprehensive and globally connected platforms in the brokerage industry.

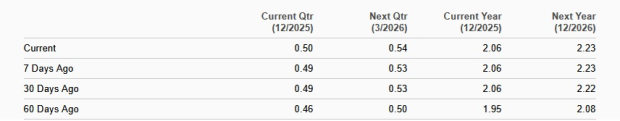

In fact, analysts also seem optimistic regarding IBKR’s earnings growth potential. Over the past 60 days, the Zacks Consensus Estimate for IBKR’s 2025 and 2026 earnings has moved upward. The estimates reflect year-over-year growth rates of 17.1% and 8.1% for 2025 and 2026, respectively.

Thus, supported by its fundamental strength and earnings growth prospects, IBKR stock looks like an attractive investment option now. Also, from a valuation perspective, its shares present a compelling buying opportunity. The stock is undervalued as the market has not yet fully recognized its growth prospects.

At present, IBKR carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite