|

|

|

|

|||||

|

|

Vertiv VRT and Super Micro Computer SMCI are major players in the data center market, particularly in the rapidly growing area of AI data center infrastructure and liquid cooling solutions. While Vertiv focuses on power and cooling infrastructure for data centers, Super Micro Computer is strengthening its position with end-to-end AI rack-scale systems that integrate compute, networking, storage, and liquid cooling.

Per the Fortune Business Insight report, the global data center market size was valued at $242.72 billion in 2024. It is expected to grow from $269.79 billion in 2025 to $584.86 billion by 2032. This shows a compound annual growth rate of 11.7% during the forecast period from 2025 to 2032. Both VRT and SMCI are expected to benefit from this rapid growth pace.

So, VRT or SMCI —Which of these Data Center Infrastructure stocks has the greater upside potential? Let’s find out.

Vertiv is benefiting from the accelerating growth of data centers globally, driven by the rapid adoption of AI and the increasing demand for digital infrastructure. The global acceleration of AI adoption is driving significant demand for data center infrastructure. Vertiv is capitalizing on this trend, particularly in the Americas, where it saw a 43% organic sales growth in the third quarter of 2025, and in APAC, which grew 21% year over year.

In the trailing 12 months, organic orders grew approximately 21%, with a book-to-bill of 1.4 times for the third quarter of 2025, indicating a strong prospect. The backlog grew 12% sequentially and 30% year over year to $9.5 billion. This growth is primarily driven by the rapid adoption of AI and the increasing need for data centers to support the digital transformation.

The company’s extensive product portfolio, which spans thermal systems, liquid cooling, UPS, switchgear, busbar, and modular solutions, remains noteworthy. Acquisitions have also played an important role in expanding Vertiv’s portfolio.

Vertiv’s partnership with Caterpillar has significantly contributed to its growth. In November, the company announced a strategic collaboration with Caterpillar to deliver integrated, modular on-site power and cooling solutions that accelerate data center deployment and improve energy efficiency.

Super Micro Computer is benefiting from the growing deployment of AI and HPC workloads. As data centers are proliferating and existing ones are scaling up their capacity, the demand for SMCI’s high-performance and energy-efficient servers is rising.

As AI servers become more powerful, they also generate more heat. Super Micro Computer has taken the lead in liquid cooling with its Direct Liquid Cooling (DLC) and newer DLC-2 technologies. These solutions reduce power and water usage by up to 40% while lowering noise levels to just 50 decibels, similar to a quiet room. Liquid cooling is critical for large-scale AI deployments, where traditional air cooling is no longer sufficient. Super Micro Computer’s early leadership in this area gives it a long-term edge in building efficient, sustainable data centers.

Another key factor driving SMCI’s growth is its Data Center Building Block Solution (DCBBS), which offers customers a comprehensive, plug-and-play solution for AI-ready data centers. DCBBS enables rapid planning, design, and deployment while optimizing performance and reducing power consumption through advanced technologies like DLC and DLC-2. This solution is critical for customers looking to accelerate their digital transformation and build efficient AI factories.

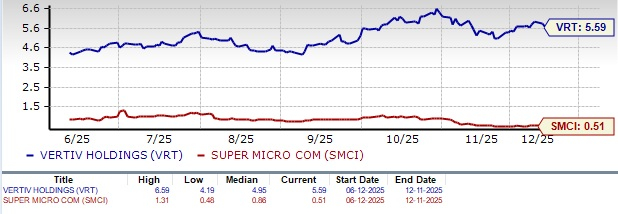

In the trailing six-month period, Vertiv shares surged 56% while Super Micro Computer shares plunged 21.5%. The outperformance in VRT can be attributed to its extensive product portfolio, which spans thermal systems, liquid cooling, UPS, switchgear, busbar, and modular solutions.

The decline in SMCI’s share price can be attributed to declining revenues and shrinking margins. SMCI’s fiscal first-quarter 2026 revenues and earnings declined 15.5% and 56%, respectively.

Valuation-wise, VRT shares are currently overvalued, as suggested by a Value Score of F. Super Micro Computers shares are cheap, as suggested by a Value Score of A.

In terms of forward 12-month Price/Sales, VRT shares are trading at 5.59X, higher than SMCI’s 0.51X.

The Zacks Consensus Estimate for VRT’s 2025 earnings is pegged at $4.11 per share and has remained unchanged over the past 30 days. This indicates a 44.21% increase year over year.

Vertiv Holdings Co. price-consensus-chart | Vertiv Holdings Co. Quote

However, Zacks’ Consensus Estimate for SMCI’s fiscal 2026 earnings is pegged at $2.16 per share and has remained unchanged over the past 30 days. This indicates a 4.85% increase year over year.

Super Micro Computer, Inc. price-consensus-chart | Super Micro Computer, Inc. Quote

VRT’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 14.89%. SMCI earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters while missing it once, with an average surprise of 5.80%. VRT’s average surprise is higher than that of SMCI.

While both Vertiv and Super Micro Computer are benefiting from the booming data center infrastructure market, Vertiv offers greater upside potential with a strong portfolio, rich partner base, and significantly higher earnings momentum compared to SMCI.

Despite SMCI’s expanding portfolio, trade restrictions and strong competition may hurt global sales. Lingering concerns from past accounting issues remain a major negative.

Currently, Vertiv has a Zacks Rank #2 (Buy), making the stock a stronger pick than Super Micro Computer, which has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Nvidia Partner Surges After Earnings Beat; Expects 'Momentum' To Continue In 2026

VRT

Investor's Business Daily

|

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite