|

|

|

|

|||||

|

|

Tesla TSLA has taken a big step forward in its robotaxi journey by testing vehicles with no human oversight. In Austin, TX, two Tesla Model Y robotaxis were recently spotted driving on public roads with no one inside the vehicles. This is an important milestone for a program that sits at the center of Tesla’s long-term growth story.

Just a week earlier, CEO Elon Musk had reiterated that the company was close to removing safety monitors in Austin, suggesting that fully driverless Teslas could be operating on public roads by the end of the year. This latest development appears to support that timeline.

Since the robotaxi program’s launch in June, Tesla’s goal has been clear— eliminate safety monitors and move to fully autonomous rides. If successful, it could mark a turning point for the business.

But does this progress make Tesla stock a compelling investment right now? Let’s take a closer look at the growth drivers and risks to find out.

Tesla launched its first robotaxi service in Austin on June 22. The service is currently operational in Austin and San Francisco, with Phoenix next after the company recently secured the required permits. Tesla has also outlined plans to expand into Las Vegas, Dallas, Houston and Miami, though each launch will depend on regulatory clearance and safety validation.

For now, Tesla’s robotaxi system still requires human supervision. In Austin, safety monitors sit in the passenger seat on city roads and move to the driver’s seat for highway driving. In the Bay Area, a monitor remains behind the wheel at all times. However, the start of driverless testing suggests Tesla could still meet CEO Elon Musk’s target of removing safety monitors by year-end.

That said, Tesla’s autonomy timeline has often been over ambitious. The company previously aimed to reach half of the U.S. population by the end of the year, yet its active robotaxi operations remain limited to Texas and California. While Tesla has logged more than 550,000 robotaxi miles—mostly in Austin and the Bay Area—this progress still falls short of the scale implied by its earlier projections.

Meanwhile, Alphabet’s GOOGL Waymo continues to lead the autonomous ride-hailing race. Its entire fleet operates without safety drivers, and it recently surpassed 450,000 weekly paid rides. Waymo is also expanding rapidly, including freeway operations and service across multiple U.S. cities. Tesla argues its advantages lie in scalability and lower costs, but closing the gap will take time.

Tesla’s automotive business has been under pressure. After reporting its first-ever annual decline in vehicle deliveries in 2024, the slowdown has carried into 2025. Deliveries fell 13% year over year in the first quarter and another 13.4% in the second quarter, amid weakening demand across key markets. Europe remains a major drag, with demand hurt by an aging vehicle lineup, rising competition and declining pricing power. The third quarter provided only a temporary lift as buyers rushed to lock in the expiring $7,500 federal EV tax credit.

Looking ahead, fourth-quarter deliveries are expected to soften again as incentives roll off and competition intensifies, particularly from Chinese EV makers such as BYD Co Ltd BYDDY. BYD has already pulled ahead of Tesla in the global pure EV market through the third quarter of 2025.

To support volumes, Tesla has leaned on discounts toward year-end, a strategy that risks further squeezing margins. Management has already cautioned that automotive margins will remain under pressure due to price cuts and higher input costs.

In contrast, Tesla’s Energy Generation and Storage segment continues to gain momentum. The business delivered record deployments across residential, commercial, and utility-scale customers, driven by strong demand for Megapack and Powerwall systems. Energy has quietly become Tesla’s highest-margin division, with a growth profile that now outpaces its automotive business. Energy storage deployments have compounded at roughly 180% over the past three years, and ongoing production ramp-ups at the Megapack factory position the segment for continued growth.

Tesla’s humanoid robot, Optimus, represents another potential long-term growth driver, though its commercialization timeline remains uncertain. Still, Tesla is positioning itself early in the humanoid robotics space, leveraging its strengths in AI training data, vertical integration and manufacturing scale.

Pilot production of Optimus V3 is underway at Tesla’s Fremont factory, with plans to scale output to around one million units annually by late 2026. Beyond that, Tesla intends to expand its Texas Gigafactory with a dedicated facility to support mass production. Initial use cases are likely to focus on repetitive tasks within Tesla’s own operations before broader adoption.

CEO Elon Musk believes Optimus could eventually become Tesla’s largest product. For now, the project remains a high-upside but execution-dependent bet for long-term investors.

Shares of Tesla have gained 13% year to date, underperforming the industry.

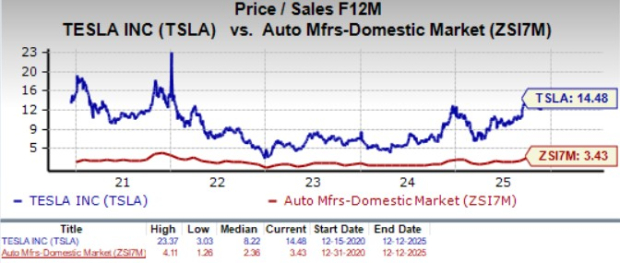

From a valuation standpoint, TSLA trades at a forward price-to-sales ratio of 14.48, way above the industry. Tesla carries a Value Score of D.

While the consensus mark for Tesla’s 2025 revenues and EPS implies a year-over-year decline of 3% and 32%, respectively, the same for 2026 revenues and EPS suggests 11.6% and 43% growth from 2025 projected levels.

See how the Zacks Consensus Estimate for TSLA’s earnings has been revised over the past 90 days.

Tesla’s latest driverless robotaxi tests highlight real progress, but the company is still playing catch-up in autonomy, and meaningful profits from robotaxis, AI, or Optimus remain several years away. Execution risk is there, especially given Tesla’s history of aggressive timelines.

While the Energy segment continues to deliver steady growth and margin support, weakness in the core EV business—ranging from softer demand to eroding pricing power—limits near-term upside.

At this stage, investing in Tesla is more a bet on its long-term vision than near-term fundamentals. That makes the risk-reward balance unattractive for fresh entry today. However, for existing shareholders, holding still makes sense. If even part of Tesla’s long-term vision materializes, the company retains the potential to create significant value over time.

TSLA stock carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour |

Tech Firms Arent Just Encouraging Their Workers to Use AI. Theyre Enforcing It.

GOOGL

The Wall Street Journal

|

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite