|

|

|

|

|||||

|

|

The bull run in equity markets in the outgoing year, following the tariff bloodbath, was largely driven by AI, with investors betting big on its inherent growth prospects. AI-based semiconductor chips are typically used in “training” AI systems to solve complex problems in split seconds. These chips include graphics processing units (GPUs), field-programmable gate arrays (FPGAs) and application-specific integrated circuits (ASICs), which dramatically accelerate the identical, predictable and independent calculations required by AI algorithms.

Cutting-edge AI systems need state-of-the-art semiconductor chips for perfect synchronization among themselves for superior performance standards. As computing requirements escalate, particularly in the realm of AI, there is a pressing need for strengthened semiconductor production to meet these rising demands. The 2022 Chips Act, allocating $39 billion in direct grants and $75 billion in loans and loan guarantees, stands as a cornerstone initiative by the U.S. government to revitalize domestic semiconductor production.

The One Big Beautiful Bill Act, passed by the Trump administration in July 2025, further aimed to spur chip production with tax credits of 35%, up from 25% levied earlier, if the semiconductor firms expanded domestic manufacturing capacity by the end of 2026. As these firms embark on ambitious expansion plans propelled by government support, the stage is set for a transformative shift in the semiconductor landscape, with far-reaching implications for technological advancement and economic growth.

Semiconductor chips are the building blocks of telecommunication equipment, electronic goods and IoT devices. With exponential growth in video and other bandwidth-intensive applications owing to the wide proliferation of smartphones and increased deployment of superfast 5G technology, telecommunications firms are considerably investing in LTE, broadband and fiber to provide additional capacity and ramp up the Internet and wireless networks while facilitating a seamless transition to the cloud. To maintain superior performance standards, there is a continuous need for network tuning and optimization, which creates demand for state-of-the-art wireless products and services. Moreover, a faster pace of 5G deployment is expected to augment the scalability, security and universal mobility of the telecommunications industry and propel the wide proliferation of IoT devices, smartphones, wearables and tablets.

With operators moving toward converged or multi-use network structures, combining voice, video and data communications into a single network, the industry is increasingly developing solutions to support wireline and wireless network convergence. The industry players have enabled enterprises to rapidly scale communications functionalities to a vast range of applications and devices with easy-to-use software application programming interfaces.

The wide proliferation of cloud networking solutions further results in increased storage and computing on a virtual plane. As both consumers and enterprises use the network, there is tremendous demand for quality networking equipment, resulting in higher chip demand.

Adoption of state-of-the-art technologies such as AI, ML (machine learning), DOCSIS (Data Over Cable Service Interface Specification), DSL (Digital Subscriber Line) and Next Generation PON (Passive Optical Network) platforms for the highest bandwidth applications has led to higher demand for semiconductor chips. Further, a combination of network-based video transcoding, packaging, storage and compression technologies required to deliver new IP video formats and home gateways to connected devices inside and outside the home is increasingly driving the industry growth.

Based on robust growth drivers, we have selected a handful of semiconductor stocks that are likely to lead the next tech rally in 2026. In addition to solid Zacks Rank and strong fundamentals, these stocks have a healthy Zacks Industry Rank and are placed within the top half of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

NVIDIA Corporation NVDA: Santa Clara, CA-based, NVIDIA is the worldwide leader in visual computing technologies and the inventor of the GPU. Over the years, the company’s focus has evolved from PC graphics to AI-based solutions that now support high-performance computing (HPC), gaming and virtual reality (VR) platforms.

NVIDIA is rapidly gaining traction in enterprise AI, expanding its market beyond cloud providers. Major companies across industries are integrating NVIDIA’s AI platforms to automate workflows, enhance productivity and improve decision-making. The company’s DGX Cloud AI infrastructure, which allows enterprises to train and deploy AI models at scale, has seen increased adoption. The expansion of CUDA software and AI frameworks strengthens NVIDIA’s ecosystem, making it the preferred choice for enterprises developing AI applications. In addition, the generative AI revolution continues to be a tailwind for NVIDIA. The company’s Hopper 200 and upcoming Blackwell GPUs are designed for training and inference of large language models, recommendation engines and generative AI applications.

With an average broker recommendation (ABR) of 1.16, the stock has gained 32.5% over the past year. Earnings estimates for NVIDIA for the current and next fiscal year have moved up 11.5% and 34.7%, respectively, since December 2024. It has long-term earnings growth expectations of 46.3% and has a Zacks Industry Rank #26 (top 11%). NVIDIA sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

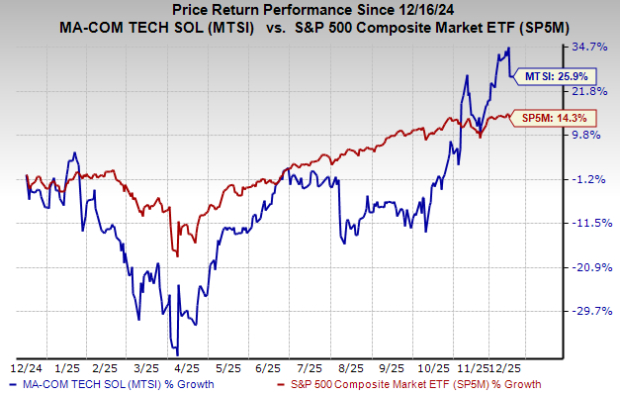

MACOM Technology Solutions Holdings, Inc. MTSI: Based in Lowell, MA, MACOM offers power analog semiconductor solutions to varied markets. The company develops and produces analog radio frequency (RF), microwave and millimeter wave semiconductor devices, and components for applications in optical, wireless and satellite networks.

Changing data consumption patterns with a growing propensity to consume video content over IP have created the need for a faster data transfer rate. Solid demand for cloud-based services and the upgrade of data center architectures to 100G, 200G, 400G and 800G interconnects is expected to drive the adoption of MACOM’s higher-speed optical and photonic components. MACOM is witnessing solid demand for components that enable 100GB connectivity in the data centers and service provider markets. Semiconductor chips from the company are also being increasingly used in military applications that require advanced electronic systems such as radar-warning receivers, communications data links and tactical radios, UAVs, RF jammers, electronic countermeasures, and smart munitions.

MACOM has a Zacks Industry Rank #83 (top 34%). With an ABR of 1.56, the stock has gained 25.9% over the past year. Earnings estimates for MACOM for the current and next fiscal year have moved up 6.9% and 36.8%, respectively, since December 2024. It has long-term earnings growth expectations of 21.8%. MACOM carries a Zacks Rank #2 (Buy).

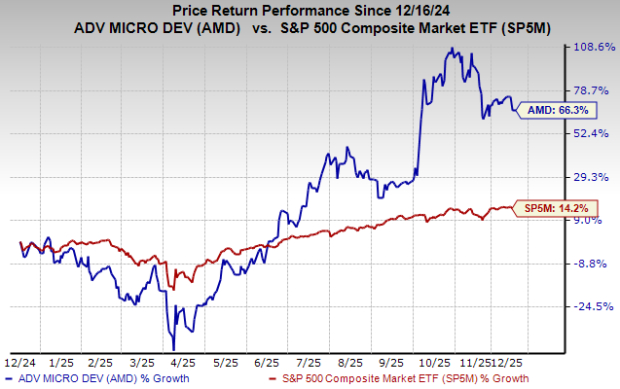

Advanced Micro Devices, Inc. AMD: Santa Clara, CA-based Advanced Micro has strengthened its position in the semiconductor market on the back of its strong product portfolio. It offers Virtex and Kintex, Artix, and Spartan FPGAs as well as System-on-Chip (SoC) like Zynq, Zynq UltraScale+ Multi-Processing System-on-a-Chip (MPSoC), Versal Adaptive SoC, Alveo accelerator cards, and Pensando data processing units (DPUs).

The latest MI300 series accelerator family strengthens AMD’s competitive position in the generative AI space. The accelerator is based on the AMD CDNA 3 accelerator architecture. It supports up to 192 GB of HBM3 memory, enabling efficient running of large language model training (up to 80 billion parameters) and inference for generative AI workloads. It is also benefiting from strong enterprise adoption and expanded cloud deployments. In addition, strength in 7-nanometer-based processors is expected to strengthen the company's competitive position in the commercial and server markets. AMD is currently leveraging Taiwan Semiconductor Manufacturing Company's 7 nm process technology, which is enabling it to deliver its advanced 7 nm chips faster to market. The AMD Radeon RX 7900 series chiplet design combines 5 nm and 6 nm process nodes, each optimized for specific chips in the GPU.

With an ABR of 1.61, the stock has gained 66.3% over the past year. It has long-term earnings growth expectations of 43.3% and has a Zacks Industry Rank #14 (top 6%). AMD carries a Zacks Rank #3 (Hold).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 33 min | |

| 45 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite