|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Alphabet’s YouTube TV will soon be rolling out several different genres of skinny cable-television bundles.

This is a strategic shift that studios and cable channels have been especially hoping to avoid.

Alphabet can afford to offer these bundles because it doesn’t necessarily need them to turn a direct profit.

The U.S. cable television industry was already hanging by a thread. Technology giant Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) may be about to completely snip it.

This is the likely outcome of a move that Alphabet's cable-television alternative -- YouTube TV -- recently announced it would soon be making. Although details are still scant, the company plainly said, "Early next year, we'll launch YouTube TV Plans, bringing more choice and flexibility to our subscribers with over 10 genre-specific packages."

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

And yes, all-important sports is one of those genres. This sports option will include programming from at least Fox, Comcast's NBC, and Walt Disney's ESPN -- brands that are also trying to build stand-alone sports entertainment services outside of cable television with much of the same programming content that YouTube TV's sports-centric bundle will offer. They'll now be competing with their own distribution partner.

It's the cable companies, however, that have the most to worry about here. The launch of YouTube TV's new offerings may well mark the beginning of the end of the cable business as we know it today.

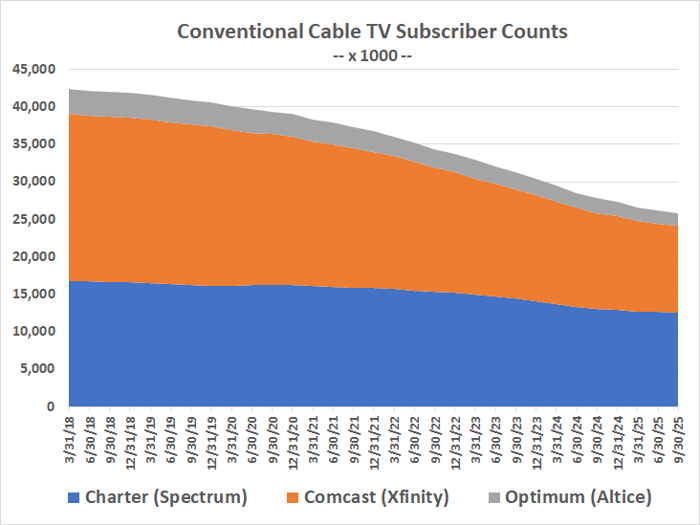

It's certainly no secret that the country's cable television business has been on the ropes for over a decade now. Just since early 2018, industry stalwarts Xfinity, Spectrum, and Altice have shed 16.6 million paying customers. That's a loss of nearly 40% of its total customer base during that seven-year stretch, matching the pace of attrition other names in the business have also experienced.

Data sources: Comcast, Optimum Communications, Charter Communications. Chart by author.

Blame the rise of streaming, of course -- it's just cheaper. Then again, so is cable-alternative YouTube TV. Although still relatively more expensive than a wide lineup of multiple streaming services, its starting price point of $82.99 per month is also considerably less than the nation's average cable bill after local taxes and fees are added to the mix. That's how YouTube TV has amassed on the order of 10 million customers just since its limited launch in 2017, followed by its nationwide availability as of 2019.

And now it's going to cost even less -- sort of. A "skinny" cable bundle's lower price is only made possible by offering a smaller total number of television channels. But with a choice of more than 10 different packages, consumers will only be paying for what they want to watch, and not paying for programming they don't. That's why the move could -- and should -- end up adding paying customers, even if they're paying less than the standard $82.99 every month.

Image source: Getty Images.

More to the point for interested investors, this is a shift that cable providers have been hoping to avoid, mostly because they've relied so heavily on bloated bundles and subsequently bloated pricing for so long. Already nursing thin profit margins, if players like Xfinity, Optimum, and Charter's Spectrum are forced to follow YouTube TV's lead, their already-deteriorating cable businesses could implode.

The matter begs an important question: How and why is YouTube TV able to do what its linear cable rivals haven't? A couple of arguable reasons stand out.

First, film and television studios, cable TV channel owners, and even broadcast networks themselves likely see the writing on the wall. Despite every effort to stem the tide of customer losses, conventional cable TV is failing. Much of the blame for this implosion ultimately lies at the feet of studios and media conglomerates themselves. For years, they were able to insist cable companies carry -- and pay for -- the entirety of their programming lineup.

That sort of all-or-nothing leverage just doesn't exist anymore, however. Consumers now have a choice, including not purchasing a cable package at all. This in turn is forcing cable companies to push back on content providers' efforts to make distributors pay for channels their customers don't often watch.

Being the only major video content distributor that's actually gaining viewers rather than losing them, though, YouTube TV was well-positioned to be the first middleman to convince these content providers to make their programming available on an à la carte basis.

Walt Disney serves as the evidentiary canary in the coal mine. Just last month, Disney's programming (ABC, ESPN, and others) was briefly removed from YouTube TV when the two companies couldn't come to carriage fee terms both parties liked. Now the media giant appears perfectly willing to let YouTube TV add ESPN to a sports-oriented bundle that's apt to exclude some of Disney's other cable channels, and is likely to serve far fewer paying customers than the overall cable industry does.

Maybe several quarters of tepid revenue growth and shrinking profits from Disney's sports arm had something to do with the decision. The entertainment media giant can't simply pretend like its sports-centric ESPN isn't feeling the impact of the broader cord-cutting movement forever, after all.

Data source: The Walt Disney Co. Chart by author.

It's not just Disney, of course. Most film and TV studios along with cable channel owners are in the same boat.

Then there's the second reason. Unlike cable companies, YouTube TV doesn't necessarily need to turn a profit by serving as a programming middleman. The company's got a myriad of other ways of monetizing consumers that choose to plug themselves into any aspect of Google's digital ecosystem.

For instance, YouTube TV's paying subscribers will still see commercials, and also see ads when viewing ordinary YouTube videos. Most other cable companies just don't operate such ancillary profit centers.

It's not always the case that what's good for one company is inherently bad for that organization's competitors. But this is not one of those times.

Even if Alphabet's near-term upside with skinny YouTube TV bundles is modest, it presents another significant challenge to an already-beleaguered cable television industry. This is particularly true for the purer plays like Charter or Altice, although it's not as if Comcast isn't going to feel the impact on Xfinity's continued marketability. Comcast's cable service accounts for about one-fifth of the company's total revenue, after all.

Bottom line? It's yet another reason to buy Alphabet, as well as more reason to steer clear of the cable TV industry despite its sizable dividend yields.

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of December 15, 2025

James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Walt Disney. The Motley Fool recommends Comcast. The Motley Fool has a disclosure policy.

| 34 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Just 8 Stocks Control A Third Of The S&P 500's Cash And Counting

GOOGL GOOG

Investor's Business Daily

|

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite