|

|

|

|

|||||

|

|

Serve Robotics Inc. SERV has successfully met its 2025 operational target by deploying over 2,000 autonomous delivery robots, making it the largest sidewalk delivery fleet in the United States. This achievement reflects strong execution, as the company reached its goal as scheduled, within its planned strategy and budget.

The milestone was driven by rapid geographic expansion into major U.S. markets, with further city launches planned for early 2026. SERV is set to expand into Buckhead, GA, and Alexandria, VA, by 2025-end. It also highlights the company’s significant scaling, with its fleet expanding about twentyfold this year, driven by growing partnerships with major delivery platforms and restaurant and retail brands. These efforts advance SERV’s goal of building a nationwide, interconnected autonomous delivery network powered by a unified AI platform.

The company also emphasizes the environmental benefits of the fleet, as the zero-emission robots replace conventional delivery vehicles, helping reduce traffic congestion and carbon emissions in the cities. At the same time, Serve Robotics’ robots operate with minimal human intervention in dense, complex city environments while maintaining high levels of safety and reliability. Ali Kashani, co-founder and CEO of the company, sees groceries, convenience items, parcels and returns as ideal for autonomous delivery. He expects SERV’s robots to play a key role in local logistics over the next five years, supporting diverse delivery.

Serve Robotics is accelerating its growth through major partnerships, rapid operational scale and an expansion strategy. The company has strengthened ties with Uber and added DoorDash, the largest U.S. delivery platform, giving it access to over 80% of the U.S. food delivery market. Its restaurant reach has surged to more than 3,600 locations, up 45% from last quarter and more than ninefold year over year. Over the past year, Serve Robotics has grown its fleet tenfold, increased its city footprint fivefold and doubled its major platform partnerships.

During the third quarter of 2025, the company surpassed 1,000 robots deployed, marking a key inflection point that significantly accelerated learning across its network. Building on this momentum, Serve Robotics successfully met its 2025 operational target by deploying 2,000 autonomous delivery robots by mid-December. As the fleet continues to scale, the company’s AI learning flywheel is expected to accelerate further, with each additional mile driven enriching proprietary urban datasets and enabling faster, continuous improvements in perception, planning and navigation models.

In addition, Serve Robotics has added new national restaurant partners such as Jersey Mike’s, alongside ongoing collaborations with Shake Shack and Little Caesars, with another major QSR brand expected to join the roster. With its growing fleet and expanding footprint, Serve Robotics is positioning itself as a leader in autonomous delivery and physical AI.

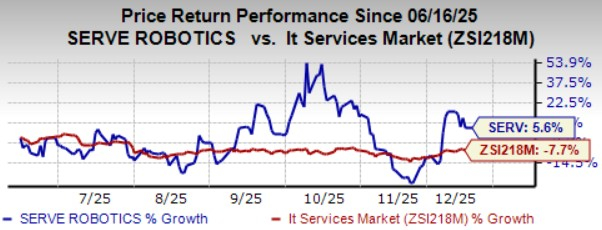

SERV stock has climbed 5.6% in the past six months, outperforming the Zacks Computers - IT Services industry’s 7.7% decline. This momentum has been supported by a series of strategic acquisitions, high-impact platform partnerships and rapid expansion across multiple end markets. The recent acquisition of Vayu Robotics further strengthens SERV’s platform by integrating AI foundation models with a scalable, simulation-driven data engine. Its third-generation fleet leverages best-in-class sensors to create proprietary urban datasets that continuously enhance AI performance. These capabilities are expected to improve efficiency, accelerate autonomy and strengthen SERV’s competitive position, supporting sustainable long-term growth.

Currently, Serve Robotics carries a Zacks Rank #4 (Sell).

Some top-ranked stocks from the Computer and Technology sector are:

NVIDIA Corporation NVDA sports a Zacks Rank of 1 (Strong Buy) at present. The company delivered a trailing four-quarter earnings surprise of 2.8%, on average. NVIDIA stock has gained 30.3% year to date. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA’s 2026 sales and earnings per share (EPS) indicates growth of 62% and 55.2%, respectively, from the prior-year levels.

Amphenol Corporation APH presently sports a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 17.9%, on average. Amphenol stock has surged 86.1% year to date.

The Zacks Consensus Estimate for Amphenol’s 2026 sales and EPS indicates growth of 12.4% and 20.7%, respectively, from the year-ago period’s levels.

Vertiv Holdings Co VRT flaunts a Zacks Rank of 1 at present. The company delivered a trailing four-quarter earnings surprise of 14.9%, on average. Vertiv stock has rallied 42% year to date.

The Zacks Consensus Estimate for Vertiv’s 2026 sales and EPS indicates growth of 20.8% and 26.6%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite