|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Global infrastructure spending remains structurally strong heading into year-end 2025, supported by aging assets, energy transition mandates, grid resiliency needs and the rapid expansion of data-center capacity. The key investment takeaway is that the “infrastructure cycle” is no longer just roads and bridges—it now includes transmission, distribution, electrification, water and mission-critical facilities that must be built (and rebuilt) over multi-year timelines.

In the United States, public-works visibility extends into 2026 thanks to the Infrastructure Investment and Jobs Act (IIJA), which provides about $350 billion for federal highway programs across fiscal 2022–2026. At the same time, grid modernization is increasingly viewed as a capital “super-cycle,” with major multi-year spending plans tied to reliability and load growth from electrification and data centers.

In Europe, policymakers are explicitly prioritizing faster approvals for grid projects as part of a competitiveness push, while Germany’s construction industry is already pointing to a massive infrastructure investment plan as a catalyst for a 2025–2026 recovery in civil works. The Central Association of the German Construction Industry (ZDB) forecasts a slight real increase in sector turnover of 0.6% this year, reversing three years of decline, followed by a 2.5% surge in 2026. Globally, long-range investment needs remain significant across energy, transport, water, and telecom, reinforcing durable demand for engineering, construction and specialty services leaders.

Against this backdrop, Jacobs Solutions J is leveraging its engineering and program-management capabilities, record backlog and rising demand across public infrastructure, data centers and advanced manufacturing to support growth into fiscal 2026. Apart from Jacobs, Dycom Industries DY, Sterling Infrastructure STRL, MasTec MTZ, EMCOR Group EME and Quanta Services PWR stand out as five companies with differentiated exposure to the most durable areas of infrastructure demand and growing visibility into 2026.

Dycom is emerging as one of the clearest beneficiaries of the next phase of digital infrastructure build-out. Management reported record quarterly results driven by fiber deployment, wireless programs and accelerating demand tied to data centers and hyperscalers. Importantly, Dycom highlighted that it is still in the early stages of what it views as a generational deployment of digital infrastructure, with outside-plant data center networks expected to ramp meaningfully starting in calendar 2026.

Backlog reached an all-time high, supported by diversified bookings across traditional carriers and hyperscaler customers, while BEAD-related broadband funding is moving closer to execution. Management also emphasized the durability of its service and maintenance business, which adds recurring revenue and margin stability. Dycom’s pending acquisition of a mission-critical electrical contractor further expands its reach inside data centers, strengthening its long-term positioning as digital infrastructure spending intensifies through 2026.

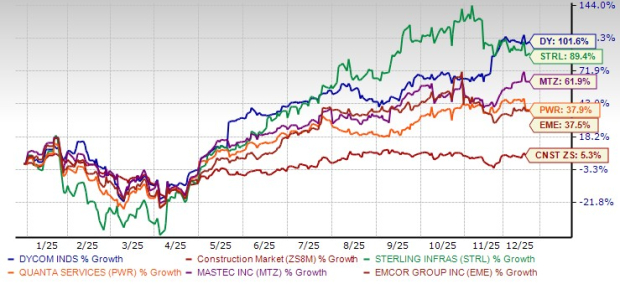

Dycom stock has gained 101.6% year to date. The Zacks Consensus Estimate for fiscal 2026 and 2027 EPS has increased to $10.71 (from $10.01) and to $14.45 (from $10.62) over the past 30 days. This indicates 35% growth on 29.2% expected revenue expansion for fiscal 2027. DY stock currently sports a Zacks Rank #1 (Strong Buy) and has a VGM Score of B. You can see the complete list of today’s Zacks #1 Rank stocks here.

Share Price Performance (YTD)

Sterling continues to pivot successfully toward higher-margin, faster-growing infrastructure markets. Management highlighted exceptional growth in its E-Infrastructure Solutions segment, driven primarily by data center site development and mission-critical projects. This mix shift has supported both margin expansion and strong backlog growth, giving Sterling unusually high visibility relative to its size.

The company’s Transportation segment is also benefiting from steady public-works demand, while its disciplined exit from lower-margin operations has improved overall profitability. Sterling’s backlog growth and expanding pipeline of signed and unsigned awards provide confidence that elevated activity levels can extend into 2026, particularly as data center and power-related projects scale further.

Sterling stock has gained 89.4% year to date (YTD). The Zacks Consensus Estimate for 2026 EPS has increased to $11.95 from $10.98 over the past 60 days, indicating 14.6% growth on 19.1% expected revenue expansion. STRL stock currently flaunts a Zacks Rank #1.

MasTec offers one of the most diversified infrastructure platforms in the group, spanning communications, power delivery, clean energy, pipelines and industrial infrastructure. Management pointed to strong execution across non-pipeline segments, with communications and power delivery benefiting from broadband expansion, grid modernization and data center-related power demand.

Critically, MasTec emphasized that reported backlog understates longer-term visibility, particularly in power and pipeline projects that are expected to ramp in 2026. The company continues to see substantial capital commitments across transmission, substations, renewables and gas-fired generation, all of which position it to capture incremental spending as infrastructure investment accelerates.

MasTec stock has gained 61.9% YTD. The Zacks Consensus Estimate for 2026 EPS has increased to $8.12 from $7.83 over the past 60 days, indicating 27.3% growth on 8.4% expected revenue expansion. MTZ stock currently carries a Zacks Rank #3 (Hold) and has a VGM Score of B.

EMCOR stands out for its combination of execution discipline, margin resilience and expanding exposure to data centers and mission-critical facilities. Management highlighted record remaining performance obligations, driven largely by network, communications and data center projects, where demand has nearly doubled year over year.

The company’s electrical and mechanical construction businesses are benefiting from strong project mix, prefabrication capabilities and disciplined contract selection. EMCOR’s service businesses add recurring revenue and cushion cyclical swings, while its balance sheet strength allows for continued investment and acquisitions. With data center, healthcare and manufacturing projects driving backlog growth, EMCOR appears well-positioned for sustained infrastructure demand into 2026.

EMCOR stock has gained 37.5% YTD. The Zacks Consensus Estimate for 2026 EPS has increased to $27.41 from $27.08 over the past 60 days, indicating 8.6% growth on 5.7% expected revenue expansion. EMCOR stock currently carries a Zacks Rank #3 and has a VGM Score of B.

Quanta Services sits at the center of one of the most capital-intensive infrastructure cycles in decades. Management reported record backlog as utilities, industrial customers, and large power users accelerate investment in transmission, generation and electrification. Demand is being driven by data centers, reshoring, electric vehicles and aging grid infrastructure.

Quanta’s integrated, self-perform model and craft-skilled workforce give it a competitive advantage in executing complex, large-scale projects. Management also highlighted expanding opportunities in power generation and grid solutions as electricity demand rises sharply. With visibility extending well beyond 2025, Quanta appears positioned to remain a core beneficiary of infrastructure spending through 2026 and beyond.

Quanta stock has gained 37.9% YTD. The Zacks Consensus Estimate for 2026 EPS has increased to $12.38 from $12.31 over the past 60 days, indicating 16.9% growth on 11% expected revenue expansion. Quanta stock currently carries a Zacks Rank #3 and has a VGM Score of B.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 10 hours | |

| 12 hours | |

| 20 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Stock Market Today: Dow Sinks Amid U.S.-Iran Jitters; This Retail Stock Tumbles (Live Coverage)

PWR +6.68%

Investor's Business Daily

|

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite