|

|

|

|

|||||

|

|

AbbVie ABBV has been consistently increasing its R&D investments to support long-term growth across multiple therapeutic areas. The company’s pipeline spans immunology therapies, expanding oncology programs and innovative treatments for neuroscience indications — several of which are nearing key regulatory milestones.

Some of AbbVie’s most important pipeline assets include multiple label expansion studies for its blockbuster immunology drug Rinvoq, as well as new candidates such as tavapadon and pivekimab sunirine (PVEK). All these candidates are either in late-stage development or currently under FDA review, positioning the company for multiple potential product launches over the next few years.

ABBV continues to build on the success of Rinvoq through label expansion efforts across five additional indications — systemic lupus erythematosus (SLE), hidradenitis suppurativa (HS), vitiligo, alopecia areata (AA) and Takayasu arteritis. The company believes these expansions could add roughly $2 billion to Rinvoq’s peak-year sales. AbbVie expects to file a regulatory submission for Rinvoq in alopecia areata before this year’s end, with data readouts from HS and SLE studies anticipated in 2026. The company recently reported positive top-line data from two late-stage studies evaluating Rinvoq in vitiligo, further supporting its expansion strategy.

AbbVie recently submitted a regulatory filing seeking approval for tavapadon as a once-daily oral treatment for Parkinson’s disease (PD) — an area with significant unmet need and commercial potential. The filing is supported by data from three late-stage studies, which showed symptomatic improvement across a broad PD population. If approved, tavapadon would represent AbbVie’s second FDA clearance in the PD indication after Vyalev, whose early launch uptake across marketed regions has been encouraging.

On the oncology front, pivekimab sunirine (PVEK) — an investigational antibody-drug conjugate (ADC) — is currently under FDA review as a potential treatment for blastic plasmacytoid dendritic cell neoplasm (BPDCN), a rare and aggressive blood cancer with limited treatment options. If approved, this could be the third ADC in AbbVie’s portfolio, alongside Elahere and Emrelis. PVEK is also being developed in a mid-stage study for acute myeloid leukemia.

Other key oncology candidates advancing through late-stage development include Temab-A (for metastatic colorectal cancer) and etentamig (for relapsed/refractory multiple myeloma).

AbbVie has also pursued an aggressive acquisition strategy in recent years to strengthen its early-stage pipeline. While immunology remains its core area, it has also signed deals across various other therapeutic areas, including oncology and neuroscience. AbbVie has executed more than 30 M&A transactions since the beginning of 2024. This includes the recently completed acquisition of neuroscience biotech Gilgamesh Pharmaceuticals’ lead pipeline drug, which is being developed in a mid-stage study for major depressive disorder (MDD).

Collectively, these transactions have not only broadened AbbVie’s therapeutic footprint but also diversified its pipeline across multiple modalities. The expanded portfolio now includes next-generation immunology candidates, bispecifics, ADCs, and innovative therapies targeting neuropsychiatric and neurodegenerative disorders. Notably, both PVEK and tavapadon were added to the company’s pipeline through acquisitions of ImmunoGen and Cerevel Therapeutics, respectively.

AbbVie is a dominant player in the immunology space, powered by three blockbuster drugs — Skyrizi, Rinvoq and Humira — which together account for nearly half of its top line. Although the company faced a major setback in 2023 when Humira lost U.S. exclusivity, it has since returned to robust growth, driven by the strong and accelerating sales trajectories of Skyrizi and Rinvoq.

The targeted market is highly competitive. A key player in this space is Johnson & Johnson JNJ, which markets two blockbuster drugs — Stelara and Tremfya. Both of these medications are approved for multiple immunology indications, including UC and CD. Since Stelara lost U.S. patent exclusivity earlier this year, J&J has shifted focus to Tremfya to maintain its market position.

Another pharma giant expanding its presence in immunology is Eli Lilly LLY, following the FDA approval of Omvoh for the UC indication in late 2023. Omvoh marked LLY’s first immunology drug approved for a type of IBD in the United States, playing a key role in expanding its portfolio in this therapeutic area. The Eli Lilly drug received FDA approval for the CD indication in January.

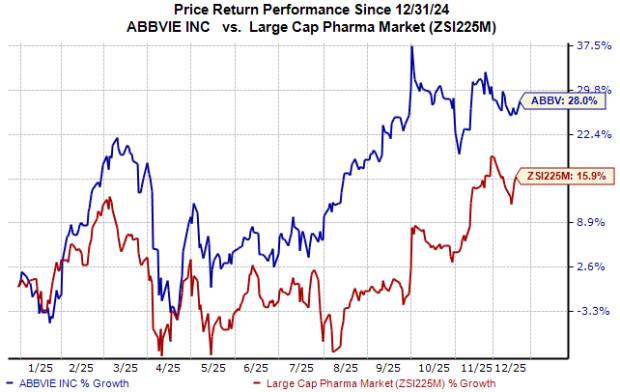

Shares of AbbVie have outperformed the industry year to date, as seen in the chart below.

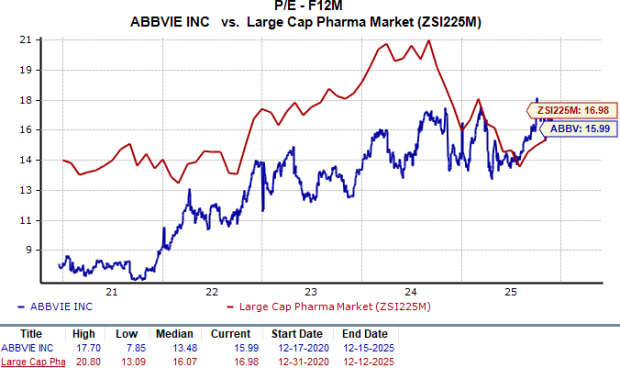

From a valuation standpoint, AbbVie is trading at a slight discount to the industry. Based on the price/earnings (P/E) ratio, the company’s shares currently trade at 15.99 times forward earnings compared to the industry's average of 16.98. The stock is trading above its five-year mean of 13.48.

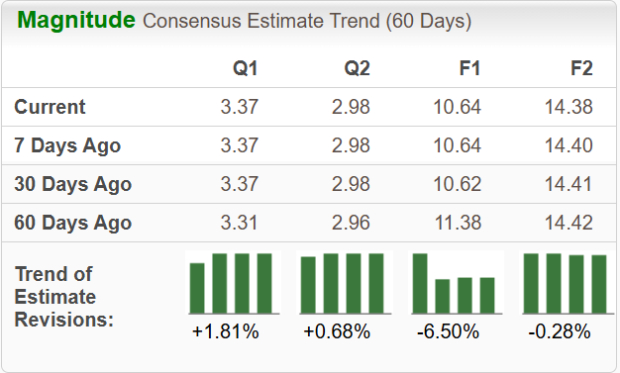

Movements in EPS estimates for 2025 and 2026 have been mixed in the past 30 days.

AbbVie currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 38 min | |

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 12 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Eli Lilly builds orforglipron cache to avoid previous GLP-1RA shortages

LLY

Pharmaceutical Technology

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite