|

|

|

|

|||||

|

|

The United States HVAC (heating, ventilation and air conditioning) market is experiencing strong multi-year growth, driven by rising energy efficiency demands, the adoption of smart technology, construction booms and government funding initiatives. Firms like Comfort Systems USA FIX and Carrier Global Corporation CARR, whose business operations are directly tied to HVAC and related markets, are benefiting from these favorable trends.

Besides, the three consecutive Fed rate cuts from September 2025 to December are a cherry on the cake. On Dec. 10, 2025, the Federal Reserve slashed its interest rates by another 0.25 percentage points, setting the benchmark between 3.5% and 3.75%. After these cuts, the Federal Open Market Committee, or FOMC, is now expecting only one rate cut in 2026, with another one anticipated in 2027. The reduction in borrowing rate catalyzes the ongoing favorable market trends, boosting more project initiations, leading to a promising future.

Comfort Systems offers installation and contracting services across HVAC markets and is currently focused on seeking opportunities for large-scale projects and investing additional cash for inorganic growth initiatives. Conversely, Carrier Global’s business surrounds HVAC equipment and technology and is mainly focused on advancing growth through technological advancements and new product launches.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Comfort Systems is realizing benefits from robust demand trends across the Technology sector, mainly because of strong data center and chip manufacturing-related activities. So far in 2025, the Technology sector contributed 42% of the total revenues, reflecting growth from 32% a year ago, thanks to hyperscalers and related infrastructure developers continuing to invest aggressively, despite ongoing macro headwinds.

As of Sept. 30, 2025, the company had a record backlog of $9.38 billion, with a same-store backlog of $9.2 billion, indicating year-over-year increases of 65.1% and 62%, respectively. Management emphasized that the backlog is high quality, well-priced and increasingly weighted toward large and complex projects that align with FIX’s core capabilities. Comfort Systems is benefiting from customers committing earlier and booking projects further out, with meaningful portions of the backlog now extending into 2026 and 2027. Modular construction has become a key differentiator in this market, enabling faster delivery and labor efficiency.

Beyond data centers, industrial and institutional markets remain supportive. Industrial customers represent roughly two-thirds of revenues, while institutional verticals such as healthcare, education and government continue to show steady activity, including new hospital builds and expansions. The company continues to post record margins and cash flow, driven by disciplined project selection, strong pricing, labor sharing across operating companies, and productivity gains from BIM, prefabrication and modularization.

Apart from market tailwinds, FIX’s inorganic growth efforts are also notable aspects. On Oct. 1, 2025, FIX acquired two electrical companies based in Western Michigan and Southern Florida, FZ Electrical and Meisner Electric, respectively. These acquisitions are expected to enhance Comfort Systems' market presence across industrial and health care capabilities, and combinedly are expected to deliver more than $200 million of incremental annual revenues and $15-$20 million of incremental annual EBITDA.

Carrier is gaining from the continued outperformance of Commercial HVAC, particularly in the Americas. It has built a robust and expanding backlog in this segment, supported by significant capacity investments, differentiated product launches and rising win rates. Data centers are a standout growth vector, with the company on track to double annual data center revenues to around $1 billion and with backlog visibility now extending into 2027-2028. CARR secured multiple marquee project wins, including large hyperscaler contracts and a notable data center order in the Middle East, alongside other large infrastructure projects such as the Shanghai Oriental Hub, reinforcing its leadership in complex and energy-efficient system solutions.

Apart from data center tailwinds, CARR is benefiting from resilient non-data-center commercial HVAC demand, supported by healthcare, infrastructure, manufacturing reshoring and select commercial real estate activity. New product introductions, such as high-efficiency air-cooled chillers with magnetic bearing technology, have strengthened differentiation and improved Carrier’s ability to win. Notably, digital platforms such as Abound and Lynx continue to gain traction through multi-year software wins and rising paid subscriptions, adding a higher-margin, more predictable revenue stream.

Beyond the Americas, international long-term market trends remain strong. In Europe, electrification and decarbonization policies are driving structural demand for heat pumps, with Carrier benefiting from strong Viessmann technology and an improving mix. Besides, in India, Japan and the Middle East, commercial HVAC and transportation solutions continue to deliver double-digit growth.

However, despite strong positioning in several growth areas, the company is struggling with a sharp downturn in the North American residential HVAC market. Weak consumer demand, slower sell-through and elevated channel inventories drove steep volume declines, particularly in the third quarter of 2025. This residential softness created under-absorption in factories and weighed heavily on segment profitability, forcing Carrier to right-size production and accelerate restructuring actions. Besides, ongoing weakness in China’s residential and light commercial markets continues to offset solid growth in India and the Middle East. Tariffs, while currently neutral on profit, still require ongoing pricing actions, and restructuring costs and workforce reductions underscore the cyclical and execution risks embedded in the current environment.

As witnessed from the chart below, in the past six months, Comfort Systems’ share price performance stands significantly above Carrier, the Zacks Building Products - Air Conditioner and Heating industry and the broader Construction sector.

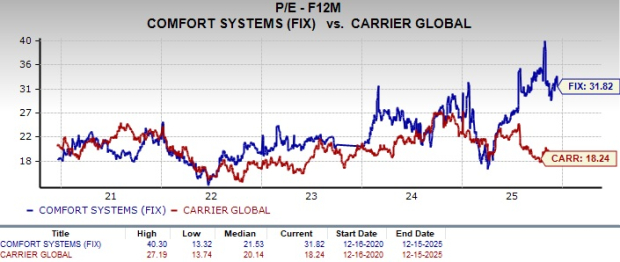

Considering valuation, over the last five years, Comfort Systems has been trading above Carrier on a forward 12-month price-to-earnings (P/E) ratio basis.

Overall, from these technical indicators, it can be deduced that FIX stock offers an incremental growth trend but with a premium valuation, while CARR stock offers a declining trend with a discounted valuation.

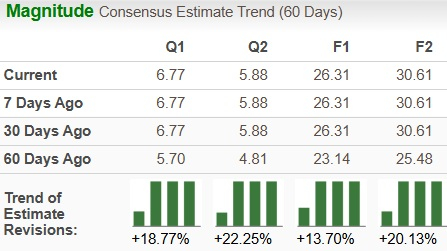

The Zacks Consensus Estimate for FIX’s 2025 EPS indicates 80.2% year-over-year growth, with the 2026 estimate indicating an increase of 16.4%. The 2025 and 2026 EPS estimates have moved up in the past 60 days.

FIX EPS Trend

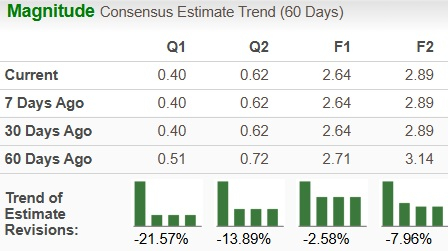

The Zacks Consensus Estimate for CARR’s 2025 earnings implies a year-over-year improvement of 3.1%, while the same for 2026 indicates growth of 9.7%. The 2025 and 2026 EPS estimates have trended downwards in the past 60 days.

CARR EPS Trend

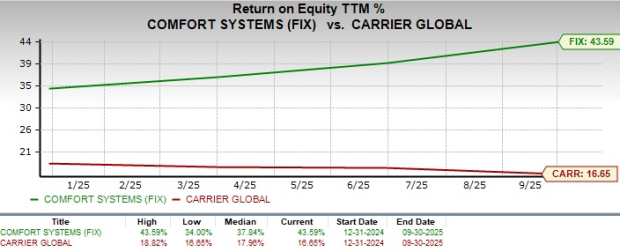

Comfort Systems’ trailing 12-month ROE of 43.6% significantly exceeds Carrier’s average, underscoring its efficiency in generating shareholder returns.

The U.S. HVAC market remains positioned for sustained multi-year growth, supported by energy-efficiency mandates, smart building adoption, construction activity and easing monetary conditions following the Fed’s recent rate cuts.

Comfort Systems stands out in execution and visibility. Strong exposure to data centers, semiconductor facilities and other technology-driven projects has materially lifted revenues and margins, supported by disciplined project selection and operational efficiency. On the other hand, while Carrier is strategically well-positioned in commercial HVAC, data centers and international electrification trends, it faces notable near-term pressures. Weak North American residential demand, factory under-absorption and restructuring costs continue to weigh on profitability and earnings estimate revisions.

An upward-trending EPS estimate, robust ROE and accretive acquisitions underscore FIX stock’s momentum, justifying its Zacks Rank #1 (Strong Buy), despite a premium valuation. Although CARR stock’s discounted valuation and long-term technology investments provide downside support, its Zacks Rank #3 (Hold) reflects a more balanced risk-reward profile at this stage.

Overall, FIX stock appears better positioned for incremental growth and earnings upside, compared with CARR stock, offering a better investment option now. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Comfort Systems Is Trading At A Record High As It Constructs An AI Future

FIX

Investor's Business Daily

|

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite