|

|

|

|

|||||

|

|

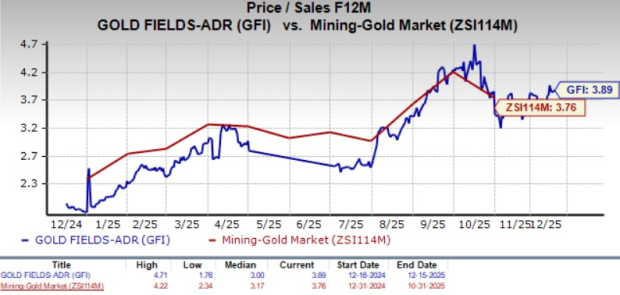

Gold Fields Limited GFI is currently trading at a forward 12-month price-to-sales multiple of 3.89X, above the peer group average of 3.75X.

The forward 12-month price-to-sales multiples for peers Agnico Eagle Mines Limited AEM and Allied Gold Corporation AAUC are 7.17X and 1.56X, respectively. GFI and AAUC currently have a Value Score of C each, while AEM has a score of D.

Gold Fields’ stock has surged 80.9% in the past six months compared with the Zacks Mining-Gold industry’s 57.4% gain and the S&P 500’s modest 16.5% rise.

Agnico Eagle and Allied Gold are up 35.9% and 65.7%, respectively.

Let’s look at the GFI’s fundamentals to analyze the stock better.

Gold Fields delivered a strong operational performance in the third quarter of 2025, with group attributable gold-equivalent production rising to 621,000 ounces, up 6% quarter on quarter and 22% year on year, driven by continued momentum across its portfolio and a successful ramp-up at the Salares Norte mine in Chile. The ramp-up at Salares Norte was a standout contributor, with gold-equivalent output at the asset increasing to 112,200 ounces, a 53% quarter-on-quarter increase.

The operation achieved commercial production and improved throughput and recoveries in line with the plan. Cost discipline was evident, with All-in Sustaining Costs declining 10% quarter on quarter to $1,557 per ounce and All-in Costs dropping 11% to $1,835 per ounce, reflecting higher sold ounces and lower capital intensity in the period.

In Australia, assets including Gruyere and St Ives maintained steady operational performance during the quarter, supported by reliable ore feed, effective mine planning and high processing plant availability. Meanwhile, South Deep in South Africa recorded a constructive quarter, aided by improved underground access, consistent mining activity and ongoing operational optimization initiatives designed to enhance operational flexibility.

From a capital allocation standpoint, Gold Fields maintained a disciplined yet growth-oriented strategy. Its free cash flow was around $166 million in the third quarter of 2025.

The company significantly increased its interim dividend to 7 rand per share (equivalent to approximately 38 cents) on Aug. 22, 2025, up from 3 rand a year ago, highlighting management’s commitment to returning value to its shareholders.

At the same time, it continued to fund major capital projects, particularly the ongoing development and winterization efforts at Salares Norte. For 2025, Gold Fields has guided total capital expenditure (Capex) of approximately $1.5 billion, including both sustaining and growth Capex.

At the end of the first half, cash and equivalents topped $1 billion, offering flexibility for operations and growth. Although net debt rose due to project investments, the net debt-to-EBITDA is 0.17x, indicating manageable leverage. The company also extended its $1.2 billion ESG-linked credit facility, aligning funding with its sustainability target. The total debt/capital of GFI is 35.44% compared with its industry’s 12.31%.

Gold Fields’ recent growth strategy has been anchored by a combination of organic project delivery and a transformative acquisition that enhances scale and portfolio quality. The most significant development has been the Salares Norte project in Chile, which achieved commercial production in 2025 and is progressing through its ramp-up phase, with ongoing capital focused on throughput optimization, recovery improvements and winterization to ensure reliable year-round operations.

The company continues to bolster its portfolio by investing in high-quality and long-life assets. Through the 2024 acquisition of Osisko Mining, it gained full ownership of the Windfall project in Quebec, Canada. Gold Fields is progressing the project, aiming to reach a final investment decision in the first quarter of 2026. The project is expected to yield roughly 300,000 ounces of gold per year, with an estimated all-in sustaining cost of about $758 per ounce, making it a key strategic asset within Gold Fields’ portfolio.

In Australia, Gold Fields has completed its A$3.7 billion acquisition of Gold Road Resources, securing full ownership of the Tier-1 Gruyere gold mine in Western Australia. Gruyere, which previously operated as a 50:50 joint venture, produces approximately 350,000 ounces of gold annually.

The company continues to advance optimization and development initiatives at South Deep in South Africa, where production remained solid at approximately 78,000 ounces of gold in the third quarter of 2025, in line with planned output and reflecting stable underground access and improved mining rates as optimisation programs progress. In Australia, St Ives also delivered strong production, contributing roughly 184,500 ounces of gold in the first half of 2025, driven by increased volumes from new open pits such as Swiftsure and Invincible Footwall South.

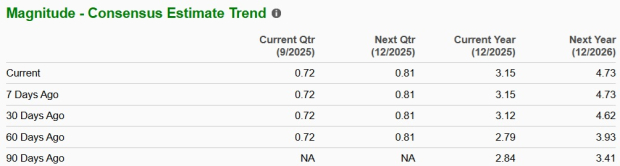

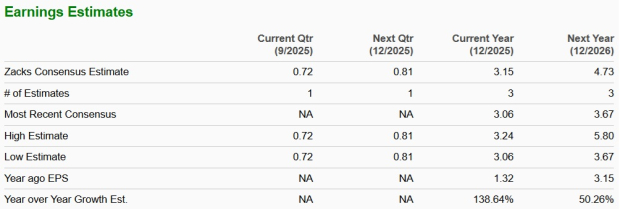

The Zacks Consensus Estimate for GFI’s 2025 and 2026 earnings has been revised higher over the past 30 days.

The Zacks Consensus Estimate for GFI’s 2025 earnings is currently pegged at $3.15 per share, suggesting a solid year-over-year surge of 139%. Earnings are expected to register roughly 50% growth in 2026.

Gold Fields continues to demonstrate strong operational momentum, underpinned by rising production, a deepening development pipeline and disciplined capital allocation. Robust free cash flow generation and a reinforced balance sheet provide the flexibility to fund growth while maintaining shareholder returns, particularly in a supportive gold price environment.

Beyond the ramp-up at Salares Norte, the company’s full ownership of Gruyere and steady advancement of the Windfall project significantly improve long-term production visibility and earnings potential. With improving fundamentals and a diversified and high-quality asset base, it is executing effectively on both strategic and operational fronts. As a result, GFI appears well-positioned for continued upside and remains an attractive investment opportunity, supported by its Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 |

Trump's Tariffs Lift Gold Prices. These Mining Stocks Are Basing.

AEM +5.36%

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite