|

|

|

|

|||||

|

|

Electric vehicle (EV) maker and tech titan Tesla TSLA had a wild run this year. It started off on a rough note, sliding more than 30% in the first three months of the year. Investor confidence took a hit as sales weakened across key markets, especially Europe and China. Tesla’s brand image started to lose the shine it once enjoyed, just as competition in the EV space intensified, particularly from Chinese EV makers such as BYD Co Ltd BYDDY.

A big part of the concern was related to TSLA’s CEO, Elon Musk. After a strong rally late in 2024 — helped by Donald Trump’s election victory and Musk’s perceived influence with the new administration — investor sentiment flipped in early 2025.

Musk’s growing involvement in politics, particularly his role leading the Department of Government Efficiency (DOGE), made investors uneasy. Many worried that Tesla was no longer getting his full attention at a moment when slowing demand and rising competition required sharp execution.

For a company that has long traded as much on belief in Musk as on fundamentals, that uncertainty mattered.

The mood began to change around late April. Musk publicly reassured investors that he would scale back his time at DOGE and refocus on Tesla. The message landed well and the stock started to recover as investors breathed a sigh of relief, hoping Musk’s renewed focus could help stabilize the business.

There was also a short-term demand boost midway through the year. As the U.S. government began phasing out the $7,500 federal EV tax credit, buyers rushed to lock in purchases before the incentive disappeared. That rush gave Tesla a temporary breather in the third quarter of 2025, with the company achieving record sales.The company delivered 497,099 vehicles, which rose 7% year over year and topped our estimate of 435,370 units.

In September, Tesla’s board proposed a record $975 billion pay package for Musk, signaling that the company’s future hinges heavily on his vision—particularly in AI, robotics and autonomy. Not long after, Musk bought $1 billion worth of Tesla shares, signaling renewed commitment.

Tesla’s latest rally has been driven by something investors have been waiting to see—progress on autonomy. Yesterday, the stock closed at record highs at $489.88 after reports surfaced that Tesla was testing fully driverless robotaxis in Austin. The news pushed Tesla’s valuation to around $1.6 trillion.

Earlier this year, Tesla launched its robotaxi service in Austin with safety drivers onboard due to regulatory and safety concerns. But over the weekend, multiple Model Ys were spotted operating without a safety driver. Musk later confirmed that fully autonomous robotaxi testing is now underway. The development has become a major catalyst for the stock’s recent surge.

That said,competition in autonomy remains intense. Alphabet’s GOOGL Waymo continues to lead the autonomous ride-hailing race. Its entire fleet operates without safety drivers, and it recently surpassed 450,000 weekly paid rides. So, Tesla is still playing catch-up in some respects.

Tesla’s vehicle sales remain under pressure, competition is fierce, and the company’s most ambitious projects—from robotaxis to humanoid robots—are likely years away from contributing meaningfully to profits.

But what’s important here is the broader shift in Tesla’s story. Even if EV sales never return to the explosive growth seen between 2020 and 2022, Tesla’s future is no longer tied solely to car deliveries. Full self-driving technology continues to improve, the robotaxi network is moving closer to scale, and Tesla’s energy generation and storage business is quietly growing into a meaningful contributor.

On top of that, Tesla’s ambitions in humanoid robots and AI-driven systems are starting to feel less like distant science fiction and more like long-term options with real upside. Unlike many AI companies focused purely on software, Tesla is applying AI to physical assets—cars, robots, energy systems, and transportation networks—that can be monetized in tangible ways.

So far this year, Tesla has managed to gain 21%.

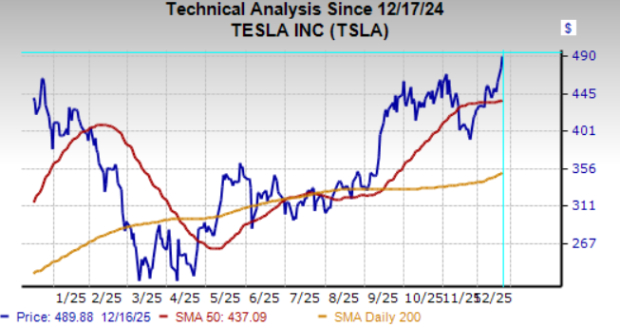

Tesla, Inc. price | Tesla, Inc. Quote

From a technical standpoint, the stock is trading above both its 50-day and 200-day moving averages, signaling improving momentum.

The company trades at more than 15.4X forward 12-month sales, far above the industry average. But Tesla has been one of those stocks whose valuation has long been divorced from its fundamentals. It has always traded at a premium, backed by promises of its long-term potential.

The Zacks Consensus Estimate for Tesla’s 2026 revenues and EPS implies an uptick of 12% and 43%, respectively, from the 2025 projected levels.

Heading into 2026, Tesla remains a high-risk, high-reward story. The near-term challenges are real, but so are the potential catalysts. For investors willing to stomach volatility, Tesla still represents a unique bet on autonomy, AI, and the future of mobility. And if even part of Musk’s vision comes together, TSLA could remain a winning stock for years to come.

Tesla currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 min |

AI Stocks Reset In 2026 Amid Software Reckoning, Hyperscaler Capex Boom

GOOGL

Investor's Business Daily

|

| 28 min | |

| 41 min | |

| 47 min | |

| 53 min | |

| 58 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite