|

|

|

|

|||||

|

|

Electronics manufacturing services provider Jabil (NYSE:JBL) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 18.7% year on year to $8.31 billion. Guidance for next quarter’s revenue was optimistic at $7.75 billion at the midpoint, 2.6% above analysts’ estimates. Its non-GAAP profit of $2.85 per share was 4.4% above analysts’ consensus estimates.

Is now the time to buy Jabil? Find out by accessing our full research report, it’s free for active Edge members.

“Fiscal 2026 is off to an excellent start, with Q1 performance ahead of expectations across revenue, core operating margins, and core EPS,” said CEO Mike Dastoor.

With manufacturing facilities spanning the globe from China to Mexico to the United States, Jabil (NYSE:JBL) provides electronics design, manufacturing, and supply chain solutions to companies across various industries, from healthcare to automotive to cloud computing.

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $31.11 billion in revenue over the past 12 months, Jabil is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. For Jabil to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

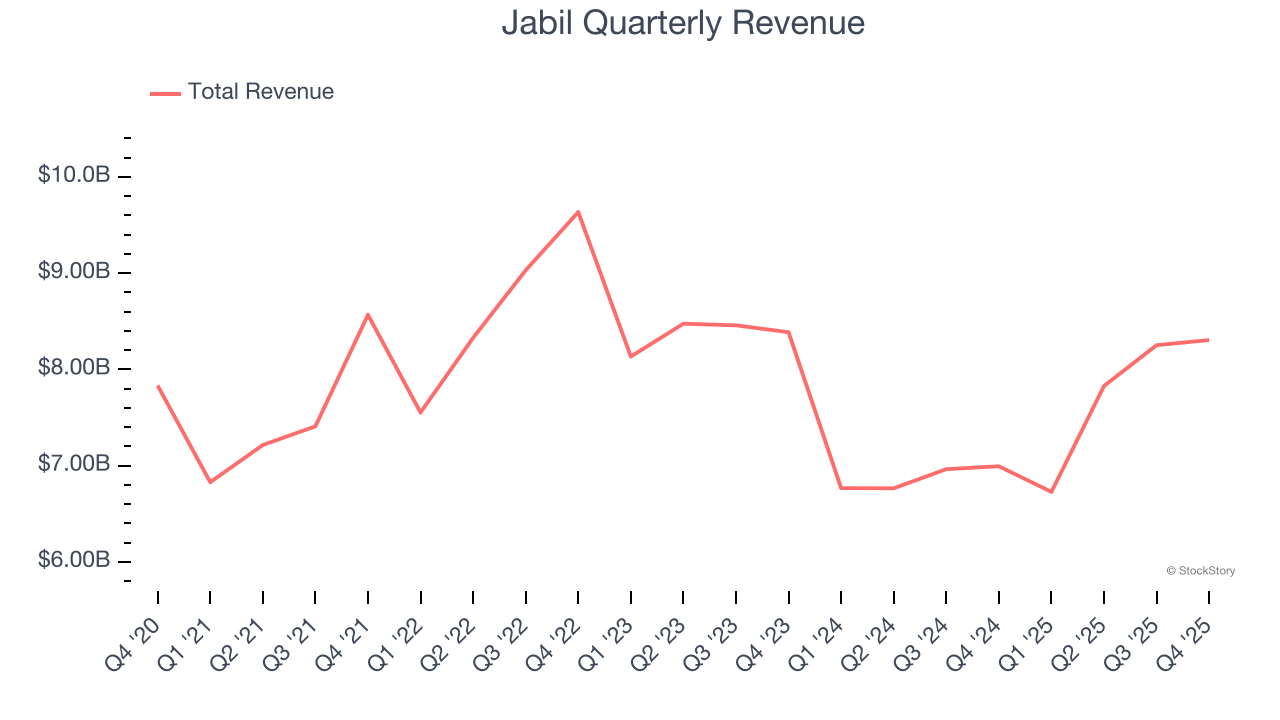

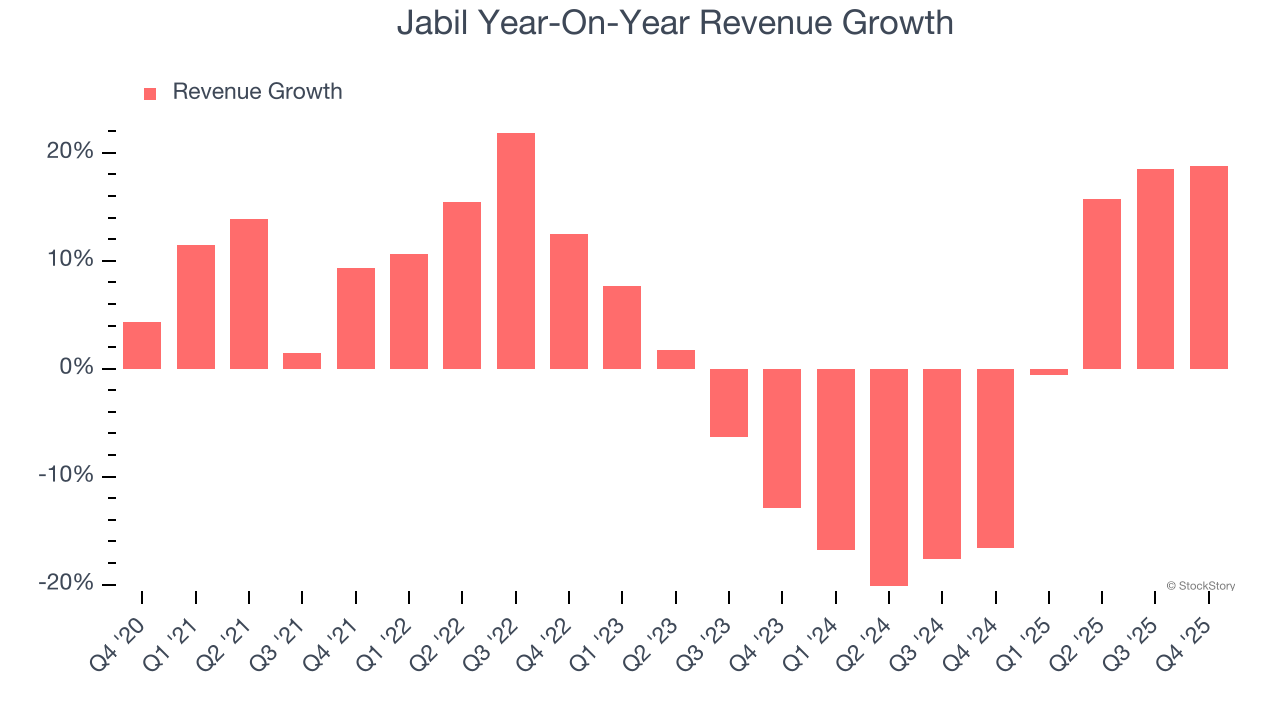

As you can see below, Jabil’s sales grew at a sluggish 2.4% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Jabil’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.6% annually.

This quarter, Jabil reported year-on-year revenue growth of 18.7%, and its $8.31 billion of revenue exceeded Wall Street’s estimates by 3.8%. Company management is currently guiding for a 15.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

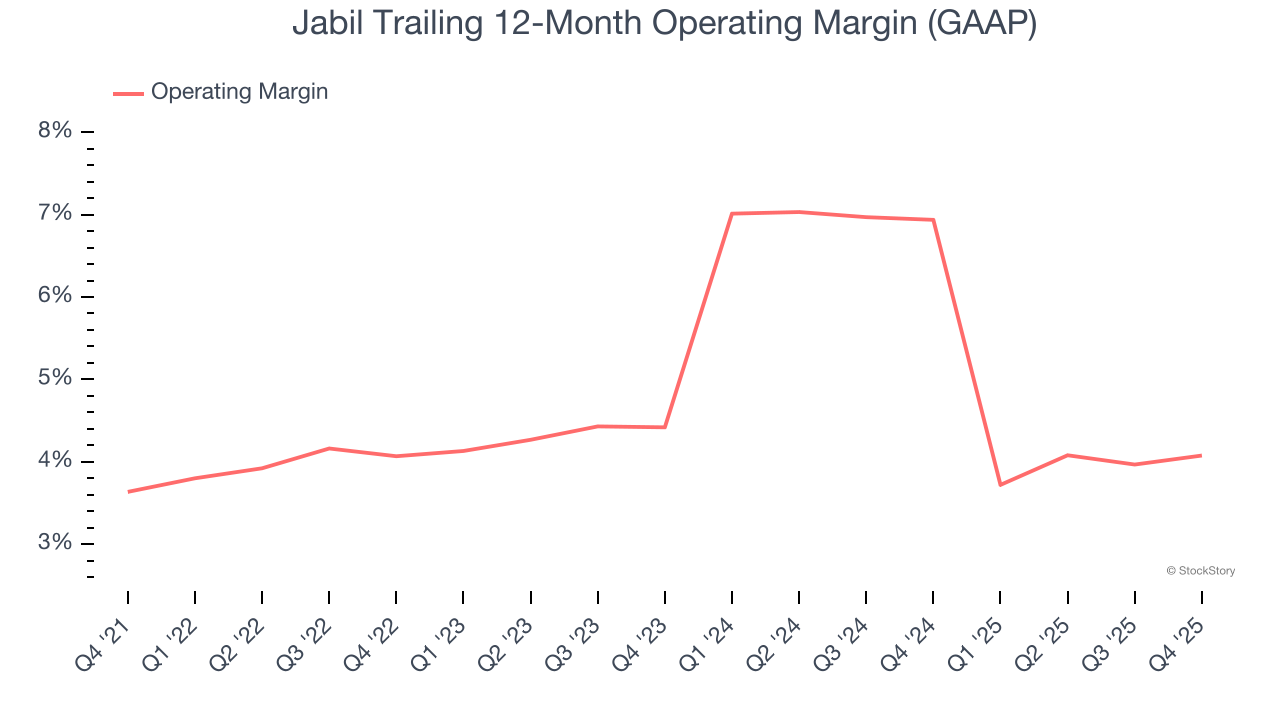

Jabil’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.6% over the last five years. This profitability was lousy for a business services business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, Jabil’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Jabil generated an operating margin profit margin of 3.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

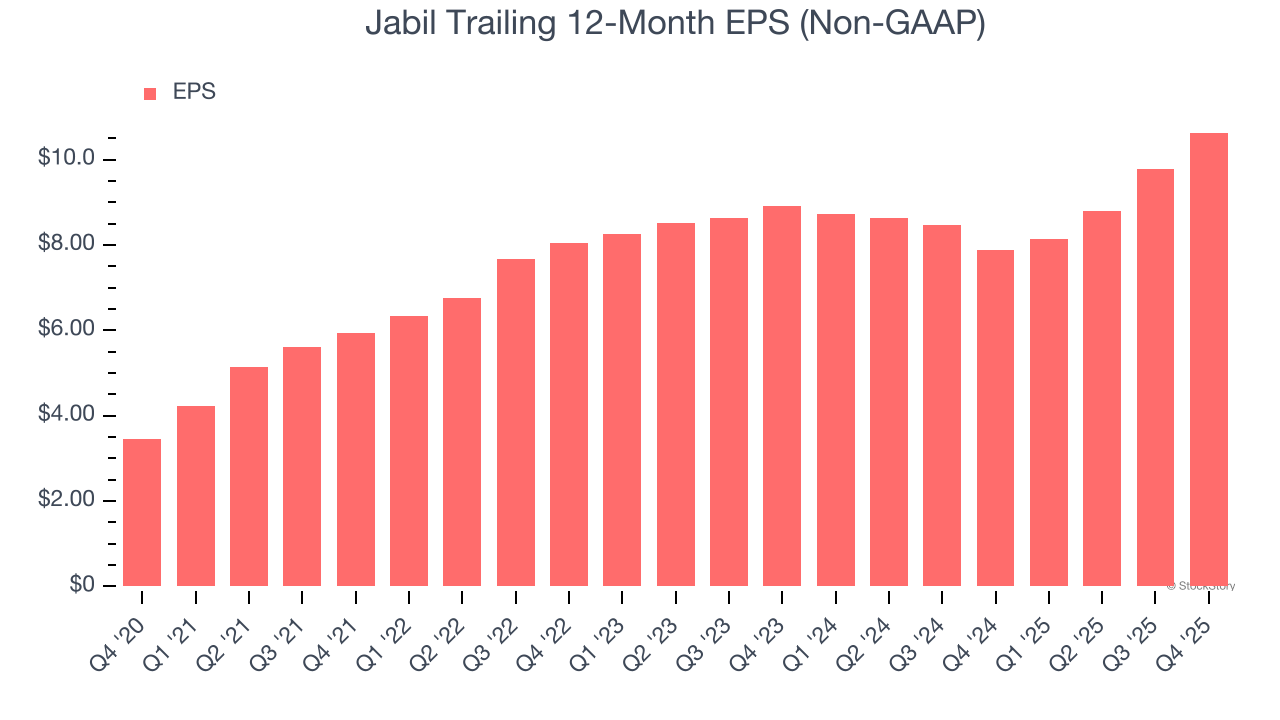

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Jabil’s EPS grew at an astounding 25.2% compounded annual growth rate over the last five years, higher than its 2.4% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Jabil, its two-year annual EPS growth of 9.2% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Jabil reported adjusted EPS of $2.85, up from $2 in the same quarter last year. This print beat analysts’ estimates by 4.4%. Over the next 12 months, Wall Street expects Jabil’s full-year EPS of $10.63 to grow 7%.

We were impressed by Jabil’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS guidance for next quarter outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.6% to $222.25 immediately after reporting.

Jabil may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| 1 hour | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite