|

|

|

|

|||||

|

|

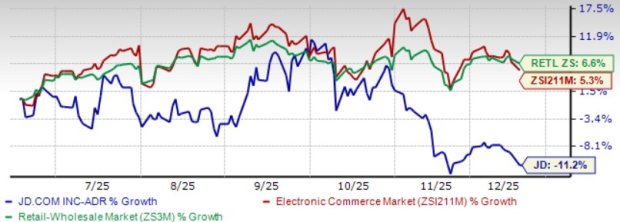

JD.com JD shares have plunged 11.2% over the past six months, lagging significantly behind the Zacks Retail-Wholesale sector’s return of 6.6% and the Zacks Internet-Commerce industry’s advance of 5.3%. The stock's weakness reflects investor concerns around profitability pressure from new business investments, moderating growth in electronics categories after government subsidies ended and the ongoing drag from food delivery losses.

This notable gap in performance raises a critical question for investors: Does JD's current price offer a compelling entry point, or are there deeper problems that warrant caution? Let's delve deeper to find out.

JD’s aggressive push into food delivery has emerged as a meaningful drag on near-term profitability. During the third quarter of 2025, the segment reported an operating loss of RMB 15.7 billion as JD scaled its on-demand delivery operations. The initiative represents a structural shift from JD’s centralized, inventory-led retail model to a hyperlocal logistics network, bringing significantly higher operating complexity.

Competition remains intense, particularly against entrenched leader Meituan, forcing JD to rely on heavy subsidies and commission-free policies to attract merchants and users. While these tactics have supported rapid GMV and order growth, they have limited revenue contribution and pressured unit economics. Achieving scale efficiency in real-time logistics requires dense routing and sustained investment, delaying meaningful margin recovery.

Encouragingly, losses narrowed sequentially in the third quarter as operating efficiency improved and order mix shifted toward higher-value transactions. Concepts such as 7Fresh Kitchen have gained early traction, but the path to breakeven remains uncertain given the capital-intensive and highly competitive nature of the market.

JD continues to face competitive pressure across pricing, logistics and user acquisition. PDD Holdings PDD maintains aggressive discounting and social commerce promotions, forcing JD to sustain elevated marketing spend. Marketing expenses surged 110.5% year over year in the third quarter, largely driven by promotions tied to new business initiatives. Alibaba BABA is deepening its asset-light marketplace strategy, sustaining pricing pressure in categories such as apparel and general merchandise where margins remain thin.

Globally, Amazon AMZN sets expectations for delivery speed and membership benefits, raising the bar for logistics-led platforms. Simultaneously, JD’s diversification into food delivery, international expansion, and lower-tier market penetration through Jingxi is absorbing significant capital. Free cash flow declined to RMB 12.6 billion on a trailing twelve-month basis as of September 30, down from RMB 33.6 billion a year earlier, reflecting investment-heavy growth and working capital needs.

The Zacks Consensus Estimate for JD's fourth-quarter 2025 EPS is pegged at 56 cents, unchanged over the past 30 days, down 45.10% year over year, signaling continued profitability pressure. Although JD holds RMB210.5 billion in cash, sustained investment limits flexibility. PDD Holdings’ lean model and Alibaba’s restructuring highlight execution challenges, while Amazon’s high-margin businesses underscore JD’s need for tighter cost discipline to rebuild confidence.

JD.com, Inc. price-consensus-chart | JD.com, Inc. Quote

JD continues to demonstrate strong user momentum. Annual active customers surpassed 700 million in October 2025, while quarterly active users and shopping frequency both rose more than 40% year over year in the third quarter, providing a solid base for future revenue growth.

Food delivery has contributed to user acquisition, with early cohorts showing cross-category purchasing behavior. The JD Plus membership base continues to expand, supporting higher engagement and lifetime value. Within core retail, JD generated revenues of RMB 250.6 billion in the third quarter, with operating margin improving to 5.9% from 5.2% a year earlier.

General merchandise revenues accelerated 18.8% year over year, while marketplace and marketing revenues increased 23.7%, driven by rising merchant participation. These higher-margin services help offset pressure from capital-intensive segments. The Zacks Consensus Estimate for JD’s fourth-quarter 2025 revenues is pegged at $51.61 billion, up 8.57% year over year, highlighting platform resilience, though incremental gains are likely absorbed by ongoing investments.

JD shares appear undervalued, supported by a Value Score of B. The stock trades at a forward 12-month price-to-earnings ratio of 9.33x, well below the industry average of 23.69x and the sector average of 24.52x. In comparison, PDD Holdings trades at 9.88x, Alibaba at 18.97x and Amazon at 28.49x, suggesting JD’s valuation discount.

The valuation discount reflects a transition phase rather than structural weakness. Ongoing investments in food delivery, logistics and international expansion are broadening JD’s growth runway and enhancing its ecosystem depth, even as near-term profitability remains under pressure. As these initiatives mature and operating efficiency improves, the current valuation gap could narrow, offering potential upside over time while warranting patience at current levels.

JD’s recent underperformance reflects a period of heavy reinvestment and elevated competitive pressure rather than a deterioration in its core franchise. The company continues to show resilience in user engagement and revenue mix, while valuation offers downside support. However, margin recovery remains gradual as food delivery and expansion initiatives weigh on near-term profitability. With earnings visibility still evolving, upside catalysts appear more medium term in nature.

JD currently carries a Zacks Rank #3 (Hold), suggesting prudent investors may consider holding positions while waiting for attractive entry points in the future. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 23 min | |

| 54 min | |

| 1 hour | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite