|

|

|

|

|||||

|

|

The telecom sector witnessed healthy demand trends in 2025 with an accelerated pace of 5G deployment and increased fiber densification, driven by a rising user propensity to stay abreast of the latest digital innovations. Despite a challenging macroeconomic environment characterized by geopolitical conflicts, raging wars, inflationary pressures, tariff threats and uncertain business conditions, the industry appears to have benefited from higher demand for scalable infrastructure to facilitate seamless connectivity amid the widespread proliferation of IoT devices.

With faster download speed and low latency, 5G is touted as the primary catalyst for Generative AI and next-generation IoT services. These include connected cars, augmented reality, virtual reality platforms, smart cities and connected devices that are likely to revolutionize key industry verticals. Business enterprises are increasingly embracing the exciting possibilities offered by AI and the IoT via real-time data transfer.

The telecommunications industry is benefiting from a software-driven, data-centric approach that helps customers build their cloud architecture and enhance their cloud experience. Fiber networks are essential for deploying small cells that bring the network closer to the user and supplement macro networks to provide extensive coverage. Telecom service providers are increasingly leaning toward fiber optic cable to meet the burgeoning demand for cloud-based business data and video streaming services by individuals.

Network Convergence Stokes Growth

With operators moving toward converged or multi-use network structures, combining voice, video and data communications into a single network, the industry is increasingly developing solutions to support wireline and wireless network convergence. The industry players have enabled enterprises to rapidly scale communications functionalities to various applications and devices with easy-to-use software application programming interfaces. The wide proliferation of cloud networking solutions further increases storage and computing on a virtual plane. As both consumers and enterprises use the network, there is tremendous demand for quality networking equipment.

Steady investments by leading carriers to upgrade their network infrastructure to meet the growing demand for flexible data, video, voice and IP solutions seem to have buoyed the sector. As the 5G ecosystem evolves with increased deployment across the globe, it is likely to offer a plethora of opportunities for diverse industries to spearhead innovation and redefine our daily lives.

However, old guard telecom firms like AT&T Inc. T are facing a steady decline in legacy services. The company’s wireline division is struggling with persistent losses in access lines as a result of competitive pressure from voice-over-Internet protocol service providers and aggressive triple-play (voice, data, video) offerings by the cable companies. High-speed Internet revenues are contracting due to the legacy Digital Subscriber Line decline, simplified pricing and bundle discounts. As AT&T tries to woo customers with healthy discounts, freebies and cash credits, margin pressures tend to escalate, affecting its growth potential.

As of Sept. 30, 2025, AT&T had $20.27 billion of cash and cash equivalents with long-term debt of $128.09 billion compared with respective tallies of $10.5 billion and $123.06 billion in the previous quarter. This indicates that although its short-term liquidity has improved, its long-term debt burden has increased significantly. At the end of the third quarter, the company had a current ratio of 1.01 and a cash ratio of 0.38. It indicates the company may face challenges in meeting short-term debt obligations.

As AT&T faces significant challenges, investors could be better off if they bet on the following three telecom stocks that hold solid inherent growth potential to be potential winners in 2026. In addition to solid Zacks Rank and strong fundamentals, these stocks have a healthy Zacks Industry Rank and are placed within the top half of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

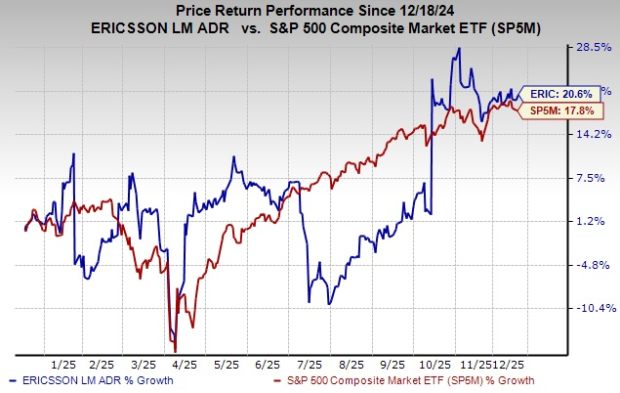

Ericsson ERIC is well-positioned to capitalize on the market momentum with a competitive 5G product portfolio. With a holistic growth focus, the company strives to be the leading telecommunications infrastructure provider worldwide and establish a focused enterprise business. Ericsson is focusing on 5G system development and has undertaken many notable endeavors to position itself for market leadership on 5G. It currently has 194 live 5G networks across the globe, spanning 82 countries. The company believes that the standardization of 5G is the cornerstone for digitizing industries and broadband. The deployment of 5G networks is likely to boost the adoption of IoT devices, with technologies like network slicing gaining more prominence.

Ericsson continues to invest in the Enterprise business to make it a sizeable part of its business. The company has introduced on-demand network slicing capability in Android 14 devices. It empowers developers to enhance the flexibility of applications and allows service providers to better align network connectivity with user-specific requirements. Ericsson has stepped up production in its 5G Smart factory in Lewisville, TX, to cater to the increased demand for 5G equipment, bringing it to the forefront of 5G innovation. With highly automated and efficient processes, the factory is fully powered by renewable electricity, producing next-generation 5G and Advanced Antenna System radios for Ericsson's U.S. customers.

With a VGM Score of A, the stock has gained 20.6% over the past year. Earnings estimates for Ericsson for the current and next fiscal year have moved up 50% and 6.9%, respectively, since December 2024. It has long-term earnings growth expectations of 8.4% and has a Zacks Industry Rank #87 (top 36%). Ericsson carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

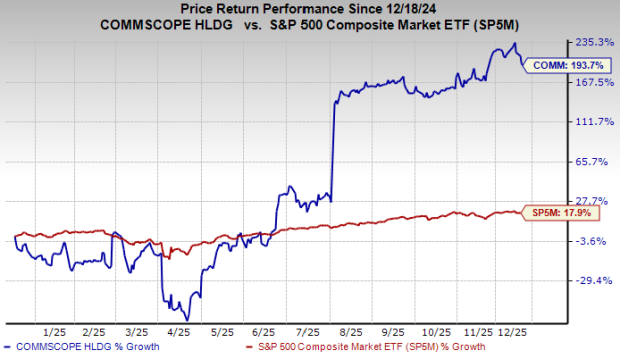

CommScope Holding Company, Inc. COMM is developing solutions that are essential for the success of 5G technology. Its product portfolio has been specifically designed to help global service providers efficiently deploy fiber networks. CommScope has strengthened its portfolio by acquiring Casa Systems' Cable Business assets. The acquisition enhanced CommScope’s market-leading position in Access Network Solutions. It bolstered its virtual CMTS (Cable Modem Termination Systems) and PON (Passive Optical Network) product offerings, bringing significant synergies to the company’s operations, especially in the domain of cloud-native network solutions.

CommScope has launched the HX6-611-6WH/B antenna to revolutionize the way network operators scale their operations by providing a high-capacity microwave backhaul solution that meets the demands of future networks. By operating seamlessly in both the 6 GHz and 11 GHz bands, the HX6-611-6WH/B ensures reliable, long-haul connectivity, making it a critical asset for mobile network operators (MNOs) looking to future-proof their infrastructure. The company’s continuous innovation in microwave backhaul technology is expected to boost demand for its products as MNOs seek to upgrade their networks to handle the growing data traffic and connectivity needs of the future. The introduction of this advanced antenna further underscores the company's commitment to delivering high-performance, cost-effective solutions to address the evolving needs of the telecommunications industry.

With an average broker recommendation (ABR) of 1.83 and long-term earnings growth expectations of 13.5%, the stock has gained 193.7% over the past year. Earnings estimates for CommScope for the current and next fiscal year have moved up 358.3% and 68.2%, respectively, since December 2024. It has a Zacks Industry Rank #16 (top 7%). CommScope sports a Zacks Rank #1 at present.

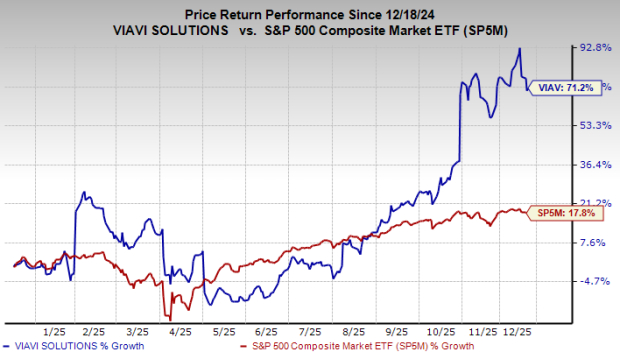

Viavi Solutions Inc. VIAV is a leading provider of network test, monitoring and service enablement solutions to diverse sectors across the globe. The product portfolio of the company offers end-to-end network visibility and analytics that help build, test, certify, maintain, and optimize complex physical and virtual networks. Viavi also offers high-performance thin film optical coatings for light-management solutions used in anti-counterfeiting, 3D sensing, electronics, automotive, defense and instrumentation markets.

Viavi’s wireless and fiber test solutions are in the early stages of a multi-year investment cycle fueled by the transition of OEMs and service providers to superfast 5G networks. Management expects growth to be driven by the secular demand for 5G wireless, fiber and 3D sensing. The 5G transition is expected to be disruptive, creating new growth avenues for industries across the board. The company expects to leverage major secular growth trends in 5G wireless, fiber and 3D sensing to achieve higher revenues and profitability with greater flexibility in the capital structure. 5G is likely to augment the scalability, security and universal mobility of the telecommunications industry, which is expected to propel the proliferation of IoT.

With an ABR of 1.55 and a VGM Score of B, the stock has gained 71.2% over the past year. Earnings estimates for Viavi for the current and next fiscal year have moved up 28.8% and 26.7%, respectively, since December 2024. It has a Zacks Industry Rank #32 (top 13%). Viavi carries a Zacks Rank #2 at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite