|

|

|

|

|||||

|

|

The brokerage industry has experienced strong momentum this year, largely driven by technological advancements and market participation trends. As brokerage firms invested heavily in digital trading platforms, mobile apps and artificial intelligence (AI)-enhanced services, these improved their execution speed, personalized recommendations and overall client experience, making markets more accessible and efficient for retail and institutional investors.

Commission-free trading models and a rise in new account openings also helped drive higher trading volumes, increasing revenue opportunities through alternative income streams, such as interest on cash balances, margin lending and premium features. These trends have helped support broader market engagement and sustained interest in equity markets throughout 2025, benefitting industry players like Robinhood Markets HOOD, Interactive Brokers Group IBKR and The Charles Schwab Corporation SCHW.

While Schwab experienced millions of daily trades and significant net new assets, with more than 4.2 million new brokerage accounts opened in 2025, IBKR’s Daily Average Revenue Trades (DARTs) rose strongly, driven by renewed market volatility and more active positioning from traders across equities, options and futures markets.

Then again, Robinhood benefited from explosive growth in alternative trading segments, such as crypto and prediction markets, alongside strong equities and options trading volumes.

These brokerage stocks distinctly outperformed the broader markets in 2025, highlighting how trading performance translated into market valuation gains. While shares of Schwab and Interactive Brokers have rallied 29.7% and 42.3%, respectively, this year, the HOOD stock has skyrocketed 222.1%, all three outperforming the S&P 500 Index’s 18% growth. If we compare the companies’ performance with the industry to which they belong, it appears that while SCHW underperformed its peers on average, HOOD and IBKR outperformed the industry’s 36.2% rise.

Looking to 2026, several of the positive trends are expected to continue and benefit the brokerage industry. AI and automation are projected to remain core to brokerage operations, not only for trade execution but also for enhanced personalization, fraud detection and risk management. These will help firms streamline costs and improve client loyalty.

Moreover, broader stock market optimism, supported by expectations of continued earnings growth and economic resilience, is expected to sustain investor engagement and trading activity. The ongoing democratization of financial markets through fractional shares, alternate assets and deeper fintech integration will likely attract new investors and expand revenue channels for brokerages. Meanwhile, innovation in extended trading hours and international access could boost market participation.

Thus, the companies mentioned above will likely continue to benefit amid favorable trading conditions next year. Hence, it seems to be a wise idea to keep them on your radar now.

Let us dive deeper into each of the three stocks to understand their fundamental strength and growth prospects better.

Robinhood: Headquartered in Menlo Park, CA, this fintech and online broker has transitioned from a commission-free trading app to a diversified platform with strong fundamental performance, driven by robust revenue growth, expanding user engagement and profitability. HOOD earns money from a mix of transaction-based fees, net interest income, subscription services like Robinhood Gold and newer offerings such as prediction markets and banking products.

Its transaction-based revenues witnessed a compound annual growth rate (CAGR) of 36.7% over the last five years (ended 2024), driven by options and equities trading, with the uptrend continuing in the first nine months of 2025. Though HOOD has been lowering its dependence on this revenue source, efforts to become a leader in the active trader market, alongside increased retail participation and secular tailwinds, will likely continue to drive its transaction-based revenues.

Robinhood has been engaged in opportunistic acquisitions to deepen its footprint and expand its product reach. Last month, in partnership with Susquehanna International Group, HOOD announced a deal to acquire a 90% stake in MIAX Derivatives Exchange. In June, it bought Bitstamp to grow its global crypto business and agreed to acquire WonderFi in May 2025 to strengthen its Canadian crypto presence. In February, HOOD acquired TradePMR to enter the RIA custody market. In the last two years, the company has acquired Pluto Capital (to enhance its AI capabilities and advisory technology), Chartr (accelerating the Sherwood media business) and X1 Inc.

Robinhood’s efforts to grow through rapid product innovation have been impressive. Some of its key launches include Cortex (an AI assistant for custom indicators, market analysis and real-time insights) and Legend (which adds advanced tools such as futures trading, short selling, simulated options returns and near-24/5 index options access). New banking features (including expansion into mortgage loans) and the Gold credit card have broadened its personal-finance footprint. Internationally, Robinhood is offering tokenized U.S. stocks and ETFs with 24/5 commission-free trading and aims to tokenize private companies. Expanded crypto services and a proprietary blockchain, along with new offices in Toronto and plans for APAC, position HOOD as a rising global fintech ecosystem.

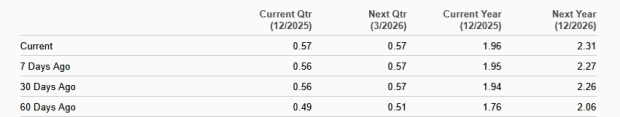

The Zacks Consensus Estimate for the company’s 2026 revenues is pegged at $5.40 billion, indicating a year-over-year rise of 21%. Its earnings estimate of $2.31 per share suggests growth of 17.9%. In the last 60 days, HOOD’s earnings estimate for 2026 has been revised 12.1% higher, reflecting analysts’ optimism regarding its earnings growth potential. Currently, Robinhood sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Interactive Brokers: This Zacks Rank #2 (Buy) electronic brokerage firm processes trades in stocks, digital assets, futures, options and forex on more than 160 exchanges across several countries and currencies. Unlike many of its peers, the company has a very low level of compensation expenses relative to net revenues (10.4% in the first nine months of 2025), primarily driven by its technological excellence, which helps it generate solid growth.

Since its inception, Interactive Brokers has been focusing on developing proprietary software to automate broker-dealer functions, which has resulted in a steady improvement in revenues. Total net revenues witnessed a CAGR of 21.8% over the last five years (2019-2024), with the upward momentum continuing in the first nine months of 2025. Given IBKR’s solid DART numbers and a robust trading backdrop, net revenues are expected to keep improving in the quarters ahead.

Serving more than 4.1 million customer accounts and holding more than $750 billion in client equity across its global platform, IBKR has continuously been taking efforts to diversify its product offerings. Recently, it announced that it is allowing retail investors to fund individual brokerage accounts using stablecoins. A few days ago, IBKR announced that eligible clients outside of Brazil can now trade Brazilian equities through the Brazil Stock Exchange, giving investors more ways to access emerging market opportunities across Latin America. Also, it has announced the introduction of United Arab Emirates equities through two leading exchanges.

In October 2025, IBKR launched the Karta Visa card for its clients to make purchases globally. In August, it introduced Connections, a feature designed to help investors discover trading opportunities and evaluate investments by highlighting related ideas across global markets. A few months ago, IBKR launched zero-commission U.S. stock trading in Singapore and NISA accounts to help Japanese investors build wealth tax-free. After launching Forecast Contracts for eligible clients in the United States and Hong Kong, IBKR has expanded it into Europe.

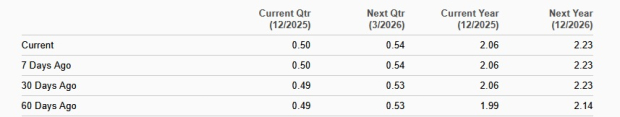

These initiatives, along with several others, are expected to strengthen Interactive Brokers’ market share amid stiff competition and help diversify operations. The Zacks Consensus Estimate for the company’s 2026 revenues is pegged at $6.27 billion, indicating a year-over-year rise of 5.7%. Its earnings estimate of $2.23 suggests growth of 8.1%. In the last 60 days, IBKR’s earnings estimate for 2026 has been revised 4.2% higher.

Schwab: The company provides a comprehensive suite of investment, banking and wealth management solutions. At its core, it offers brokerage services, alongside retirement accounts, financial planning and advisory products, while its banking arm delivers deposit and lending services, such as checking, savings and credit products.

Schwab continues to benefit from aggressive efforts to increase its client base in advisory solutions. The company’s total managed investing solutions revenues witnessed a CAGR of 12.2% over the last five years (2019-2024), with the uptrend continuing in the first nine months of 2025. The acquisitions of TD Ameritrade, USAA’s Investment Management Company, Wasmer, Schroeder & Company, LLC and the buyout of Motif’s technology and intellectual property have strengthened the company’s position and helped diversify revenues.

Despite SCHW lowering fees on certain investing solution products, revenues from the same increased as average client asset balances improved. The company’s total client assets recorded a five-year (ended 2024) CAGR of 20.1%, with the uptrend continuing in the first nine months of 2025. Notably, Schwab's plans to open 16 new branches and expand or relocate 25 existing ones will likely give the company a way to engage with clients during important financial moments, leading to higher client satisfaction, which, in turn, will result in clients consolidating more of their assets with Schwab.

Despite the Federal Reserve cutting interest rates, Schwab’s focus on repaying high-cost bank supplemental funding balances is expected to continue to support its net interest margin (NIM) growth. By September 2025-end, the bank's supplemental funding balance declined 85% to $14.8 billion from the peak of $97.1 billion in May 2023. As such, NIM increased in the first nine months of 2025 to 2.68% from 2.04% in the prior-year period.

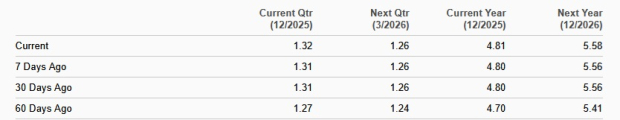

Currently, Schwab carries a Zacks Rank #3 (Hold). The consensus estimate for its 2026 revenues of $25.89 billion indicates a year-over-year rise of 8.8%. Its 2026 earnings estimate of $5.58 suggests growth of 16%. In the last 60 days, earnings estimates have been revised 3.1% higher.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 7 hours | |

| 9 hours | |

| 10 hours | |

| 16 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite