|

|

|

|

|||||

|

|

Tesla's operating expenses increased by 50% in the third quarter and are likely to remain elevated as it spends billions of dollars to expand into robotics and autonomy.

Meanwhile, Tesla's core EV business is suffering, and vehicle sales fell below 40,000 in November.

Tesla's stock is priced for perfection at a time when the company is trying to get back on track.

Tesla (NASDAQ: TSLA) has been a fantastic stock for long-term investors, with returns exceeding 3,100% over the past decade. However, the company currently faces significant headwinds, as sales of its electric vehicles (EVs) are slowing, costs are rising, and it places big bets on unproven markets including robotics and autonomous vehicles (AVs).

It's no surprise, then, that many investors are trying to determine what to do with Tesla stock. Is it a good time to buy with its shares priced under $500, or is it too early to take a risk on the company transitioning toward future technologies when its EV business is slumping?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here are three reasons why I believe it's best not to buy Tesla stock right now.

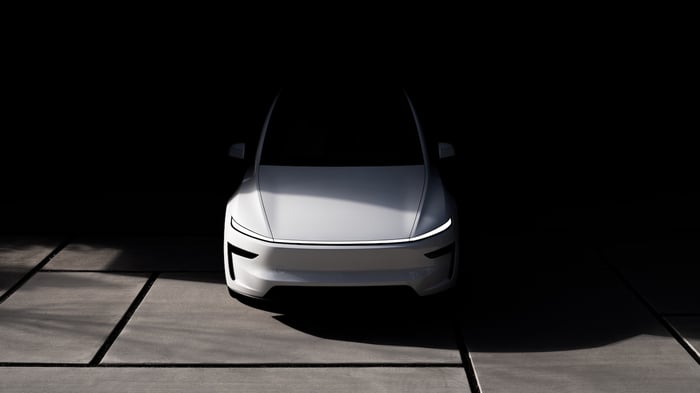

Image source: Tesla.

Tesla CEO Elon Musk is transitioning his company toward an autonomous vehicle and robotics company. The idea is for Tesla to mass-produce its Optimus robots -- up to 1 million by 2030 -- and for the company to vastly expand its fledgling robotaxi service that's currently only in a handful of cities. It's worth noting Musk said in July the service would cover half the country by the end of the year, which is now, and it's nowhere near achieving this.

There's nothing wrong with Tesla focusing on these two opportunities, considering that AVs could eventually be worth $1.4 trillion by 2040, and humanoid robotics will be worth an estimated $5 trillion by 2050.

But to achieve its goals, Tesla is spending heavily, and it's likely to increase from here. The company's operating expenses rose by 50% to $3.4 billion in the third quarter, and research and development (R&D) costs jumped 57% to $1.6 billion. Management specifically said the operating cost increase was "driven by SG&A [selling, general, and administrative], AI and other R&D projects."

For Tesla to expand into nascent robotics and AV markets, additional billions of dollars will need to be spent at a time when the company's core business -- selling electric vehicles -- isn't doing so hot.

It's easy to get caught up in Tesla's big plans to be an autonomous vehicle and robotics company, but Tesla is still primarily an electric vehicle company right now. Unfortunately, business is not so good.

Tesla's net income fell 37% to $1.4 billion in the third quarter, leaving the company with significantly less money to reinvest in the business.

Things could be getting worse, too. Following the expiration of the federal EV tax credits, Tesla's vehicle sales fell below 40,000 in November -- its lowest monthly sales in years. Tesla's third-quarter results temporarily received a boost as customers rushed to take advantage before credits expired at the end of September, which helped lift Tesla's revenue 12% to $28 billion in the quarter.

However, the November vehicle sales numbers indicate that Tesla and other EV manufacturers have a significant problem on their hands. EVs often cost more than traditional gas-powered vehicles, and after years of inflation and high interest rates, and no more tax credits, there's less demand for EVs than in the recent past.

This would be a significant problem on its own for Tesla, but it's compounded by the fact that the company is spending so much to move into robotics and AVs.

Even if Tesla somehow pulls off its transition to AVs and robotics and turns around its stumbling EV business, it doesn't eliminate the fact that investors are paying a high premium for a company as it makes risky moves.

Tesla's shares currently have a price-to-earnings ratio of 206, far above the tech sector's average P/E ratio of about 45.

This means Tesla's stock is already priced for perfection at a time of significant transition, falling profit, and increasing expenses. That's too risky for my liking, even if Tesla eventually achieves its goals. I think investors are better off not buying Tesla stock right now, at least waiting until the company can prove that it can reinvigorate sales and earnings from its electric vehicle business.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 18, 2025.

Chris Neiger has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

| 23 min | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite