|

|

|

|

|||||

|

|

Utility service providers benefit from several positive factors, including increased electricity tariffs, accretive acquisitions, cost reductions, and the deployment of energy-efficiency initiatives. The power business also benefits from ongoing efforts to enhance the resilience of electric infrastructure to adverse weather conditions and the transition to affordable, renewable energy sources for electricity production.

The maintenance and improvement of utilities' current infrastructure heavily rely on capital expenditures. These expenditures go toward updating, modernizing and repairing assets. In order to meet the growing demand for data centers, utility providers are investing in output enhancement.

Driven by the shift to renewable energy, electric utilities in the United States are expanding beyond their historical function as sources of income. Climate measures and federal incentives are changing the utilities sector. Utilities leading this transition are well positioned for steady growth, offering investors a relatively low-risk way to participate in the expanding clean energy market.

With the growing clean energy market, utility companies like Duke Energy DUK and Exelon Corporation EXC are becoming attractive investment options. Both companies focus on regulated electric utilities, which means more stable earnings because many of their rates and returns are approved by public utility commissions.

Duke Energy is expanding its renewable and clean-energy footprint by accelerating EV adoption and cutting emissions across its operations. The company is growing its EV fleet, rolling out new charging and advisory programs for customers, and aims to electrify most of its vehicles by 2030. It has already reduced carbon emissions by 44% from 2005 levels and is targeting deeper cuts across Scope 2 and selected Scope 3 emissions by 2035.

Duke Energy plans to sharply reduce coal usage — retiring most of its coal capacity by 2030 and fully exiting coal by 2035 — while advancing methane reduction goals and investing in new generation capacity. Together, these initiatives support its long-term objective of achieving net-zero carbon emissions by 2050.

Exelon is focused on the transmission and distribution of clean energy, with a business model designed to deliver stable earnings despite weather-related demand fluctuations. A substantial share of distribution revenues is decoupled from customer usage, providing greater revenue and earnings stability.

With operations spanning seven regulatory jurisdictions, Exelon serves more than 10 million customers and is supported by a diversified rate base. Ongoing cost efficiencies and disciplined expense management help limit customer cost increases below inflation. Looking ahead, increasing demand from high-density and data-center customers and a load pipeline of more than 19 gigawatts provide strong visibility into future growth.

Let's compare the two stocks' fundamentals to find out which one is a better investment pick at present.

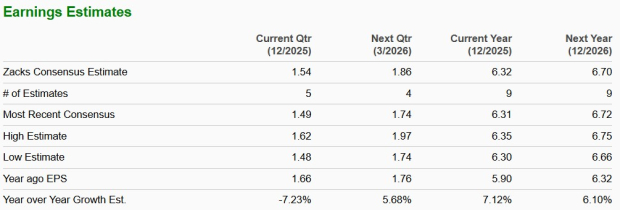

The Zacks Consensus Estimate for Duke Energy’s 2025 and 2026 earnings per share (EPS) indicates a year-over-year increase of 7.12% and 6.1%, respectively.

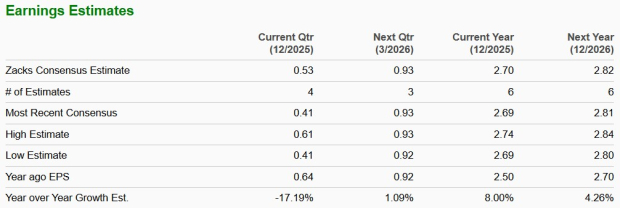

The Zacks Consensus Estimate for Exelon’s 2025 and 2026 EPS indicates a year-over-year rise of 8% and 4.26%, respectively.

ROE measures how efficiently a company is utilizing its shareholders’ funds to generate profits. DUK’s current ROE is 9.98% compared with EXC’s 10.29%. Both outperform the industry’s ROE of 9.9%.

Duke Energy currently anticipates spending capital worth $190-$200 billion over the next decade, a major portion of which will go to the clean energy transition. Of this, the company currently expects to spend in the range of $95-$105 billion during 2026-2030. The company has already invested $9.88 billion in the first nine months of 2025 and remains on track to invest approximately $15 billion in 2025.

Exelon plans to invest nearly $38 billion during 2025-2028 in regulated utility operations. The capital investment will be directed to support customer needs and grid reliability. The company is set to invest $21.7 billion in electric distribution, $12.6 billion in electric transmission and $3.8 billion in gas delivery in the 2025-2028 period. In 2025, the company is expected to invest $9.1 billion to strengthen its operations. Beyond this plan, management is considering an additional investment of $10-$15 billion to strengthen its transmission lines.

Utility companies generally distribute dividends and increase shareholders’ value. Currently, the dividend yield for DUK is 3.62% compared with the Zacks S&P 500 composite’s average of 1.1%, and the same for EXC is 3.61%.

DUK shares trade at a forward 12-month Price/Earnings (P/E F12M) of 17.55X compared with EXC’s P/E F12M of 15.74X, making EXC relatively more attractive from a valuation standpoint.

Both DUK and EXC benefit from their strategic investments to further improve infrastructure and cater to the expanding customer base. As regulated providers of essential electricity services, they operate under oversight from public utility commissions, which typically approve pricing and allowed returns — resulting in more predictable revenues and steadier earnings.

However, our choice at the moment is EXC, given its better near-term earnings growth, and better ROE and valuation. Both DUK and EXC stocks carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-12 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-08 | |

| Mar-08 | |

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite