|

|

|

|

|||||

|

|

Artificial intelligence (AI)-powered data centers are now booming. The AI infrastructure space remains rock solid, supported by an extremely bullish demand scenario. Research firm McKinsey & Co. has estimated that global AI-powered data center infrastructure capex will reach around $7 trillion by 2030.

The energy-hungry AI space has made nuclear energy one of the hottest industries on Wall Street over the past year. Nuclear energy is increasingly recognized as a key solution to meeting rising global electricity demand and shifting toward cleaner energy sources. The Federal Energy Regulatory Commission reported that the U.S. data center electricity demand is expected to climb to 35 gigawatts (GW) in 2030 from 19 GW in 2023.

To strengthen the nation’s nuclear sector, President Donald Trump has issued four executive orders aimed at modernizing regulatory frameworks, expediting reactor testing and approvals, leveraging nuclear technology for national security, and expanding the domestic nuclear industrial base. These measures target an increase in U.S. nuclear capacity from about 100 gigawatts (GW) in 2024 to 400 GW by 2050.

The galloping requirement of electricity for data centers, significantly boosted the demand for those electric utilities that have access to nuclear power. Here we recommend three nuclear power stocks to buy for the long term.

These stocks are: Constellation Energy Corp. CEG, Talen Energy Corp. TLN and Dominion Energy Inc. D. Each of these stocks currently carries either a Zacks Rank #2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

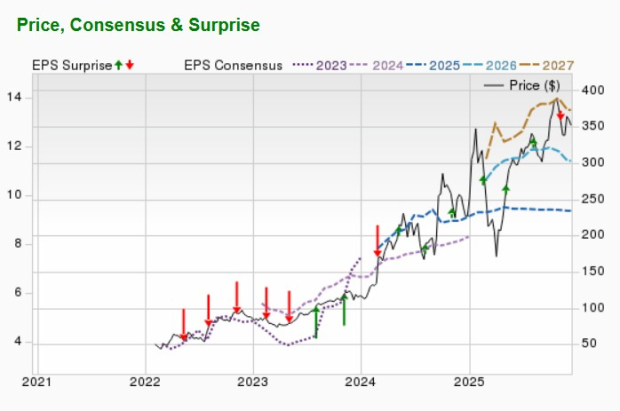

Zacks Rank #3 Constellation Energy is a leading energy company in the United States with a significant thrust on clean energy, especially nuclear energy. CEG’s strategic $5.1 billion capital expenditure through 2025 should help acquire nuclear fuel and increase inventory levels. CEG aims to eliminate 100% of greenhouse gas emissions by leveraging innovative technology.

As a result of its steady investment to upgrade its nuclear units, CEG’s 21 nuclear reactors across 12 sites from the Midwest to the Northeast achieved a 98.8% operating rate during June through August 2025, reliably powering about 16 million homes and businesses.

Constellation Energy is an industry leader in operating nuclear plants safely, efficiently and reliably. Its acquisition of NRG Energy Inc.’s (NRG) 44% ownership stake in the South Texas Project Electric Generating Station has added a 2,645 MW, dual-unit nuclear plant to its portfolio.

In late 2024, Microsoft Corp. (MSFT) entered into a 20-year agreement with CEG to revive the Three Mile Island nuclear plant in Pennsylvania. The $1.6 billion investment aims to restart the reactor, which has been dormant since 2019, to provide carbon-free electricity for Microsoft’s expanding data centers. CEG expects to increase nuclear output by 160 MW at Byron and Braidwood, with investments of $800 million through 2029 for required low-pressure turbine replacements.

In January 2025, Constellation Energy entered into a nuclear power supply deal with the U.S. General Services Administration (GSA) for clean energy. The combined value of the deal was more than $1 billion ($840M for power + $172M for efficiency). The tenure of this deal was for 10 years to provide more than 1 million MWh nuclear power per annum to federal agencies starting in 2025, supporting the government's net-zero goals.

In June 2025, Meta Platforms Inc. (META) signed a 20-year energy deal with CEG for supplying 1.1 gigawatts of nuclear power to its growing AI data centers in Illinois. Beginning in 2027, this agreement will ensure a steady supply of clean energy. This will help Meta Platforms expand its AI operations and cut carbon emissions.

Constellation Energy has an expected revenue and earnings growth rate of 11% and 22.5%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 0.1% in the last seven days.

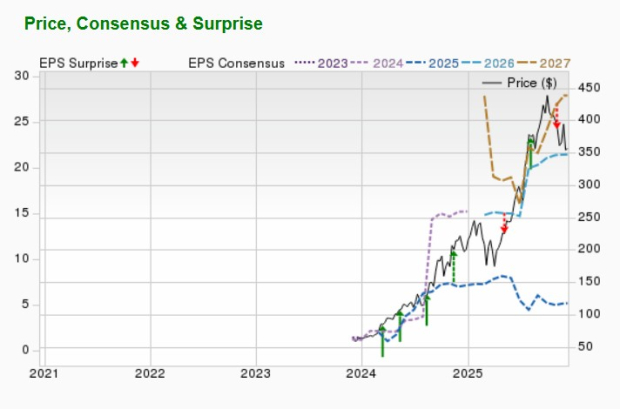

Zacks Rank #3 Talen Energy owns and operates power infrastructure principally in the United States. The company produces and sells electricity, capacity and ancillary services primarily into wholesale power markets. TLN operates nuclear, fossil, solar, and coal power plants. TLN is also developing battery storage projects.

Amazon.com Inc. (AMZN) has partnered with TLN in Pennsylvania to power its data centers with nuclear energy. On June 11, TLN announced the expansion of its existing nuclear energy relationship with Amazon to provide carbon-free energy from Talen’s Susquehanna nuclear power plant to Amazon Web Services (“AWS”) data centers in the region.

According to the agreement, TLN will provide AMZN with 1,920 megawatts of carbon-free nuclear power through 2042, with options to further extend its duration. TLN is expected to significantly benefit from the data centers’ astonishing demand for reliable and clean energy.

Talen Energy has an expected revenue and earnings growth rate of 67.4% and more than 100%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 1.2% in the last 30 days.

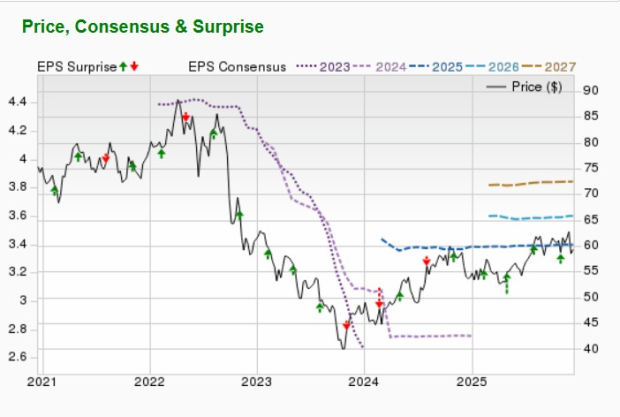

Zacks Rank #2 Dominion Energy’s long-term investment will strengthen its electric and natural gas infrastructure and increase the reliability of its services. D is adding renewable assets in its generation portfolio to achieve carbon neutrality by 2050.

Rising demand from an expanding customer base and large data centers is increasing the requirement for its services and boosting the performance of the company. D is working on a Small Modular Reactor (“SMR”), which can create new opportunities.

Dominion and its subsidiaries sell a substantial volume of energy produced under long-term power purchase agreements, which provide earnings visibility. D signed an MOU (Memorandum of Understanding) with Amazon to explore innovative development structures for enhancing potential SMR nuclear development in Virginia.

Dominion Energy has an expected revenue and earnings growth rate of 6.2% and 5.9%, respectively, for next year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 5 hours | |

| 7 hours | |

| 8 hours | |

| 10 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Nuclear Stock Briefly Flashes Buy Signal On Earnings Beat After Cathie Wood Sells

CEG +6.41%

Investor's Business Daily

|

| Feb-24 |

Nuclear Stock Flashes Buy Signal On Earnings Beat As Cathie Wood Sells

CEG +6.41%

Investor's Business Daily

|

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite