|

|

|

|

|||||

|

|

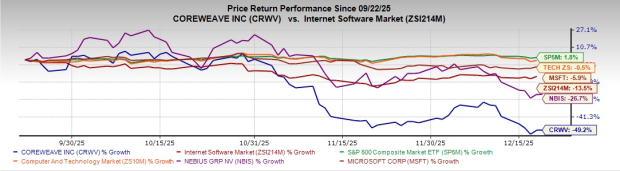

CoreWeave, Inc. CRWV is the world’s first hyperscale AI cloud, delivering purpose-built compute, storage, networking and software to help customers build, train and deploy AI products faster. The stock has tumbled 49.2% in the past three months, much higher than the Zacks Internet-Software Market’s and the Zacks Computer & Technology sector’s fall of 13.5% and 0.5%, respectively, while the S&P 500 Composite has grown 1.8%.

The company has underperformed its peers and tech behemoths like Microsoft MSFT, which has declined 5.9% over the past three months, while Nebius Group N.V. NBIS, another emerging AI infrastructure player, has plunged 26.7%. Once a market favorite riding the AI infrastructure boom, the stock has been hit by concerns around execution, heavy capital spending and leverage, alongside broader volatility in AI-related equities.

CRWV currently trades at $67.68, well beneath its 52-week high of $187. The key consideration now is whether the pullback in CRWV stock presents a buying opportunity or reflects underlying concerns. Examining recent performance metrics, management insights and guidance provides greater clarity on the path ahead.

Despite operating in a favorable demand environment, CRWV continues to face increasing supply chain pressures, where demand for its AI cloud platform greatly exceeds available capacity, limiting its ability to serve customers fully. Delays in powered-shell delivery from a data center provider are likely to adversely impact its performance in the fourth quarter. Although temporary and with the customer agreeing to adjust the schedule to retain full contract value, these setbacks have prompted management to lower its 2025 outlook. The company now expects 2025 revenue of $5.05–$5.15 billion, down from $5.15–$5.35 billion, and adjusted operating income of $690–$720 million, below the previous $800–$830 million range.

In the fourth quarter, CoreWeave plans to bring some of the largest deployments in its history online, a move that is expected to weigh on near-term adjusted operating margins due to the lag between upfront data-center costs and revenue recognition. This timing mismatch underscores the company’s continued struggle to translate heavy infrastructure spending into immediate financial returns.

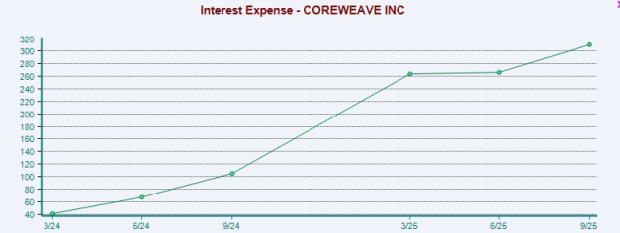

Leverage remains another concern. Management expects 2025 interest expense of $1.21–$1.25 billion due to rising debt levels needed to fund demand-led CapEx. While a lower cost of capital offers some relief, it does little to offset the scale of the interest burden. Capital intensity also remains elevated. CapEx for 2025 is now projected at $12–$14 billion, with the reduction from prior guidance largely reflecting spending deferrals rather than true cost savings, as infrastructure buildouts remain stuck in construction-in-progress. Much of the CapEx initially expected in fourth quarter has merely shifted into first quarter, extending near-term cash flow pressure.

Looking ahead, risks intensify further. Management expects 2026 CapEx to more than double from the 2025 levels, signaling even greater capital demands despite ongoing margin and leverage pressures. While the company frames these investments as strengthening its competitive position, they also heighten concerns about execution risk, balance-sheet strain and the sustainability of CoreWeave’s hyper-growth strategy.

Despite supply-chain disruptions prompting cuts to full-year revenue and CapEx guidance, management highlighted its ability to adapt operations, pursue multiple growth avenues and access ample capital. The company remains confident in its capacity to meet long-term demand, expand infrastructure at scale and strengthen its position in AI cloud services, viewing new product launches, strategic partnerships and emerging federal opportunities as key drivers of sustained hypergrowth.

CRWV strengthened its position as a leading AI cloud infrastructure provider in the third quarter, expanding its active power footprint by 120 MW to about 590 MW and boosting contracted capacity to 2.9 GW. With more than 1 GW of contracted capacity yet to come online and new compute deals that broadened its customer base, the company is well-positioned for continued growth. It has a substantial contracted backlog, which provides visibility into future revenue streams, even during short-term execution hiccups. Its revenue backlog has expanded sharply, to $55.6 billion in the third quarter, marking a 271% year-over-year increase and nearly doubling sequentially. The growth is driven by large, long-term contracts with major customers such as OpenAI, Meta and multiple hyperscalers, underscoring strong demand for AI-focused cloud infrastructure.

The backlog mix also highlights improving long-term visibility. While 40% of backlog is expected to convert within 24 months, a solid portion extends beyond that horizon, with 39% scheduled over 25–48 months and 21% beyond 49 months. This longer-dated profile enhances revenue visibility and reinforces its dependence on timely infrastructure deployment to convert backlog into recognized revenue.

Its momentum is further being driven by multi-billion-dollar partnerships with NVIDIA, including industry-first deployments of GB300 NVL72 systems and RTX PRO 6000 Blackwell Server Edition instances, giving CRWV an early edge in frontier AI and real-time workloads. The company is also pursuing inorganic growth through acquisitions, including Marimo in October, following earlier deals such as OpenPipe and Weights & Biases.

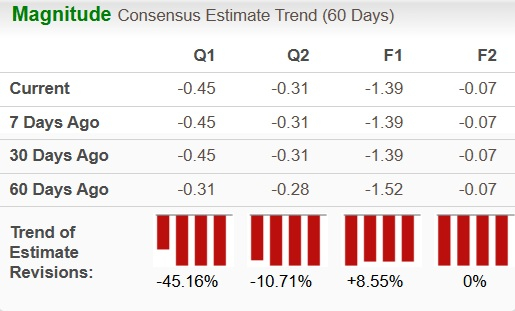

CRWV’s estimates revisions are on an upward trajectory currently. The Zacks Consensus Estimate for its earnings for 2025 has been revised north 8.5% over the past 60 days.

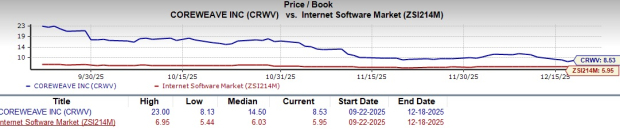

CRWV stock is not so cheap, as its Value Style Score of D suggests a stretched valuation at this moment. In terms of Price/Book, CRWV’s shares are trading at 8.53X, higher than the Internet Software industry’s 5.95X.

CRWV’s momentum has never been stronger, with expanding opportunities ahead. Backed by exceptional products, a world-class team and disciplined execution, CoreWeave is poised to enter its next phase of growth as a full-stack AI services provider and hyperscaler.

However, management flagged supply chain and data center delays as near-term risks, but views them as temporary with mitigations in place. Concerns around overcapacity, execution and CapEx are being addressed through provider diversification, self-builds, flexible contracts and diversified funding. With a Zacks Rank #3 (Hold), CRWV appears to be treading in the middle of the road, and new investors could be better off if they trade with caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 44 min | |

| 58 min |

CoreWeave Stock Falls Amid Higher 2026 Capital Spending, Margin Pressure

CRWV

Investor's Business Daily

|

| 58 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite