|

|

|

|

|||||

|

|

As of mid-April 2025, the United States has introduced sweeping new tariffs under President Donald Trump’s administration, significantly altering global trade dynamics. A 10% baseline tariff now applies to most imports, with steeper rates for countries like China, which faces tariffs as high as 145% as of April 9, 2025. Additionally, the U.S. eliminated the "de minimis" exemption that allowed duty-free entry for shipments under $800, directly impacting low-cost Chinese e-commerce platforms like Temu and Shein. In response, China has suspended exports of critical minerals essential to industries like electronics and clean energy, escalating the trade conflict. These tit-for-tat moves have deepened the U.S.-China trade war and injected fresh uncertainty into global markets.

However, such aggressive trade policies come at a cost. According to the U.S. Chamber of Commerce, the previous rounds of tariffs between 2018 and 2020 led to over $80 billion in additional expenses borne by American businesses and consumers. As history warns, these costs typically trickle down through the supply chain, raising prices and compressing margins across industries. In 2025, as inflation remains a sensitive issue and interest rates stay elevated, the reintroduction of tariffs has raised alarms in the corporate sector and on Wall Street. Investors are particularly concerned about the lack of clarity around the implementation timeline, the scope of affected goods, and potential retaliatory measures by trade partners like China, which may respond with counter-tariffs on American exports.

A recent announcement indicated that the U.S. government is preparing to impose tariffs on select pharmaceutical imports, especially from countries like China and India, which are major hubs for raw ingredients and finished drugs. This has caused concern across the industry, as increased costs could ripple through supply chains, impact affordability, and ultimately affect margins for drugmakers. Many pharmaceutical companies depend heavily on international manufacturing partnerships, making them especially vulnerable to even modest trade disruptions. The sentiment has become more cautious, and as uncertainty grows, so does the interest in more resilient healthcare segments.

The medical device sector has emerged as a robust and promising investment avenue, even amid broader economic uncertainties. Over recent years, this industry has experienced significant growth, driven by a combination of technological advancements, demographic trends, and an increasing demand for innovative healthcare solutions. The sector includes a wide range of devices, from diagnostic tools and surgical instruments to wearable health technology and implantable devices, all of which are critical to improving patient outcomes and enhancing healthcare delivery.

In 2024, the medical device industry saw an impressive surge in regulatory approvals, with the FDA granting numerous new product clearances, including both 510(k) approvals and pre-market authorizations. Per a report by Fortune Business Insights, the global medical devices market size was valued at $518.46 billion in 2023 and is projected to grow beyond $886.80 billion by 2032, exhibiting a CAGR of 6.3%.

Amid ongoing tariff uncertainties, investors are increasingly turning to undervalued stocks that combine strong balance sheets with resilient operational performance. Within this context, the medical device sector stands out as a compelling space, offering multiple opportunities backed by long-term growth drivers and technological innovation. Among the most promising undervalued picks for 2025 are Cencora, Inc. COR, Hims & Hers Health HIMS and Prestige Consumer PBH.

Cencora is one of the world’s largest pharmaceutical services companies. Specialty products in COR’s portfolio include biologics, biosimilars, cell and gene therapies, plasma-derived medicines and complex injectables. Cencora recently launched Accelerate Pharmacy Solutions, a unified portfolio of solutions designed to help hospital and health systems customers optimize operations and improve financial performance. Additionally, Cencora inked a definitive agreement to acquire Retina Consultants of America to expand its leadership in Specialty.

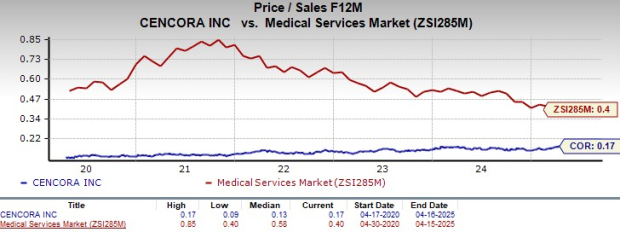

Cencora currently carries a Zacks Rank #2 (Buy) and a Value Score of B. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The stock is currently trading at a Price-to-Sales (P/S) ratio of 0.17, which is significantly lower than the broader Medical Services market’s 0.40. The company beat on earnings in each of the trailing four quarters, delivering an average surprise of 4.94%. Moreover, the bottom-line estimate predicts 11.6% growth in the company’s 2025 earnings.

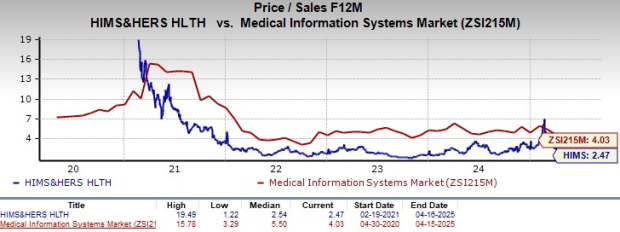

Hims & Hers Health is a modern health and wellness company focused on delivering personalized, accessible care through a digital-first platform. Founded in 2017, HIMS offers subscription-based telehealth services and partners with retailers to address a wide range of health concerns, from mental health and dermatology to sexual wellness and primary care. Operating through two main revenue streams—online subscriptions and wholesale retail—the company aims to simplify the healthcare experience and empower consumers with convenient, affordable solutions.

HIMS currently carries a Zacks Rank #2 and a Value Score of B. The stock’s P/S of 2.47X is discounted relative to the industry’s 4.03X. Moreover, the bottom-line estimate predicts 58% growth in the company’s 2025 earnings.

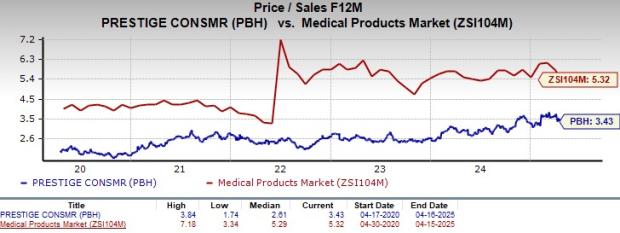

Prestige Consumer is a leading provider of over-the-counter healthcare and household cleaning products. The company develops, manufactures, markets, and distributes its products across the United States, Canada, Australia, and select international markets. PBH reaches consumers through a wide range of retail channels, including mass merchandisers, drugstores, grocery chains, dollar stores, convenience outlets, club stores, and e-commerce platforms.

Prestige Consumer’s fast-growing gastrointestinal (GI) product category represents nearly one-fifth of North American sales. The portfolio is headlined by three iconic GI brands: Dramamine, Fleet and Gaviscon. Each solves for unique consumer needs and leverages the company’s wide assortment of brand-building capabilities to drive long-term growth.

PBH currently carries a Zacks Rank #2 and a Value Score of B. The stock is currently trading at a P/S ratio of 3.43, which is significantly lower than the industry’s 5.32. The company beat on earnings in the last reported quarter with a surprise of 5.17%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 8 hours | |

| Feb-26 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite