|

|

|

|

|||||

|

|

Teradyne TER and Advanced Micro Devices AMD are key suppliers of AI components in the semiconductor market. While TER supplies critical automated test equipment used to validate and ensure the performance of advanced AI chips, AMD designs high-performance CPUs and GPUs that power AI workloads in data centers and enterprise applications.

Per the Fortune Business Insight report, the global semiconductor market size was valued at $681.05 billion in 2024. It is expected to reach $2,062.59 billion by 2032 from $755.28 billion in 2025, witnessing a CAGR of 15.4%. Both Teradyne and Advanced Micro Devices are expected to benefit from this rapid growth pace.

So, TER or AMD — Which of these AI Component Supplier Stocks has the greater upside potential? Let’s find out.

Teradyne is positioning itself as a key player in the AI-driven semiconductor testing market. In the third quarter of 2025, Semiconductor Test revenues rose 7% year over year and 23% sequentially, accounting for 78.8% of sales in the reported quarter.

The uptick can be attributed to strong AI-related demand, which is driving significant investments in cloud AI build-out as customers accelerate the production of a wide range of AI accelerators, networking, memory, and power devices. The company’s UltraFLEXplus system is specifically designed for high-performance processors and networking devices, which are critical for AI applications.

Teradyne’s expanding portfolio has been noteworthy, particularly through its focus on AI-driven technologies and semiconductor testing solutions. In October 2025, Teradyne announced the launch of the ETS-800 D20, the latest addition to the ETS-800 platform of high-performance test systems for power semiconductors.

Teradyne is integrating AI features into its robotics products, such as UR cobots and AMRs, to enhance performance in AI-driven work cell applications. In the third quarter of 2025, 8% of robotics sales were for AI-related products, up from 6% in the previous quarter.

Advanced Micro Devices is positioning itself as a key player as an AI component supplier by focusing on expanding its data center AI business and delivering advanced AI solutions.

The company’s data center AI business is experiencing significant growth, driven by the ramp-up of its Instinct MI350 Series GPUs and the upcoming launch of the MI400 Series accelerators and Helios rack-scale solutions in 2026. These products are designed to deliver high performance and efficiency for AI training and inference workloads.

In December, AMD expanded its partnership with HPE to introduce the open, rack-scale “Helios” AI architecture. This new setup combines AMD GPUs, EPYC CPUs, ROCm software, and Broadcom-backed Ethernet networking. It aims to support next-generation global and European AI and HPC systems starting in 2026.

The company has also secured a multiyear agreement with OpenAI to deploy 6 gigawatts of Instinct GPUs, starting with MI450 Series accelerators in 2026. This partnership is expected to generate more than $100 billion in revenues in the coming years. AMD is also collaborating with Oracle, IBM, Cohere, and other major AI players for large-scale deployments.

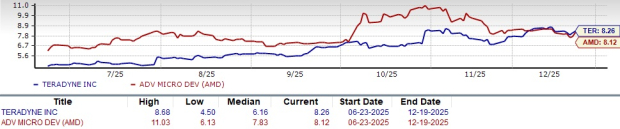

In the trailing six-month period, TER and AMD shares have rallied 123.4% and 64.7%, respectively. Teradyne’s robust and diversified portfolio to meet the rising demand for AI-driven technologies is contributing to its growth prospects continuously, driving top-line growth.

Despite AMD’s expanding portfolio and rich partner base, the company is facing stiff competition from NVIDIA and Intel.

Valuation-wise, TER and AMD shares are currently overvalued as suggested by a Value Score of D and F, respectively.

In terms of forward 12-month Price/Sales, TER shares are trading at 8.26X, higher than AMD’s 8.12X.

The Zacks Consensus Estimate for TER’s 2025 earnings is currently pegged at $3.51 per share, which has remained unchanged over the past 30 days, indicating a 9.01% year-over-year rise.

Teradyne, Inc. price-consensus-chart | Teradyne, Inc. Quote

The Zacks Consensus Estimate for AMD’s 2025 earnings is currently pegged at $3.96 per share, which has declined by a penny over the past 30 days, indicating a 19.64% year-over-year rise.

Advanced Micro Devices, Inc. price-consensus-chart | Advanced Micro Devices, Inc. Quote

Teradyne’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 10.76%. Advanced Micro Devices’ earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 2.45%. However, TER’s average surprise is higher than that of Advanced Micro Devices.

While both Teradyne and AMD are well-positioned to benefit from the booming AI semiconductor market, Teradyne offers higher growth potential due to stronger earnings surprises and a diversified AI-focused portfolio.

AMD’s expanding portfolio and growing data center AI footprint are expected to improve its top-line growth. However, its near-term prospects are dull due to stiff competition from NVIDIA in the cloud data center and AI chip markets. These factors are expected to remain an overhang on the stock.

Currently, Teradyne carries a Zacks Rank #2 (Buy), making the stock a stronger pick than Advanced Micro Devices, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 51 min | |

| 2 hours | |

| 2 hours | |

| 4 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite