|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

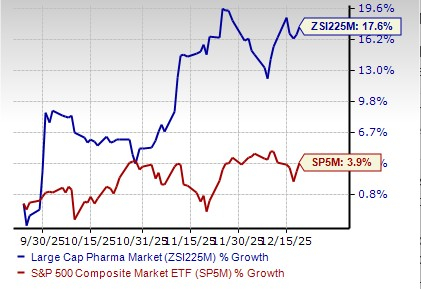

After a weak first half, the drug and biotech sector has recovered in the past 2-3 months, with most large drugmakers signing drug pricing agreements with the Trump administration. After a cautious start, dealmaking activity by big pharma surged in the second half, which also boosted investor confidence in the sector. The Large Cap Pharmaceuticals industry has outperformed the S&P 500 index in the past three months, as seen in the chart below.

Innovation is also at its peak for the industry, with key spaces like obesity, cell and gene therapy, inflammation, rare disease, neuroscience and next-gen oncology treatments attracting investor attention. The industry, however, faces its share of headwinds like regular pipeline setbacks, patent cliffs and regulatory risks. Despite the headwinds, rapid innovation, increased use of AI in drug development, positive pipeline/regulatory developments and continued M&A momentum signal a favorable growth outlook for 2026. In this article, we discuss five big drugmakers — Eli Lilly LLY, J&J JNJ, AbbVie ABBV, Amgen AMGN and AstraZeneca AZN — that have outperformed the industry this year, as seen in the chart below, and the factors that are likely to drive their growth in 2026.

Lilly has seen tremendous success with its popular tirzepatide medicines, diabetes drug Mounjaro and weight loss medicine, Zepbound.

Despite being on the market for slightly more than three years, Mounjaro and Zepbound have become key top-line drivers for Lilly, with demand rising rapidly. Launches of Mounjaro and Zepbound in new international markets and improved supply from ramped-up production in the United States led to strong sales growth in 2025. Mounjaro and Zepbound are expected to continue to see strong demand in 2026. Lilly’s other new drugs, like Kisunla, Omvoh and Jaypirca, are also contributing to its top-line growth with the trend expected to continue in 2026.

Lilly is investing broadly in obesity and has several new molecules currently in clinical development, including two late-stage candidates, orforglipron, a once-daily oral GLP-1 small molecule, and retatrutide, a GGG tri-agonist. Lilly has announced positive data across six studies on orforglipron in obesity and type II diabetes. An oral pill like orforglipron has the potential to be a more convenient alternative to injectable treatments like Zepbound and rival Novo Nordisk’s Wegovy. Lilly filed regulatory applications for orforglipron in obesity this month, setting up the timeline for a potential launch next year. Earlier this week, an oral version of NVO’s Wegovy was approved by the FDA as the first oral GLP-1 in the United States.

Lilly’s triple-acting incretin, retatrutide (which combines GLP-1, GIP and glucagon), delivered significant weight loss with substantial relief from osteoarthritis pain in a phase III study in patients with obesity and knee osteoarthritis pain. Data from the phase III study were announced earlier this month.

LLY is also working to diversify beyond GLP-1 drugs by expanding into cardiovascular, oncology, and neuroscience areas. In 2025, it announced several M&A deals to strengthen its pipeline.

Lilly has its share of problems. Prices of most of Lilly’s products are declining in the United States. Potential competition in the GLP-1 diabetes/obesity market is a key headwind.

Lilly has a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The stock has risen 39.3% year to date. Estimates for Eli Lilly’s 2026 earnings have improved from $30.78 per share to $33.61 per share in the past 60 days.

J&J has recorded a strong operational performance so far in 2025, backed by double-digit growth in revenues from key brands and contributions from new launches

Sales in J&J’s Innovative Medicine unit rose 3.4% in the first nine months of 2025 on an organic basis despite the loss of exclusivity (LOE) of its multi-billion-dollar product, Stelara, and the negative impact of the Part D redesign. Growth is being driven by J&J’s key drugs like Darzalex, Erleada and Tremfya. New drugs like Carvykti, Tecvayli, Talvey, Rybrevant and Spravato also contributed significantly to growth.

In 2026, J&J expects accelerated growth in the Innovative Medicine segment to be driven by its key products as well as new drugs and recently launched products, including Tremfya in inflammatory bowel disease (IBD), Rybrevant plus Lazcluze in non-small cell lung cancer and the newly approved drug, Inlexzo in bladder cancer.

J&J’s MedTech business has improved in the past two quarters, driven by the acquired cardiovascular businesses, Abiomed and Shockwave, as well as Surgical Vision and wound closure in Surgery. Improvements in J&J’s electrophysiology business also drove the growth.

In 2026, J&J expects better growth in the MedTech business than 2025 levels, driven by increased adoption of newly launched products across all MedTech platforms and increased focus on higher-growth markets. J&J expects to launch new products like Shockwave C2 Aero catheter and Tecnis intraocular lens in the United States, as well as make a regulatory submission for the OTTAVA robotic surgical system in 2026. These new products may also contribute to growth in 2026.

The pending separation of its Orthopaedics franchise in the MedTech segmentshould improve its MedTech unit’s growth and margins, as the Orthopaedics franchise has been a slow-growth business for J&J.

The company has rapidly advanced its pipeline this year, attaining significant clinical and regulatory milestones that will help drive growth through the back half of the decade. J&J has also been on an acquisition spree, with the acquisition of Intra-Cellular Therapies this year strengthening its presence in the neurological and psychiatric drug market.

Despite headwinds like softness in the MedTech unit in China, the legal battle surrounding its talc lawsuits, the Stelara patent cliff and the impact of Part D redesign, J&J looks quite confident that it will be able to navigate these challenges.

J&J has a Zacks Rank #2 (Buy) at present.

The stock has risen 43.3% year to date. The Zacks Consensus Estimate for 2026 earnings has risen from $11.46 per share to $11.49 per share over the past 60 days.

Sales of AbbVie’s blockbuster drug, Humira, are declining due to loss of exclusivity and biosimilar erosion. However, AbbVie has successfully navigated Humira's loss of exclusivity by launching two other successful new immunology medicines, Skyrizi and Rinvoq, which are performing extremely well, bolstered by approvals in new indications.

Skyrizi and Rinvoq generated combined sales of $18.5 billion in the first nine months of 2025.

Strong immunology market growth, market share gains and momentum from new indications, such as the recent launch of Skyrizi in UC, as well as the potential for five new indications for Rinvoq over the next few years, are expected to drive these drugs’ growth.

Strong sales performance of drugs like Rinvoq, Skyrizi, Venclexta and Vraylar, coupled with significant contributions from newer drugs like Ubrelvy, Elahere, Epkinly and Qulipta, should keep driving the company’s top line in 2026. However, AbbVie is seeing decreasing sales of the Aesthetics unit due to macro challenges and low consumer sentiment, especially in the United States, which will continue be a headwind in 2026.

Boosted by its new product launches, AbbVie expects a high single-digit CAGR through 2029, as it has no significant LOE events for the rest of this decade. A substantial portion of this growth is expected to be driven by the robust performance of Skyrizi and Rinvoq.

AbbVie has been on an inorganic growth track over the past couple of years to bolster its early-stage pipeline, which should drive long-term growth. Particularly, it is signing several M&A deals in the immunology space, its core area, while also entering into some early-stage alliances in oncology and neuroscience.

AbbVie has a Zacks Rank #3. So far this year, the stock has risen 28.2%. The Zacks Consensus Estimate for 2026 earnings has risen from $14.41 to $14.42 per share over the past 60 days.

Amgen’s revenues from key medicines like Repatha, Evenity and Blincyto and new drugs like Tavneos and Tezspire are driving the top line. Rare disease drugs and new biosimilar launches are also contributing to top-line growth. These drugs are making up for declining revenues from mature drugs like Enbrel. Amgen expects key drugs like Repatha, Evenity, Tezspire and oncology and rare disease drugs, as well as biosimilars, to continue to drive top-line growth in 2026.

Amgen has successfully launched some new biosimilar products this year, which generated impressive sales in the first nine months of 2025. Amgen’s new biosimilar launches will play a key role in mitigating the impact of Amgen’s upcoming LOE over the next few years. Patents for RANKL antibodies (including sequences) for Prolia and Xgeva expired in February 2025 in the United States, while the same expired in some European countries in November 2025. Though their sales were steady in the third quarter, sales of these best-selling drugs are expected to erode in the fourth quarter and in 2026, as some biosimilars have been launched in the U.S. market

Amgen has several key pipeline assets, with its primary focus on obesity candidate, MariTide,a GIPR/GLP-1 receptor, being developed as a single dose in a convenient autoinjector device with a monthly and possibly less frequent dosing. This key feature differentiates it from Eli Lilly and Novo Nordisk’s popular GLP-1-based obesity drugs, Zepboundand Wegovy, which are weekly injections. In clinical studies, it has shown predictable and sustained weight loss and a meaningful impact on cardiometabolic parameters. Several pipeline data readouts are expected over the next six to 12 months, which could be important catalysts for the stock.

Amgen has a Zacks Rank #3. So far this year, the stock has risen 27.3%. The Zacks Consensus Estimate for 2026 earningshas increased from $21.43 to $21.62 per share over the past 60 days.

AstraZeneca has several blockbuster medicines in its portfolio with sales exceeding $1 billion, including Tagrisso, Fasenra, Farxiga, Imfinzi, Lynparza, Calquence and Ultomiris. These drugs are driving the company’s top line, backed by increasing demand trends, which are expected to continue in 2026.

Newer drugs like Wainua, Airsupra, Saphnelo, Datroway (partnered with Daiichi Sankyo) and Truqap have also contributed to top-line growth in 2025, more than offsetting the loss of exclusivity of some mature brands like Brilinta, Pulmicort and Soliris. The rare disease business also improved in the third quarter.

Backed by its new products and pipeline drugs, AstraZeneca believes it can post industry-leading top-line growth in the 2025-2030 period. AstraZeneca expects to generate $80 billion in total revenues by 2030. By the said time frame, AstraZeneca plans to launch 20 new medicines, with nine new medicines already launched/approved. It believes that many of these new medicines will have the potential to generate more than $5 billion in peak-year revenues. The company is also on track to achieve a mid-30s percentage core operating margin by 2026.

AstraZeneca faces its share of challenges, like the impact of Part D redesign on U.S. oncology sales and ongoing investigations at its China subsidiary. Generic/biosimilar competition in the United States and Europe is hurting sales of key drugs like Brilinta and Soliris.

AstraZeneca has a Zacks Rank #3. So far this year, the stock has risen 10.7%. The Zacks Consensus Estimate for 2026 earnings has been stable at $5.15 per share over the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite