|

|

|

|

|||||

|

|

Shares of CRISPR Therapeutics CRSP were up 3.7% yesterday after the company announced encouraging updates from ongoing studies on its next-generation CAR-T therapy candidate, zugocaptagene geleucel or zugo-cel (formerly CTX112), which is being developed for treating certain autoimmune diseases and hematologic malignancies.

CRISPR Therapeutics is currently evaluating zugo-cel in an ongoing phase I basket study for the treatment of autoimmune rheumatologic diseases, including systemic lupus erythematosus (SLE), systemic sclerosis and inflammatory myositis.

As of the data cutoff of Dec. 17, 2025, patients treated with zugo-cel demonstrated deep B-cell depletion that was sustained for at least 28 days. Initial efficacy data indicate meaningful clinical improvement at the 100-million-cell dose, with the first SLE patient achieving DORIS-defined remission through six months.

DORIS-defined remission is a widely accepted standard for measuring remission in patients with SLE.

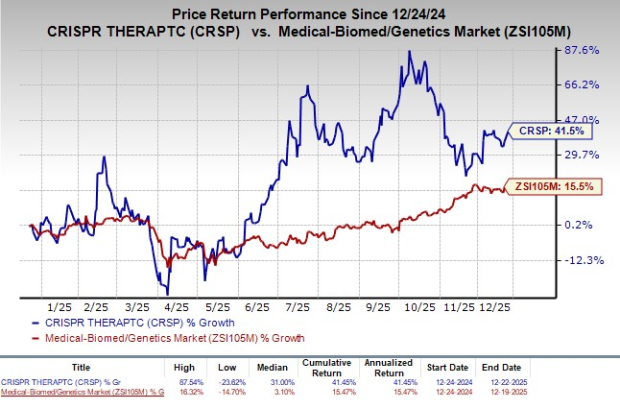

In the past year, shares of CRISPR Therapeutics have rallied 41.5% compared with the industry’s increase of 15.5%.

Zugo-cel was generally well tolerated in the study, with no serious side effects reported. Additional updates from the above-mentioned studies on zugo-cel are expected in the second half of 2026.

The company has also initiated a phase I basket study investigating zugo-cel in two autoimmune hematologic diseases — immune thrombocytopenia purpura and warm autoimmune hemolytic anemia.

Besides autoimmune disorders, zugo-cel is also being evaluated in early-to-mid-stage studies for treating patients with relapsed or refractory (R/R) CD19-positive B-cell malignancies, including large B-cell lymphoma (LBCL), follicular lymphoma, marginal zone lymphoma and mantle cell lymphoma (MCL).

Encouraging clinical results to date support the progression of zugo-cel into phase II development. The recommended phase II dose (RP2D) for zugo-cel was recently endorsed at the 600 million cell dose for the LBCL cohort. Patients received zugo-cel after a standard course of lymphodepletion with fludarabine and cyclophosphamide.

As of the data cut-off of Nov. 20, 2025, single-agent zugo-cel showed strong activity at the 600-million-cell dose, achieving a 90% overall response rate and a 70% complete response rate, with two-thirds of patients in complete response at one year in relapsed or refractory large B-cell lymphoma.

Additional updates from these studies on zugo-cel are expected in the second half of 2026.

CRISPR Therapeutics also announced that it has entered into a new collaboration and clinical supply agreement with pharma giant Eli Lilly LLY to evaluate zugo-cel in combination with the latter’s BTK inhibitor Jaypirca (pirtobrutinib) in aggressive B-cell lymphomas.

LLY’s Jaypirca was approved for treating adults with R/R MCL in the United States in 2023.

The FDA recently approved Jaypirca to treat adults with relapsed or refractory chronic lymphocytic leukemia or small lymphocytic lymphoma who have previously received a covalent BTK inhibitor.

Given Lilly’s huge resources, the above collaboration should help CRISPR Therapeutics to access bigger capabilities and resources for supporting its ongoing clinical programs.

CRISPR Therapeutics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are CorMedix CRMD and Castle Biosciences CSTL, both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CorMedix’s 2025 earnings per share (EPS) have increased from $1.85 to $2.87. EPS estimates for 2026 have moved up from $2.49 to $2.88 during the same period. CRMD stock has surged 48.7% in the past year.

CorMedix’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 27.04%.

In the past 60 days, estimates for Castle Biosciences’ loss per share have narrowed from 64 cents to 34 cents for 2025. During the same time, loss per share estimates for 2026 have narrowed from $1.82 to $1.06. In the past year, shares of CSTL have rallied 49.3%.

Castle Biosciences’ earnings beat estimates in three of the trailing four quarters, while missing the same on the remaining occasion, the average surprise being 49.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 min | |

| 38 min | |

| 1 hour | |

| 2 hours | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 |

Hims And Hers Surges Over 50% On Deal To Sell Novo Nordisk Obesity Drugs

LLY

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite