|

|

|

|

|||||

|

|

Novo Nordisk NVO announced the FDA approval of Wegovy pill (once-daily oral semaglutide 25 mg) to reduce excess body weight and maintain weight reduction in the long term, and to reduce the risk of major adverse cardiovascular events. The stock is up in the pre-market hours today following the news.

The drug is already approved in the United States as a once-weekly injection for reducing major cardiovascular events, easing HFpEF symptoms, and relieving osteoarthritis-related knee pain in obesity. It has also been granted accelerated approval by the FDA to treat noncirrhotic metabolic dysfunction-associated steatohepatitis with moderate-to-advanced liver fibrosis.

The approval of oral Wegovy marks a major milestone for Novo Nordisk, making it the first GLP-1 RA approved in an oral form for weight management. Compared with injectable formulations, the pill offers a far more convenient administration option, significantly lowering treatment burden and potentially improving patient adherence.

The FDA approval of Novo Nordisk’s Wegovy pill was primarily based on robust late-stage clinical evidence from the phase III OASIS development program. The global program comprised four studies enrolling about 1,300 obesity patients. A key 64-week phase IIIb study, OASIS 4, evaluated the efficacy and safety of the Wegovy pill compared to placebo in 307 adults with obesity or overweight with one or more comorbidities.

Results from OASIS 4 demonstrated strong and clinically meaningful weight loss, where obesity patients treated with the Wegovy pill achieved a mean reduction of 16.6% when treatment was adhered to. The magnitude of weight loss was comparable to injectable Wegovy 2.4 mg, with one in three patients achieving 20% or greater weight reduction. Importantly, the safety and tolerability profile of oral Wegovy was consistent with prior semaglutide studies, reinforcing confidence in its use. Novo Nordisk also noted that no currently available oral GLP-1 therapy matches the level of weight loss achieved with the Wegovy pill in clinical studies. The FDA approval was also supported by cardiovascular risk-reduction evidence from the SELECT study of Wegovy.

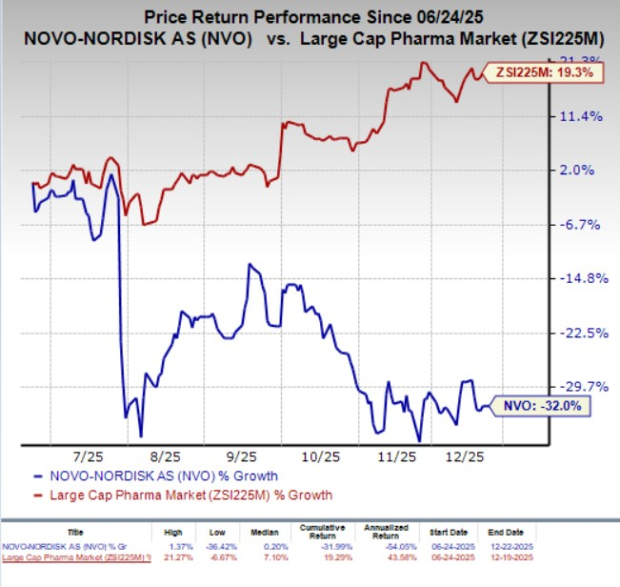

In the past six months, NVO shares have plunged 32% against the industry‘s 19.3% growth.

Novo Nordisk plans to launch the Wegovy pill in the U.S. market in early January 2026. The company has also submitted regulatory applications seeking the approval of once-daily oral semaglutide 25 mg for obesity in the EU and other global health authorities in the second half of 2025.

The obesity space has garnered much of the spotlight over the past year due to the sizeable and still underpenetrated market opportunity. Novo Nordisk and Eli Lilly LLY currently dominate this space.

Wegovy directly competes with Eli Lilly’s tirzepatide injection Zepbound. Like Novo Nordisk, LLY also generates a substantial portion of its revenues from sales of this drug.

Following FDA approval of the Wegovy pill, Novo Nordisk has effectively won the race against Eli Lilly to bring an oral weight-loss therapy to market. The milestone is especially significant as intensifying competition from LLY has weighed on NVO’s market share in recent quarters. By offering a more convenient, easy-to-use oral formulation, Novo Nordisk could shift competitive dynamics back in its favor. This could potentially reignite demand for Wegovy and reaccelerate growth that has softened recently. NVO is also gearing up to advance another next-generation candidate, amycretin, for weight management into late-stage development, both as an injection and oral pill. The phase III program on amycretin is planned to be initiated during the first quarter of 2026.

Novo Nordisk A/S price-consensus-chart | Novo Nordisk A/S Quote

Eli Lilly is also investing broadly in next-generation drugs and is currently developing a range of oral and injectable medications with different mechanisms of action. This includes two late-stage candidates, orforglipron, a once-daily oral GLP-1 small molecule and retatrutide, a GGG tri-agonist. LLY remains on track to submit regulatory filings for orforglipron in obesity soon, setting up the timeline for a potential launch next year.

Smaller biotech firms, like Viking Therapeutics VKTX and Structure Therapeutics GPCR, are also advancing GLP-1–based therapies to challenge the incumbents. Viking Therapeutics is developing its dual GIPR/GLP-1 RA, VK2735, both as oral and subcutaneous formulations for the treatment of obesity. In June, VKTX started two late-stage studies evaluating the subcutaneous formulation of VK2735. While one of these studies recently completed enrolment at a rapid pace, Viking Therapeutics expects to complete enrolment in the other study by the first quarter of 2026.

Earlier in December, Structure Therapeutics reported meaningful weight-loss data from the ACCESS clinical program of its investigational, orally available GLP-1 RA, aleniglipron, for treating obesity. Structure Therapeutics is gearing up to initiate late-stage studies of aleniglipron for obesity around mid-2026, pending alignment with the FDA.

Novo Nordisk currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 17 hours | |

| 21 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite