|

|

|

|

|||||

|

|

Earlier this week, the FDA approved Eli Lilly and Company’s LLY rival Novo Nordisk’s NVO oral version of the obesity drug Wegovy (semaglutide). Wegovy is the first oral GLP-1 drug to be approved in the United States, ushering in a new era of obesity treatment. The Wegovy pill includes the same active ingredient — semaglutide — contained in NVO’s Wegovy and Ozempic injections (for type II diabetes).

Oral pills will be a more convenient alternative to the currently available once-weekly injectable obesity treatments like Lilly’s Zepbound and Novo Nordisk’s Wegovy. Oral pills may significantly lower treatment burden and potentially broaden patient adoption versus injections. Oral pills can also be manufactured at scale to meet global demand, which, in turn, can drive billions in additional sales. Novo Nordisk expects to launch the Wegovy pill in early January 2026. It has priced oral Wegovy at $149 per month (without insurance).

Lilly and Novo Nordisk presently dominate the obesity market, which is attracting massive investor interest lately. With Wegovy’s oral version, Novo Nordisk is looking to regain market share from Lilly as it expects the drug’s demand, which had softened recently, to improve.

Lilly has also developed a once-daily oral GLP-1 small molecule called orforglipron. Lilly recently filed a new drug application (NDA) with the FDA, seeking approval of orforglipron, thus setting up the timeline for a potential launch next year. Lilly has announced positive data across six studies on orforglipron in obesity and type II diabetes.

With NVO getting approval for the first oral pill for obesity, the big question arises – has Lilly lost the oral obesity pill battle to Novo Nordisk? The answer is – only time will tell. Undoubtedly, the Wegovy pill gives NVO the first-to-market advantage and will initially bring in additional revenues and hurt Lilly’s market share.

However, we remind investors that Lilly had launched Zepbound in December 2023, much later than NVO launched Wegovy injection a couple of years before. Still, Zepbound managed to capture much higher market share than Wegovy and surpassed the latter’s sales in 2025. Zepbound also showed strong weight loss data in head-to-head studies with Wegovy.

Recently, Lilly announced data from a key phase III study on orforglipron called ATTAIN-MAINTAIN, which evaluated patients switching from injectable semaglutide/tirzepatide to oral orforglipron. The goal of the study was to inform what level of weight loss patients can maintain after switching from an injectable incretin to orforglipron. The data showed that orforglipron helped people maintain the weight loss they achieved on Wegovy or Zepbound, highlighting orforglipron’s effectiveness as a long-term maintenance therapy. Lilly has also scaled up its manufacturing capacity to meet potential demand for its novel obesity medicines.

Though NVO has the lead in the oral obesity market, if history repeats itself, Lilly may be able to close the gap fast once orforglipron is approved by the FDA in 2026. This is quite evident from the fact that Lilly’s shares declined less than 1% on Tuesday in response to NVO’s Wegovy pill approval news.

Lilly is also evaluating orforglipron in late-stage studies in other disease areas like obstructive sleep apnea, osteoarthritis pain of the knee, stress, urinary incontinence and hypertension. These multiple late-stage studies on orforglipron can expand the candidate’s revenue potential beyond obesity/T2D.

Lilly is also evaluating another key candidate, triple-acting incretin, retatrutide (which combines GLP-1, GIP and glucagon), in type II diabetes and obesity, along with other indications like obstructive sleep apnea, knee osteoarthritis and chronic low back pain, in late-stage studies.

Data from a phase III study on retatrutide in obesity and knee osteoarthritis pain showed that the drug delivered significant weight loss with substantial relief from osteoarthritis pain. Lilly expects data readouts from three phase III studies on retatrutide for treating obesity in the second half of 2026.

NVO will soon advance its next-generation obesity candidate, amycretin, into late-stage development, both as an injection and oral pill. The phase III program on amycretin is planned to be initiated during the first quarter of 2026. Smaller biotechs like Structure Therapeutics GPCR and Viking Therapeutics VKTX are also developing oral GLP-1 drugs for treating obesity.

Viking Therapeutics’ dual GIPR/GLP-1 receptor agonist, VK2735, is being developed both as oral and subcutaneous formulations for the treatment of obesity.

Structure Therapeutics’ ACCESS study on its orally GLP-1 RA, aleniglipron, for obesity, met its primary and all key secondary endpoints. In the study, the 120 mg dose delivered an 11.3% placebo-adjusted weight loss. Higher doses drove deeper reductions, reaching 15.3% at 240 mg. Structure Therapeutics expects to initiate the late-stage program of aleniglipron in obesity around mid-2026.

Overall, the obesity market is huge, and we believe that multiple players can co-exist.

Lilly’s stock has risen 34.6% in the past year compared with the industry’s increase of 16.0%.

From a valuation standpoint, Lilly’s stock is expensive. Going by the price/earnings ratio, LLY’s shares currently trade at 32.07 forward earnings, much higher than 17.40 for the industry. However, LLY’s stock is trading below its 5-year mean of 34.54.

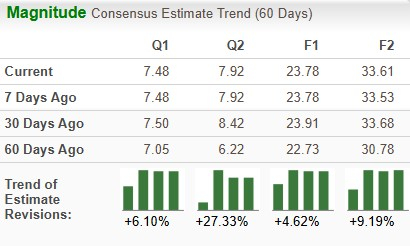

The Zacks Consensus Estimate for 2025 has risen from $22.73 per share to $23.78 per share over the past 60 days, while that for 2026 has risen from $30.78 to $33.61 per share over the same timeframe.

Lilly has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours |

Novo expands injectable Wegovy offering with European higher dose approval

NVO

Pharmaceutical Technology

|

| 12 hours | |

| 13 hours | |

| 14 hours | |

| 15 hours | |

| 16 hours | |

| 16 hours | |

| 17 hours | |

| 17 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite