|

|

|

|

|||||

|

|

Industry Description

Internet - Commerce continues to evolve as the technologies driving it advance.

On one side are increasingly powerful and capable user devices. On the other are increasingly sophisticated platforms often combining chatbots, AI and social media. AI continues to deliver increased user satisfaction and is growing into a primary enabler.

Differentiation comes from better technology for improved showcasing, variety, easier navigation and payment, speedier delivery and returns, brand building, comparison shopping, loyalty, etc. as well as good customer service and more shipping options, which generally tip the scales in favor of larger players. Particularly so, because there is fierce price competition necessitating deep discounting in many cases.

Current Trends Driving the Internet-Commerce Industry

Zacks Industry Rank Indicates Strength

The Zacks Internet - Commerce Industry is a rather large group within the broader Zacks Retail And Wholesale Sector. It carries a Zacks Industry Rank of #79, which places it in the top 33% of 243 Zacks industries.

Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. So the group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates positive near-term prospects.

Ecommerce being in the top 50% of Zacks-ranked industries is the result of its relative performance versus others. What we’re seeing in the aggregate estimate revisions are some ups and downs in estimates over the past year. The aggregate earnings estimate for 2025 is down 5.5%, while that for 2026 is down 7.1%. The macroeconomic uncertainty, the cautious tone around rate cuts and fears of a possible recession are likely contributing to softer spending and thus estimate cuts.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

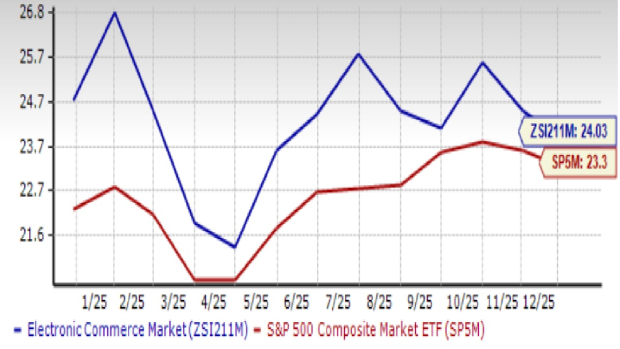

Industry Returns Have Been Sluggish

Until August, the Zacks Electronic - Commerce Industry has traded relatively close to the broader Retail and Wholesale sector as well as the S&P 500, although it started treading water thereafter, continuing mostly at a premium to the broader retail sector.

The stocks in this industry have collectively gained 4.2% over the past year, compared to the 3.4% gain for the broader Zacks Retail and Wholesale Sector and the 15.8% gain for the S&P 500.

One-Year Price Performance

Industry Fairly Valued

Historically, the industry has traded at a premium to the sector as well as the S&P 500. However, being more volatile, the difference has varied considerably. Its current price-to-forward 12 months’ earnings (P/E) of 24.03X represents a premium of 3.1% to the S&P 500 and discount of 2.2% to the broader retail sector. It’s worth noting, however, that the industry is currently trading at a slight discount to its own median level of 24.48X.

Forward 12 Month Price-to-Earnings (P/E) Ratio

2 Stocks to Add to Your Portfolio

There are a number of stocks currently worth picking, especially because of the significant variety that exists in this industry in terms of lines of business, business model, location and so forth. This is also the reason that choosing can be tricky. We have used our proprietary ranking system to pick 2 stocks that appear attractive today.

Expedia Group, Inc. (EXPE): Seattle-based Expedia is one of the largest online travel booking company is in the world, operating through B2C, B2B and trivago segments. It serves leisure and corporate travelers. Expedia takes bookings for hotel and alternative accommodation, cruise ships, rental cars, air tickets and such other services. Through Expedia Partner Solutions, a B2B brand and Egencia, it provides corporate travel management services. It also provides advertising and media services.

Expedia is seeing growth in both B2C and B2B but the latter segment is growing faster by far, raising the corporate average. In the last quarter for instance, total gross bookings grew 12%, driven by a 26% increase in B2B. Similarly, the 9% revenue growth was driven by 18% growth in the B2B segment.

This strength is attributable to the way businesses are viewing travel. There is a greater focus on live events like seminars and conferences, for which attendance is going up. Business development has always been the biggest driver of corporate travel and this year is no different. But upskilling employees is close, possibly because companies are preparing their employees for the massive change that AI is bringing. In-person engagement with clients and partners, followed by conference attendance are the other factors responsible for the strength in business travel (Deloitte: Corporate Travel Forecast, Sept 2025).

Expedia had discontinued its quarterly dividend since the outbreak of the pandemic, but resumed this year. This is an added positive for all investors, especially income-seeking ones.

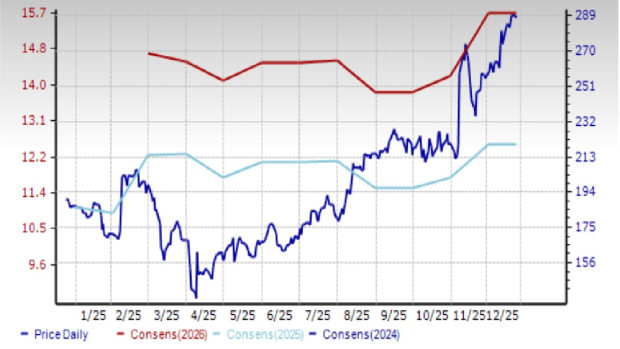

Analysts appear highly optimistic about this company. In the last 60 days, estimates for 2025 have increased 96 cents (6.8%) while those for 2026 increased $1.54 (9.2%). At current levels these estimates represent 6.7% revenue growth and 24.6% earnings growth in 2025. The following year, revenue and earnings are expected to grow a respective 6.3% and 20.8%.

The Zacks Rank #1 (Strong Buy) stock is up 51.9% year to date.

Price & Consensus: EXPE

Amazon, Inc. (AMZN): Seattle, Washington-based Amazon is one of the leading online marketplaces in the world. It has developed its business around the Prime loyalty program that drives sales across merchandise and media categories. The online business is supplemented with broad physical presence, augmented by the acquisition of the premium grocery company Whole Foods Market back in 2017. Amazon also enjoys a dominant position in the Infrastructure as a Service (IaaS) space, courtesy Amazon Web Services (AWS).

The company’s sheer size and scale allow it to offer products at some of the cheapest prices. Amazon is known for its huge discounts and deals, and the number of services it piles into Prime has ensured a subscription revenue channel. Amazon has steadily increased prices over the years, but the user base remains sticky. Its profitability depends on the AWS business, where it still enjoys first-mover advantage. With access to humongous amounts of data, Amazon has developed some AI-powered products to make the most of generative AI and other developments in the space. It also uses AI and automation across the business.

One development of concern is the recent settlement with the FTC where it was proved that Amazon used unfair practices to trick people into taking Prime memberships and then made it very difficult for them to cancel or refuse it. Amazon was directed to simplify the process, remove ambiguities for buyers and also ordered to pay $2.5 billion ($1 billion in penalty and $1.5 billion in compensation). It is also required to abide by certain fair-practice directives.

Amazon also announced a huge layoff of 14,000 staff that investors need not worry about. Amazon’s sales aren’t shrinking. On the other hand, AI is allowing greater efficiencies, such that certain management layers and HR staff are no longer necessary. Amazon expects the leaner structure to facilitate more nimble operation akin to a very large startup.

Despite its huge business volumes, analysts are optimistic about double-digit revenue and earnings growth this year although the earnings growth rate is expected to come down a bit next year. Of course this is early days yet, and actual growth rates may be much higher. Amazon certainly has a great track record of beating estimates: at double-digit rates in each of the last four quarters, averaging 22.5%. For 2025, analysts expect 11.9% revenue growth and 29.7% earnings growth. For 2026, revenue and earnings growth are expected to be a respective 11.3% and 9.3%. In the last 60 days, analyst estimates for 2025 and 2026 have increased 31 cents (4.5%) and 18 cents (2.3%).

The shares of this Zacks Rank #2 (Buy) company’s shares are up 1.3% over the past year.

Price & Consensus: AMZN

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 23 min | |

| 26 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite