|

|

|

|

|||||

|

|

After a few challenging years, marked by persistent inflation, shifting consumer priorities and uneven discretionary spending, the retail apparel and footwear industry may finally be setting up for its next major upcycle. With interest rates expected to stabilize, wage growth improving and inventory levels returning to healthier levels, 2026 could mark a turning point as consumers regain confidence and begin spending more freely on fashion and discretionary categories.

Against this backdrop, a handful of retail apparel stocks such as American Eagle Outfitters, Inc. AEO, Urban Outfitters Inc. URBN, Boot Barn Holdings, Inc. BOOT and The Gap, Inc. GAP appear well-positioned to outperform as the next consumer rally unfolds.

The apparel and footwear space has undergone a reset in the past several quarters. Retailers have focused on clearing excess inventory, reducing promotional intensity and improving sourcing and supply-chain efficiency to protect margins. At the same time, easing freight costs, improved demand forecasting and more disciplined buying are helping restore pricing power, allowing well-managed brands to translate modest top-line growth into stronger profitability.

Looking to the anticipated consumer rebound in 2026, apparel companies with strong brand relevance, differentiated product offerings and agile omnichannel strategies should be best positioned to capture renewed discretionary spending. Firms that can balance full-price selling with controlled promotions, expand their reach across both physical and digital channels, and continue investing in innovation are likely to emerge as winners. In this environment, the following four retail apparel stocks stand out as potential leaders in the next phase of the consumer recovery.

American Eagle is advancing a brand-led growth strategy focused on stronger merchandising, impactful marketing and tighter operational execution. Management emphasized improved product assortments and better in-stock positions, particularly in denim, which are driving higher traffic and digital engagement. Aerie and Offline continue to lead growth, supported by broad-based category strength and expanding brand awareness. The company is also leveraging AI thoughtfully, especially within Aerie’s marketing and community-driven initiatives, to enhance authenticity and customer connection.

On the operational side, AEO highlighted disciplined cost management, including lower cost per shipment in its direct business and leverage in buying, occupancy and warehousing, driven by higher sales. These initiatives are helping support profitability while navigating a dynamic macro and tariff environment.

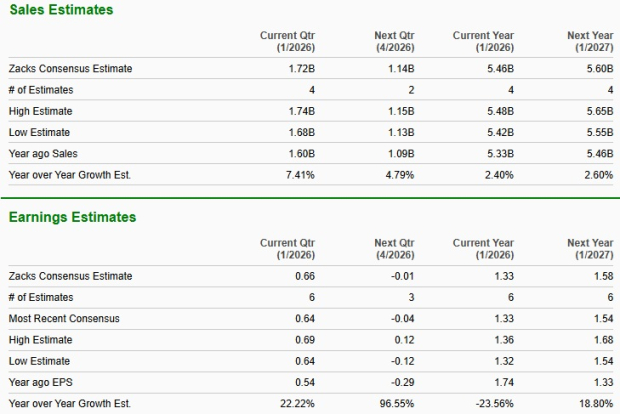

The Zacks Consensus Estimate for American Eagle’s current fiscal-year sales and EPS implies growth of 2.4% and a decline of 23.6%, respectively, from the year-ago period’s actuals. For the next fiscal year, the consensus estimate indicates a 2.6% rise in sales and 18.8% growth in earnings. This Zacks Rank #1 (Strong Buy) company has a trailing four-quarter earnings surprise of 35.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Urban Outfitters’ diversified brand portfolio continues to drive broad-based growth, brand relevance and market share gains across channels and geographies, supported by improved merchandising, disciplined promotions and strong customer engagement. Investments in product curation, inventory flow and store execution are enhancing full-price sell-through and operational efficiency.

The accelerating recovery at Urban Outfitters, steady lifestyle-led momentum at Anthropologie, and growth from Free People and FP Movement reinforce the portfolio’s resilience. Nuuly’s rapidly scaling subscription model further strengthens URBN’s ecosystem and recurring revenue profile. Together, URBN’s disciplined execution, margin focus, and balanced growth strategy underscore its improving profitability and strengthening competitive position.

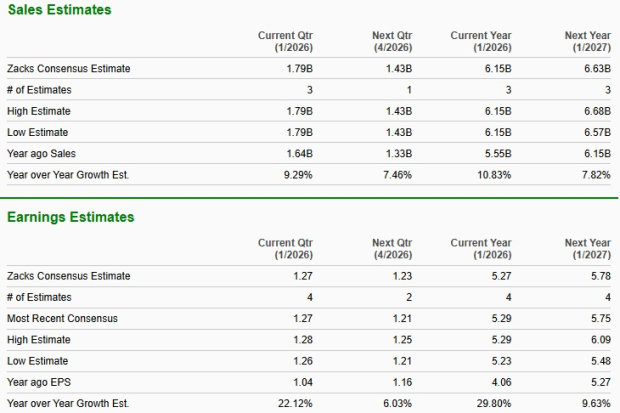

The Zacks Consensus Estimate for Urban Outfitters’ current fiscal-year sales and EPS implies growth of 10.8% and 29.8%, respectively, from the year-ago period’s actuals. For the next fiscal year, the consensus estimate indicates a 7.8% rise in sales and 9.6% growth in earnings. This Zacks Rank #2 (Buy) company has a trailing four-quarter earnings surprise of 19.3%, on average.

Boot Barn stands out as a category-defining retailer with a powerful brand position in western and work-related apparel, supported by a growing portfolio of exclusive labels that deepen differentiation and margin resilience. Management continues to execute effectively on its store-first growth strategy while using omnichannel capabilities to amplify brand reach, drive traffic and reinforce customer engagement across physical and digital platforms. Strategic investments in merchandising discipline, supply-chain efficiency and targeted use of AI are enhancing the customer experience and improving operational agility.

At the same time, disciplined promotional activity and a focus on full-price selling underscore the company’s strong pricing power and brand relevance. With an expanded addressable market, a long runway for store expansion and a scalable operating model, Boot Barn appears well-positioned to deliver sustained growth and long-term shareholder value.

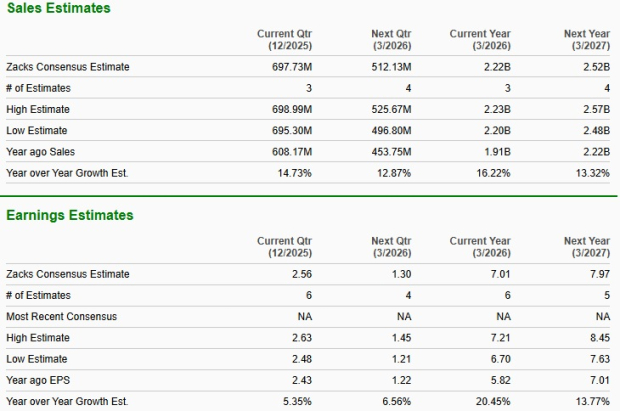

The Zacks Consensus Estimate for Boot Barn’s current fiscal-year sales and EPS calls for growth of 16.2% and 20.5%, respectively, from the year-ago period’s actuals. For the next fiscal year, the consensus estimate indicates a 13.3% year-over-year rise in sales and 13.8% growth in earnings. This Zacks Rank #2 company has a trailing four-quarter earnings surprise of 5.4%, on average.

The Gap highlighted continued progress in stabilizing the business, driven by tighter inventory management, improved product execution and disciplined cost control. Management emphasized better alignment between merchandising and demand, helping reduce promotional pressure and support healthier margins. Supply chain and operational efficiencies remained a key focus, contributing to improved execution across stores and digital channels.

Marketing efforts are becoming more targeted, strengthening customer engagement and brand relevance. While consumer demand remains uneven, management expressed confidence in ongoing operational improvements, positioning the company to navigate the uneven turf.

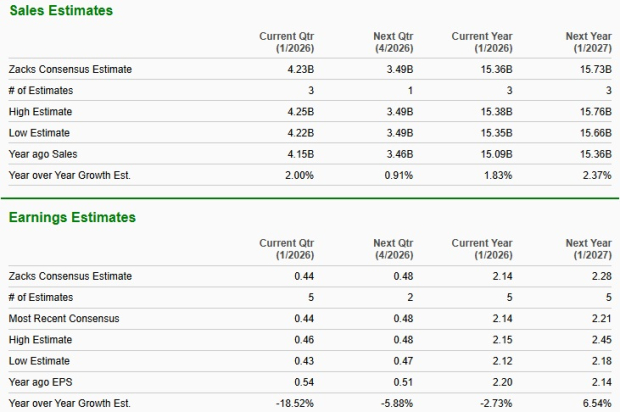

The Zacks Consensus Estimate for The Gap’s current fiscal-year sales and EPS implies growth of 1.8% and a decline of 2.7%, respectively, from the year-ago period’s actuals. For the next fiscal year, the consensus estimate indicates a 2.4% rise in sales and 6.5% growth in earnings. This Zacks Rank #2 company has a trailing four-quarter earnings surprise of 19.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 8 hours | |

| 8 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite