|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

e.l.f. Beauty, Inc. ELF and The Estee Lauder Companies Inc. EL are two influential players in global beauty, operating at different ends of the market while competing across several overlapping categories. The comparison highlights the contrast between a fast-growing mass-market disruptor and a large prestige beauty company navigating a cyclical recovery.

e.l.f. Beauty is a digitally driven cosmetics and skincare company focused on affordable pricing, rapid product launches and strong social media engagement. Its brand portfolio includes e.l.f. Cosmetics, e.l.f. SKIN, Naturium and rhode, with strength in U.S. mass retail, e-commerce and growing international markets. Estée Lauder, by contrast, is a global prestige beauty leader with a diversified portfolio across skincare, makeup, fragrance and hair care, including brands such as Estée Lauder, La Mer, M·A·C, Clinique, The Ordinary and Jo Malone, supported by a broad global distribution network and a sizable travel retail presence.

With a market capitalization of roughly $4.76 billion, e.l.f. Beauty continues to gain market share through value-driven innovation and digital momentum. Estée Lauder, with a market capitalization of $38.7 billion, is focused on stabilizing sales and rebuilding margins under its Beauty Reimagined strategy. The face-off is timely as both companies adjust to shifting consumer demand, evolving value preferences and intensifying competition across the global beauty market.

e.l.f. Beauty’s strength lies in its differentiated value-driven model, which combines affordable pricing with rapid product innovation and strong brand relevance. The company has consistently gained share in mass cosmetics and skincare by responding quickly to consumer trends and delivering quality products at accessible price points. This has enabled e.l.f. Beauty to outperform the broader beauty category, even as parts of the industry experience demand normalization.

A key competitive advantage is ELF’s digitally native marketing approach. The company relies heavily on social media engagement, influencer-led campaigns and data-driven insights to drive product discovery while maintaining relatively low traditional advertising spend. This supports efficient customer acquisition and high engagement, with e-commerce complementing strong relationships with mass retailers. The addition of Naturium and rhode further expands e.l.f. Beauty’s presence across skincare and younger consumer segments, strengthening its long-term growth platform.

Operational execution has supported scalability and profitability. Management continues to benefit from supply-chain optimization, scale efficiencies and disciplined pricing architecture, which have helped offset input cost pressures. At the same time, ELF is reinvesting in innovation, international expansion and digital capabilities to support sustained growth while maintaining an asset-light operating model.

That said, execution risk remains related to the sustainability of the company’s high product velocity and marketing-driven growth model. Continued success depends on accurately forecasting demand, maintaining rapid innovation cycles and managing inventory effectively across an expanding global footprint, particularly given ELF’s reliance on third-party manufacturing.

Apart from this, scaling newer brands such as Naturium and rhode introduces complexity, requiring careful balance between growth, brand discipline and operational focus. Nevertheless, e.l.f. Beauty’s strong track record of execution and adaptability positions the company well to navigate these challenges and continue gaining share in a dynamic global beauty market.

Estee Lauder has been benefiting from the strength of its global prestige beauty portfolio, which spans skincare, makeup, fragrance and hair care across a wide range of price points and geographies. Flagship brands such as Estee Lauder, La Mer, Clinique, M·A·C, The Ordinary and Jo Malone give the company broad category exposure and strong brand equity, supporting long-term demand despite near-term industry volatility. Skincare and fragrance remain the company’s largest profit drivers, with fragrance continuing to outperform the broader beauty category.

A key pillar of Estee Lauder’s strategy is its Beauty Reimagined transformation plan, which is focused on reigniting organic sales growth, expanding margins and simplifying operations. Management has emphasized sharper brand prioritization, fewer but more impactful product launches and improved marketing effectiveness. At the same time, the company is restructuring its cost base through supply-chain optimization, organizational streamlining and disciplined spending, which is intended to support margin recovery as demand normalizes.

Geographically, Estee Lauder retains significant long-term exposure to key growth markets, including Asia and travel retail. While demand in China and travel retail has been uneven, the company continues to invest in local innovation, consumer engagement and channel mix to position itself for recovery. E-commerce and owned retail remain important levers, complementing department stores and specialty retail partners.

However, EL’s near-term performance continues to be pressured by softer demand in certain regions, particularly Asia, as well as inventory rebalancing and reduced promotional intensity. The company’s prestige positioning also makes it more sensitive to shifts in discretionary spending, especially as consumers trade down or delay purchases in a cautious macro environment.

That said, Estee Lauder’s scale, brand portfolio and global reach provide a solid foundation for recovery. The successful execution of Beauty Reimagined through tighter cost control, improved innovation discipline and stabilization in key markets could help restore earnings momentum over time.

The Zacks Consensus Estimate for e.l.f. Beauty’s current fiscal-year sales suggests a year-over-year increase of 19.2%, while the consensus mark for earnings indicates a decrease of 15.9%. The consensus estimate for EPS for the current fiscal year has declined from $2.93 to $2.85 over the past seven days. The consensus mark for the next fiscal-year sales and EPS implies year-over-year growth of 18.1% and 25%, respectively. The consensus mark for EPS has dropped from $3.73 to $3.56 over the past seven days.

The Zacks Consensus Estimate for Estee Lauder’s current fiscal-year sales and EPS implies year-over-year growth of 4.5% and 42.4%, respectively. The consensus estimate for EPS for the current fiscal year has increased from $2.14 to $2.15 over the past 30 days. The consensus mark for the next fiscal-year sales and EPS suggests a year-over-year jump of 3.4% and 36.4%, respectively. The consensus mark for EPS has risen from $2.91 to $2.93 over the past 30 days.

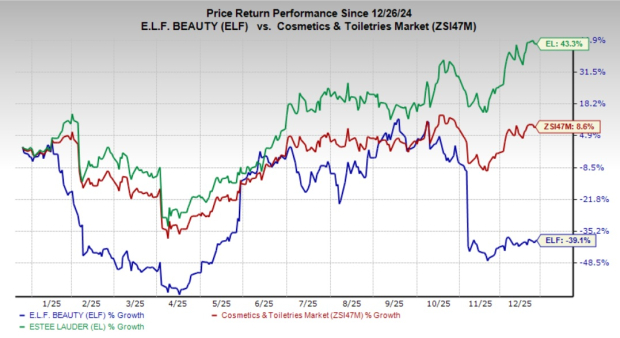

Over the past year, shares of e.l.f. Beauty have tumbled 39.1%, whereas Estee Lauder shares have rallied 43.3%. EL outperformed the industry’s growth of 8.6%, while ELF lagged.

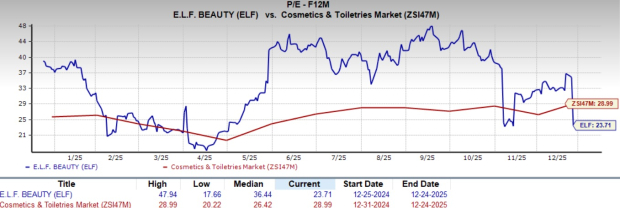

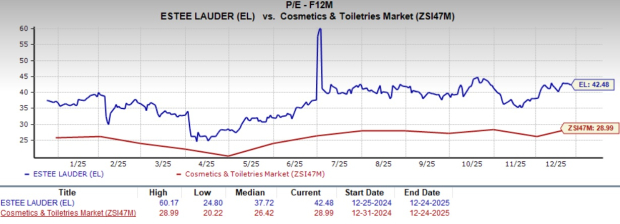

e.l.f. Beauty currently trades at a forward price-to-earnings multiple of 23.71, which is below its median level of 36.44 as well as the industry’s multiple of 28.99. Meanwhile, Estee Lauder carries a forward 12-month P/E of 42.48, higher than its one-year median of 37.72 and the industry. From a valuation perspective, e.l.f. Beauty looks relatively more attractive right now.

While e.l.f. Beauty continues to benefit from strong brand momentum and a value-focused growth model, the current setup appears more favorable for Estee Lauder. As a global prestige beauty leader, EL offers a more diversified business, a broad brand portfolio and exposure to categories that tend to recover well as consumer demand improves. Compared with e.l.f. Beauty’s reliance on continued rapid product launches and marketing execution, Estee Lauder provides greater business stability and recovery potential, making it the more attractive choice at this stage of the cycle.

While ELF holds a Zacks Rank #5 (Strong Sell), EL currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite